Hershey (HSY)

Under Pressure

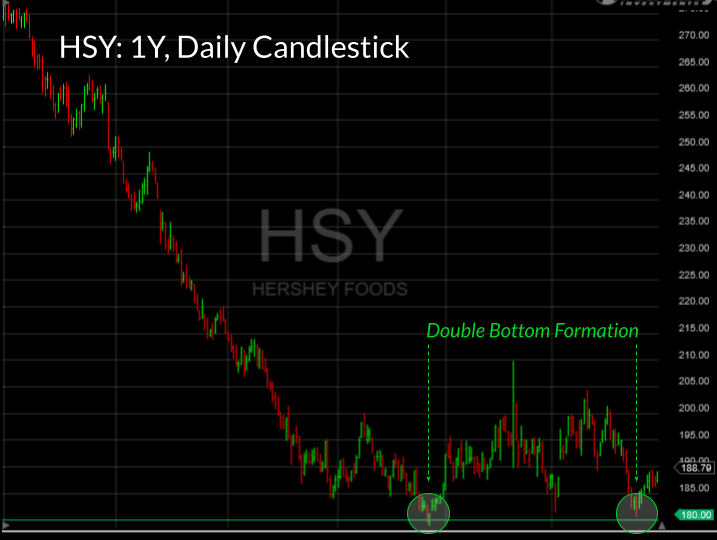

For about a year, Hershey has been a tragedy of a stock. Since topping in April 2023 around $275, HSY has fallen a little more than 30%. Why has America’s well-known chocolate-dealer fallen from Wall Street grace? Have you seen cocoa prices?

Meteoric rise. High cocoa prices adversely affect HSY’s profitability, thus the decline.

Support

HSY found support at $180, exactly where the chart suggested. This is where HSY consolidated in late 2021 before breaking out. Moreover, an argument could be made that HSY just made a double bottom.

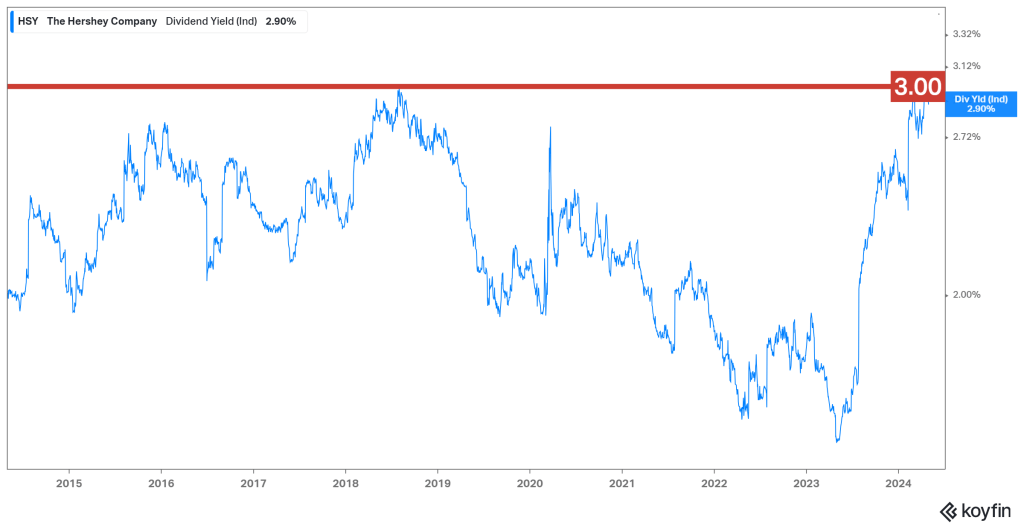

Perhaps most compellingly, the $180 price tag implies a 3% forward dividend yield: the highest in a decade without being a red flag.

Let me explain:

Now, it is worth noting that the cocoa shortage is real; the result of cocoa crop failures in Africa. That said, a hyperbolic move of this magnitude suggests speculators have pushed cocoa prices to unsustainable levels. I believe the equity market agrees with my assessment. If the equity market believed cocoa prices represented fair value, HSY should be priced like a bond, yielding 4.8 – 5% similar to the US 10-Year Treasury yield. As a result, I view the 3% yield as an implicit vote of confidence that cocoa is mispriced.

Easy Fix

Concisely, a bet on HSY is a bet that cocoa prices will normalize lower. As cocoa prices normalize lower, HSY stock should normalize higher. Don’t believe an upward move in HSY without a downward move in cocoa. It is that simple.

My Position

I bought the stock last month at ~$193. With today’s big (downward) move in cocoa, I added a little more. I am not doing anything more until after the quarter on Friday (5/3). Watch the $180 level.

Starbucks (SBUX)

Under Pressure

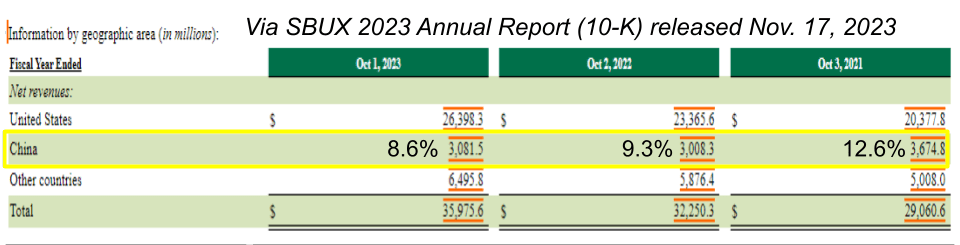

This stock has had trouble over the last 3-4 months. The main reason, in my estimation, is China. Although China’s contribution to SBUX’s topline is declining, the market places a lot of emphasis on their business operations in that geography.

It is no secret that the Chinese economy, specifically their housing market, is teetering, thus it shouldn’t be a surprise to see investors wary of SBUX.

Support

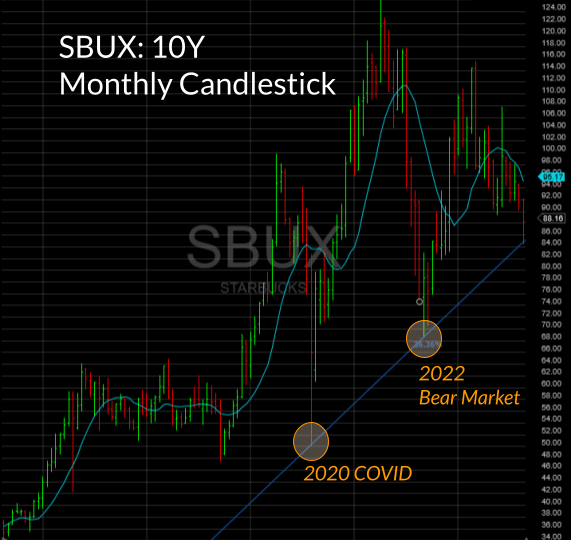

Recently, SBUX found support at $85. At first glance, the level doesn’t appear special. However, a 10-year, monthly interval chart indicated $85 is a support level created by connecting the 2020 COVID and 2022 bear market lows.

Easy Fix

After the market closes tomorrow (4/30), SBUX delivers their quarter. If SBUX can showcase or guide for strength in the United States and China, I expect the stock will continue to build on the momentum found at $85. With U.S. employment resilient and China considering meaningful stimulus, this could be the stock’s moment to recapture Wall Street’s eye.

To be clear, while I believe this support level – created by the 2020 and 2022 bottoms – has power, a bad quarter has the influence to overwhelm it. Over time, fundamentals trump technicals. Plain and simple. In other words, if the quarter is bad, that support level will be swiftly broken. Therefore, I suggest waiting for the quarter.

My Position

I am long the stock at $93. This is a new and small position for my portfolio. I haven’t added to it since my initial purchase a few months ago. The quarter will guide my next move.

Zoetis (ZTS)

Under Pressure

After failing to break out above $200, ZTS has struggled to find its footing… until last week. The weakness came as the EU launched a competitive probe, and a Wall Street Journal article accused ZTS’ medicine of causing the death of owners’ pets.

Of the two, I am more concerned with the accusations from the Wall Street Journal:

The EU is always looking for another U.S. company to fine. The EU consistently looks to justify their existence and simultaneously help fund whatever EU objective needs a cash infusion.

The Wall Street Journal article is more concerning because the drugs in question are two newer medications that markedly improve the company’s growth profile. Shelving them would be a fundamental setback. However, the accusations from the Wall Street Journal, albeit troubling, in my opinion, seem too circumstantial at this point to result in those drugs being shelved.

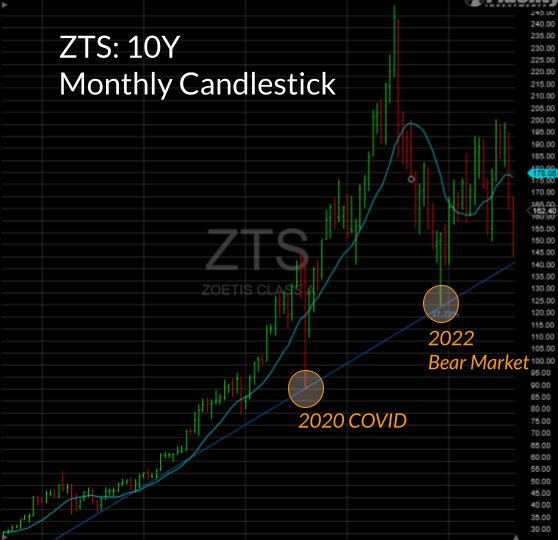

Support

Similar to SBUX, ZTS found support within a few dollars of the trendline created by the 2020 and 2022 bottoms.

Easy Fix

Have a quarter that dispels the notion that the EU probe and Wall Street Journal article will have a fundamental impact on the company.

This morning (4/29), investors are celebrating ZTS’s $350 million sale of its medicated feed additives businesses. I mention it to make it clear that the EU and Wall Street Journal remain fundamental overhangs. Wait for the quarter before putting your money to work here. ZTS has a history of acting funny around its quarter.

My Position

I am long ZTS with a mixed cost basis of $158. It’s a small position. I hope I can make it bigger, but I’ll wait to hear from ZTS management on Thursday morning (5/3) when they release earnings ahead of the open before doing anything more.

Leave a Reply