June 2024

-

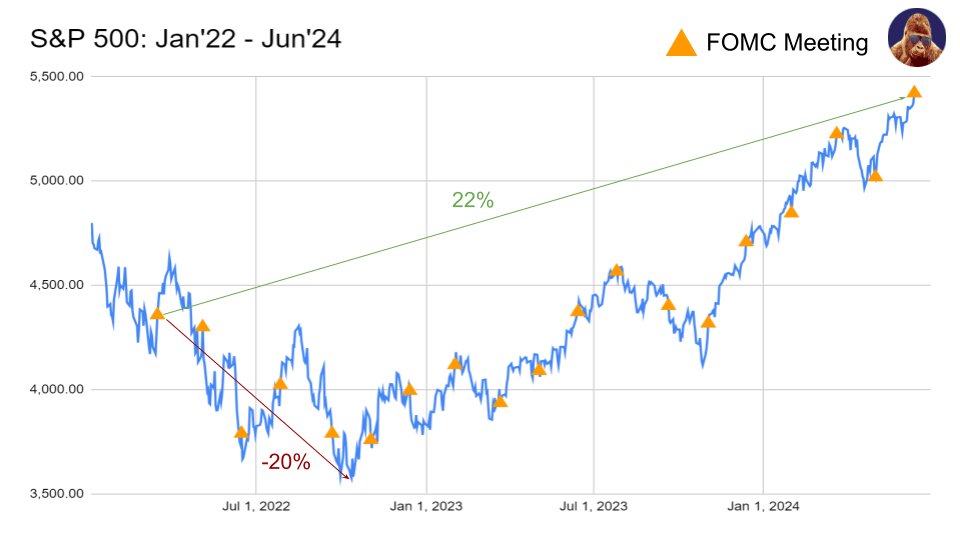

June’s FOMC Meeting was a non-event. The data suggests the FOMC Meeting hasn’t been an event for a while. This is bullish. Some Statistical Context In 2022, the FOMC Meeting held the market hostage. Without accounting for the absolute intraday insanity during Powell’s conference, in the two sessions following the meeting, the S&P 500 moved…

-

Retail sales for May appear to have validated the popular idea that consumers are getting more selective. 📍 Retail Sales: 0.1% actual vs. 0.2% estimated.📍 Retail Sales Minus Autos: -0.1% actual vs. 0.2% estimated.📍 Revisions lower to prior months. The report indicates consumers aren’t spending as much, implying that inflation (and growth) will continue to…

-

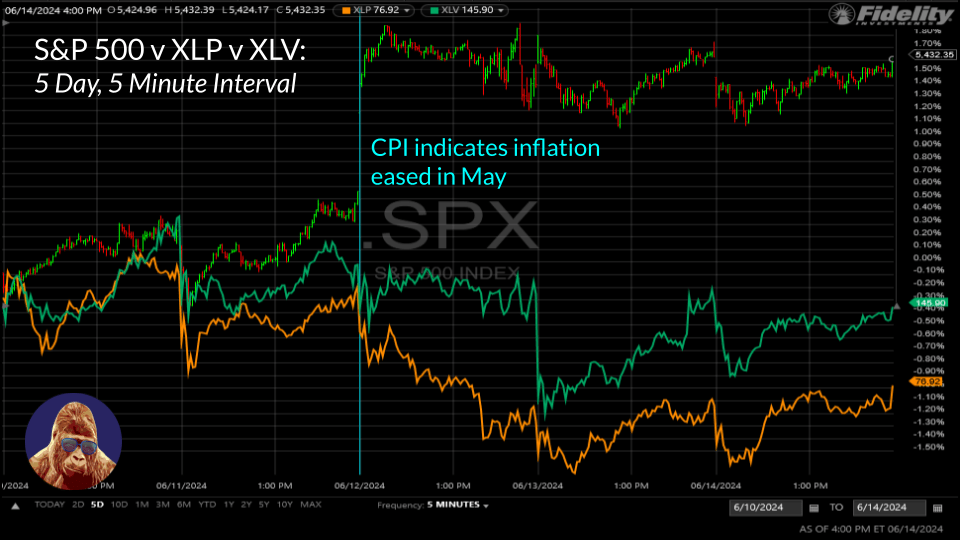

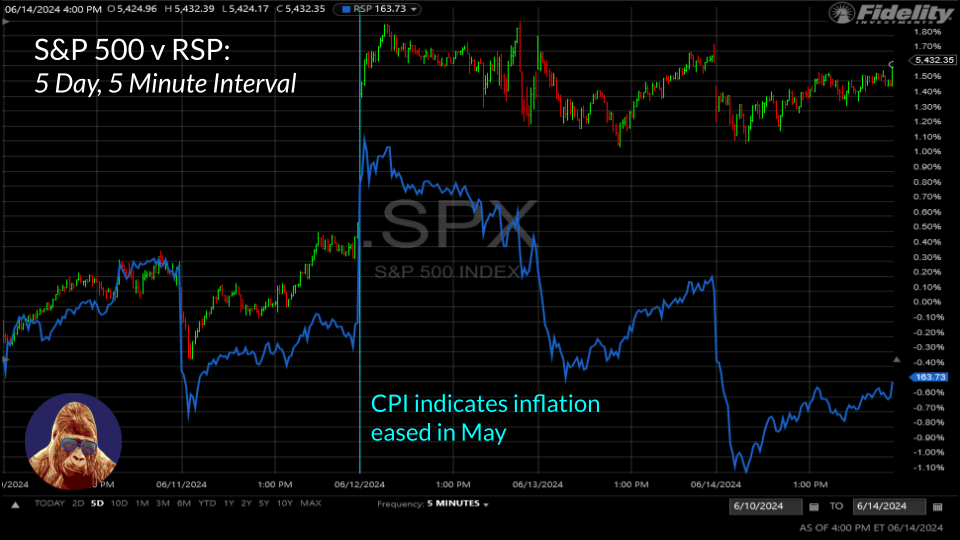

Weekly Performance S&P 500 1.58% Equal Weight S&P 500 (RSP) 0.10% NASDAQ 3.24% DOW -0.54% Russell 2000 (VTWO) -1.01% Talk of the Tape The indices tallied impressive performances behind a light May CPI and an agreeable FOMC. However, the average stock didn’t do as well. Huge moves from Apple (AAPL) and Broadcom (AVGO) propped up…

-

A Bit of Background For years, I had been happily married to my Samsung devices. But earlier this year, in a moment of weakness fueled by Vision Pro hype, I converted to Apple via the iPhone 15 Max Pro. My brother, the family’s resident Apple aficionado, rolled out the red carpet for my transition. My…

-

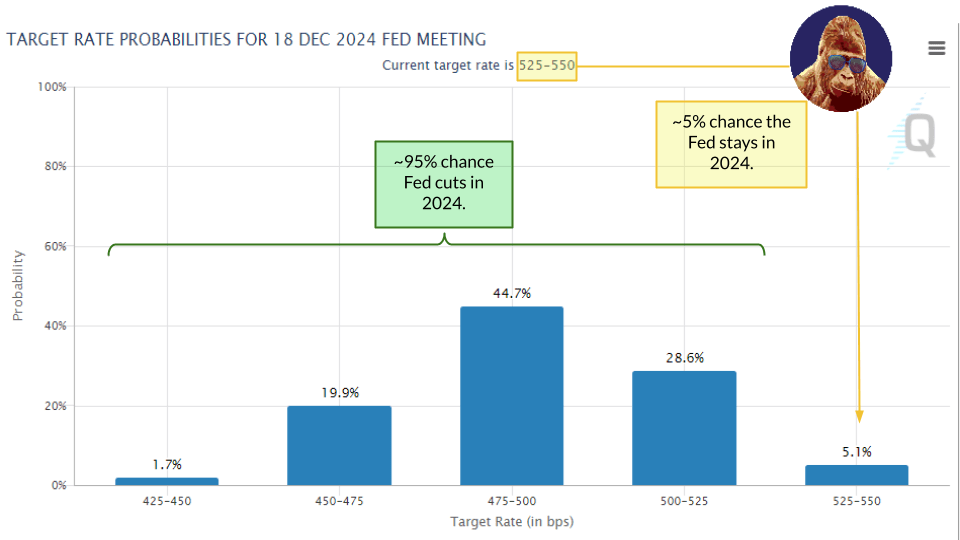

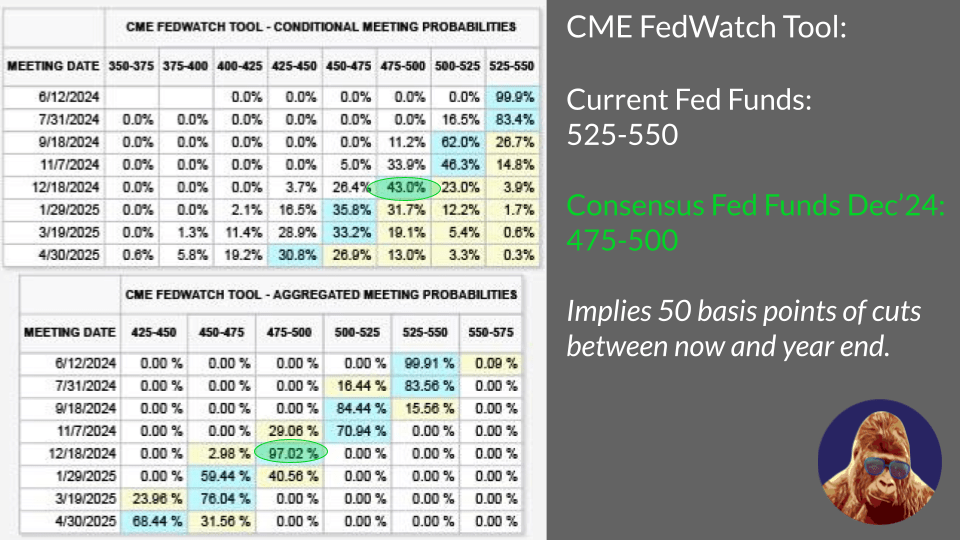

May CPI came in softer-than-anticipated this morning: Relief on inflation has mitigated the impact of last Friday’s hawkish Payrolls on interest rate expectations. According to the CME FedWatch Tool, two interest rate cuts this year remains consensus: the first in September and the second in December. The market is up nicely on the news. For…

-

Weekly Performance S&P 500 1.32% Equal Weight S&P 500 (RSP) -0.95% NASDAQ 2.38% DOW 0.29% Russell 2000 (VTWO) -2.10% Talk of the Tape Although the major indices exhibited resilience, Payrolls for May were indisputably strong, fueling legitimate concerns that upcoming inflation data will be higher than expected. The Week Ahead Monday Tuesday Wednesday Thursday Friday…

-

Around the time Nvidia (NVDA) first cracked $800 and Apple (AAPL) was teetering in the $160s, I joked that the time to trim Nvidia would come when it surpassed Apple in market cap. The joke being this milestone would trigger algorithms and/or hedge funds to go short-NVDA and long-AAPL in a predictable attempt to showcase…

-

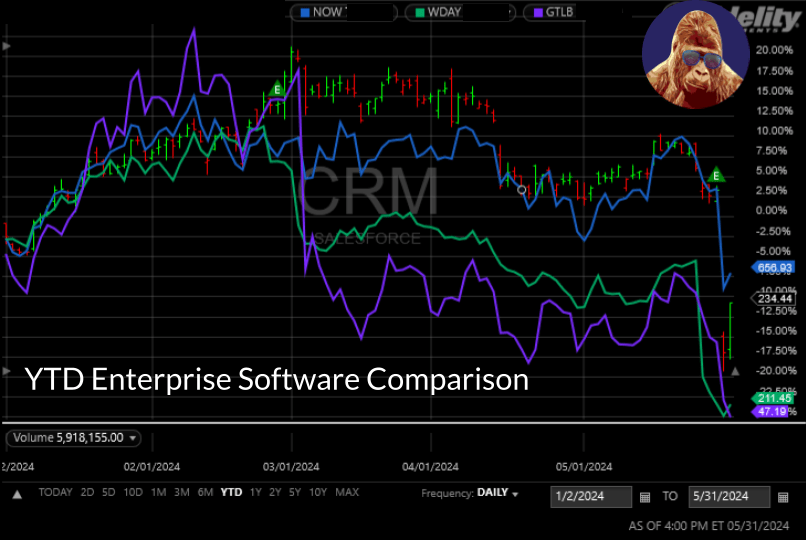

Weekly Performance S&P 500 -0.51% Equal Weight S&P 500 (RSP) — NASDAQ -1.10% DOW -0.98% Russell 2000 (VTWO) 0.02% Talk of the Tape The Personal Consumption Expenditure (PCE) Index aligned with expectation, providing real evidence interest rates are sufficiently high to achieve the Fed’s 2% inflation mandate. For the first time in recent memory, hardware,…