Weekly Performance

| S&P 500 | 0.03% |

| Equal Weight S&P 500 (RSP) | -1.30% |

| NASDAQ | 1.41% |

| DOW | -2.33% |

| Russell 2000 (VTWO) | -1.24% |

Talk of the Tape

Nvidia did it again. Jensen provided an ample spark to work with. Although I am uncertain it will fully reignite the AI-halo, the report justifies expectations for S&P 500 earnings growth. By extension, this validates the index’s new all-time high as being grounded in fundamentals, rather than mere multiple expansion driven by FOMO and speculation.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Market Holiday: Memorial Day | Cava (CAVA) | Beige Book Salesforce (CRM) | Costco (COST) | PCE |

Macro Movers

With Nvidia rolling the credits on what has been a solid 2nd quarter of earnings, focus shifts to the macro. It will be crucial to maintain a bull market mindset to interpret this data correctly.

During bear markets, markets have a tendency to attach major ramifications to every report, regardless of scope or significance. In 2022, any report with even the slightest relation to inflation was treated as a harbinger of apocalypse or salvation. It was an era of market volatility, generally skewed to the downside. So much for “efficient markets”.

Those days are over. Rules are different in a bull market.

In bull markets, we overlook short-term obstacles in favor of a positive long-term outlook. Consequently, incremental releases such as the beige book – a collection of labor observations from each of the Federal Reserve Districts – no longer call investors to action.

Personal Consumption Expenditures (PCE) Index, the Fed’s preferred inflation gauge, on the other hand, still has juice. The previous month’s PPI came in above consensus, increasing the probability PCE disappoints. That said, no single poor report can derail the market. It will take months of consistently inflationary data before bears regain legitimate credibility.

Expectations for core is 0.2% MoM and 2.8% YoY. Lower is better.

Micro Movers

Cava (CAVA): The Mediterranean Chipotle continues to impress. I never got it. I wanted a few more quarters as a public company. However, with shares up ~102% YTD, I have probably missed this one. That said, every 5-15% dip has been a bona fide buying opportunity. I’m hoping the quarter creates a buyable dip in the name.

Salesforce (CRM): Midway through April, the stock shot itself in the foot by leaking a potential acquisition. For a little over a year, investors have rewarded CRM for prioritizing organic growth and efficiency. This now-squashed deal was punished as it represents the opposite: inorganic growth through M&A, where CRM has a shaky track record, to put it diplomatically.

While I have an unrealized gain now – after months of holding my breath underwater with the stock – CRM hasn’t always been an easy hold. If management signals a return to an inorganic growth strategy, I’ll exit the position. Pursuing M&A suggests CRM lacks the internal levers to keep up with competition. I won’t hold CRM through another M&A cycle because it is destined to underperform during that period.

Costco (COST): Perhaps a top 20 stock of all-time, Costco deserves a place in any long-term portfolio. Costco will enter the quarter at an all-time high. Any dip should be monitored for a buying opportunity. One of the few capable of fighting inflation, Costco keeps prices low by forcing suppliers to comply or risk losing their partnership. As always, Costco is driven by sales and membership metrics, not margins or earnings. Don’t let an errant Wall Street note convince you otherwise.

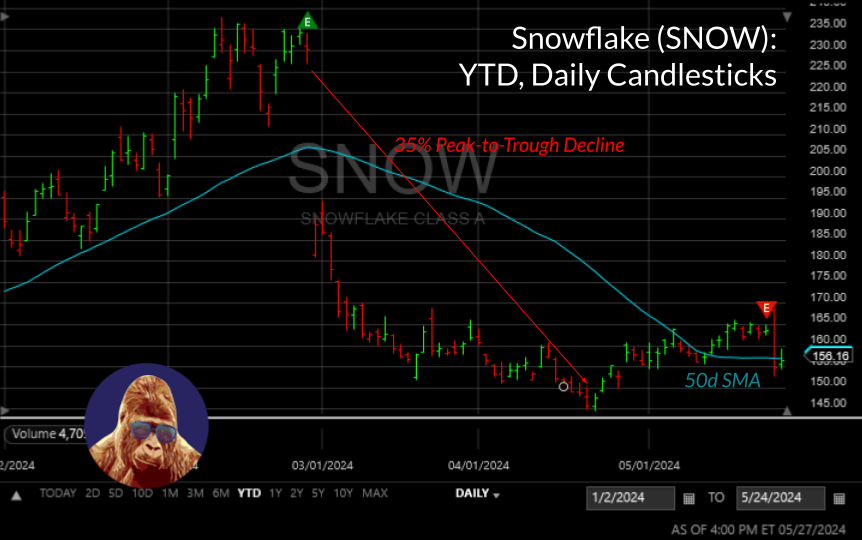

Gorilla Tactics: Snowflake (SNOW)

The same night as Nvidia, Snowflake reported earnings. Pre- and post-market trading saw a 5-7% boost, but when the market opened Thursday, the stock ended the day down over 5% below the 50-day SMA.

Not a good look.

What made the market think twice on SNOW? Surprisingly, Nvidia.

Following Q1 results, SNOW fell ~35%, capturing the narrative shift from a company with best-in-class management and no competition, to one with CEO uncertainty and rising rivals like Databricks’, whose IPO roadshow stole Wall Street’s heart.

During their Q2 call, I think the new CEO resolved some doubts, but during Nvidia’s call, SNOW was grouped with six others, reminding us of lingering competitive fears. Post-market gains faded into losses at the open.

At the 21% mark of the 35% peak-to-trough decline, I highlighted and started a position in SNOW, saying I’ll let Q2 decide my next move. Q2 showed Wall Street no longer values SNOW as unique, which was a cornerstone of my thesis. Consequently, SNOW must execute for the stock to perform. No more benefit of the doubt.

With that in mind, I believe the quarter was good, but not good enough to do anything with my current quarter position. For now, I will let technicals guide me. A move below $145 is a sell signal. Above $165 could warrant increasing my stake. Until then, it is a hold.

Leave a Reply