Weekly Performance

| S&P 500 | 1.54% |

| Equal Weight S&P 500 (RSP) | 1.16% |

| NASDAQ | 2.11% |

| DOW | 1.24% |

| Russell 2000 (VTWO) | 1.74% |

Talk of the Tape

Although PPI warned of higher inflation to come, lower retail sales and cooler CPI alleviated those concerns for the time being, allowing the stock market breadth to continue expanding.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Fed Speakers Palo Alto Networks (PANW) | Fed Speakers | FOMC Minutes Nvidia (NVDA) | – | – |

Macro Movers

With CPI behind us, Nvidia’s earnings are the talk of Wall Street. The macro factors – the Fed, inflation, etc. – held up their end of the bargain. But, will the micro factors – corporate earnings – do the same?

While the Fed will try to grab some of Nvidia’s spotlight in the first half of the week with numerous speakers and the FOMC minutes release, Nvidia takes center stage this week. So, let’s dive right into it.

Micro Movers

Nvidia (NVDA): The stock is in a league of its own. In many ways, Nvidia invented AI as we know it today. Until mid-2023, AI was viewed with skepticism – lots of potential, but not there yet. No longer. Now, AI is a major economic force with the potential to drive secular bull markets across industries. The technology is here, and Nvidia is the only legitimate supplier.

This is uncharted territory.

As such, I am not – nor is anyone really, in my opinion – truly qualified to make a precise prediction. Even if you gave me the results before their release, I still wouldn’t be able to say with certainty how NVDA and the stock market would react. Given my disposition, I feel it is more valuable to illustrate the importance of their earnings to the S&P 500.

The chart above shows the S&P 500 from May 2023 through May 2024. The green dots indicate when NVDA reported earnings each quarter. These quarters capture Nvidia’s evolution from a semiconductor company to an AI darling. If you had bought the S&P 500 before every NVDA earnings release – as it was becoming apparent AI was the real deal – you’d look like a genius and need a bigger wallet.

Over the past six months especially, as the company’s results have converted countless skeptics into believers, Nvidia has acted as “the rising tide that lifts all boats” as AI implementation promises to increase profits across large swaths of the economy. Therefore, for the time being, expectations of S&P 500’s earnings are viewed through the lens of Nvidia’s earnings. Stock market prices are ultimately determined by earnings expectations, thus the S&P 500 will go as Nvidia goes.

Gorilla Tactics: Palo Alto Networks (PANW)

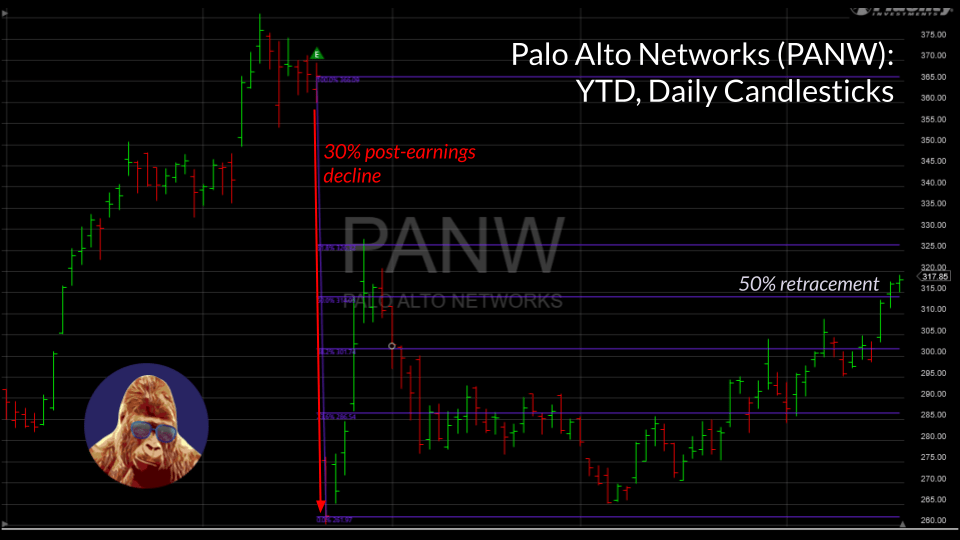

Since their 1Q report sent the stock down 30% in a single session, PANW has managed to recover 50% of those losses over the past quarter.

PANW finds itself in a precarious position. If this quarter’s results restore PANW to “beat-and-raise” status, it will be reinstated amongst the bulls. If not, this stock could find itself in a prolonged bearish hibernation.

While indirect indicators – channel checks, analyst visits, strategist previews, etc. – all suggest PANW will report a solid quarter, I remain unsure. There simply aren’t enough Wall Street analysts to cover companies thoroughly. Consequently, analysts don’t have the bandwidth to visit all the companies they cover in-person to speak with management face-to-face. Without being able to see everything firsthand, it is wise to factor in some margin of error to these indirect data points analysts cite.

That said, I bought quite a bit of PANW around $280 after the post-earnings drop, when it was highlighted in the 2.26.24 edition. If you bought around that time, you should be looking at a low-teens percent profit.

This morning, due to the stock’s precarious position and my uncertainty surrounding the quarter, I will sell 20% of the position. However, if the quarter shows management is making solid progress on the plans outlined last quarter, then I won’t hesitate to buy back those shares and then some.

Leave a Reply