Weekly Performance

| S&P 500 | -0.95% |

| Equal Weight S&P 500 (RSP) | -1.76% |

| NASDAQ | -0.80% |

| DOW | -2.27% |

| Russell 2000 (VTWO) | -2.87% |

Talk of the Tape

Although stocks put together a solid Friday session, pressure from rising oil and hotter Payrolls resulted in a down week across indices.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| – | – | CPI FOMC Minutes | PPI | Big Bank Earnings: J.P. Morgan (JPM) Wells Fargo (WFC) BlackRock (BLK) Citi (C) |

Macro Movers

March Payrolls was stronger than expected, but a closer look reveals the wage data – a key inflation input – was tamer than headline figures suggested. This week, CPI and PPI for March, two major data points for inflation, will be closely monitored.

The upside surprise on March Payrolls reduced the probability of a June cut. CPI and PPI have the potential to further reduce those chances. This could set the stage for the first pullback of the year. The S&P 500 typically experiences 4-5 corrections of 5-10% annually. So far in 2024, we’ve seen zero. That said, I believe stocks can continue to grind higher as long as a rate hike remains off the table. The key will be how the inflation data is interpreted with respect to Fed policy.

CPI: The consensus forecast for core is 3.7% on an annual basis and 0.3% on a monthly basis – both metrics 0.1% below the prior month’s readings. Over the last two months, as disinflationary progress has plateaued, both the Fed and market have demonstrated patience. However, the longer the plateau persists, the more likely market participants reconsider the current “goldilocks” scenario, which could generate turbulence.

PPI: Months before CPI clearly trended lower, PPI indicated inflation was easing. However, the last two PPI releases have not been as supportive as the market is accustomed to.

PPI has also gained more attention due to its link to PCE, the Fed’s preferred inflation gauge. While I expect market participants will view this report more as a reference point than a tradeable event, a soft outcome relative to expectations could markedly improve what I feel is an eroding sentiment on inflation.

The median analyst forecast is for core PPI to rise 0.2% MoM and 2.3% YoY.

Micro Movers

Based on the market’s reaction to macro data releases in 2024, stocks appear more sensitive to corporate earnings than economic indicators. After two years of the opposite (2022 and 2023), I hope earnings remain the dominant force in the market for some time.

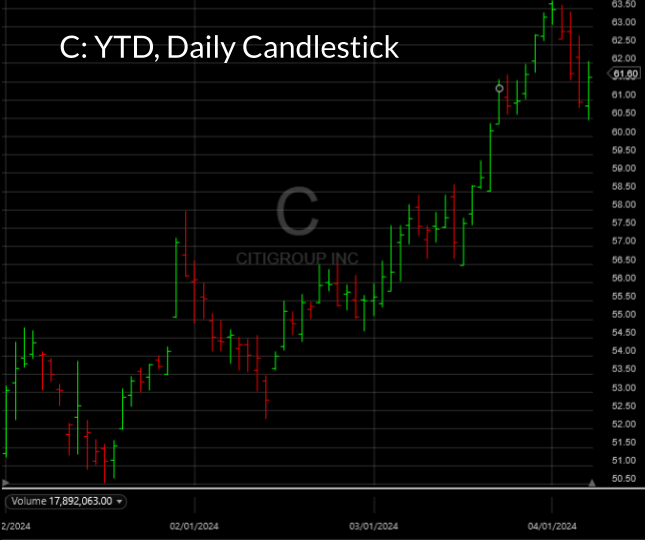

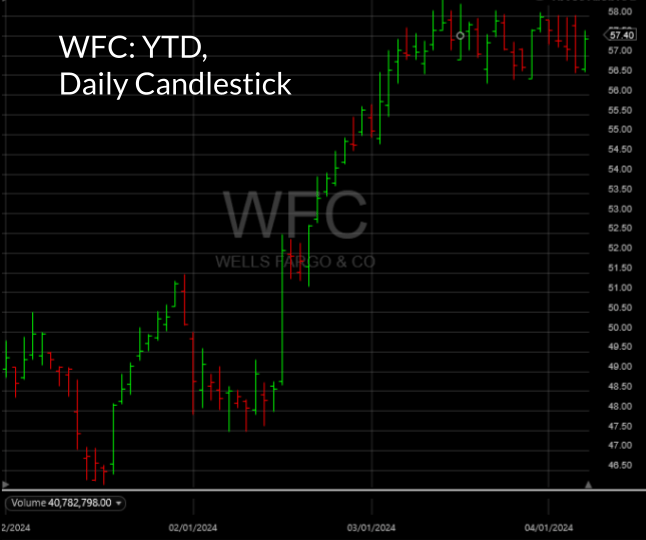

Big Bank Earnings: As in tradition, the big banks will usher in the new season of corporate earnings. This Friday, a slew of well-known names – JPM, WFC, BLK, and C – will report before the market opens.

Many financial sector stocks have impressive charts. Some may worry these stocks are too “hot” heading into their reports, but I disagree. The 15-20% YTD gains, after 2 years of consolidation, seem gradual enough to avoid being categorized as frothy.

That said, the positive price action suggests any upside surprises may be priced in, meaning companies will need to provide incrementally constructive updates to avoid stalling or falling. If you want to get in on any of the big money centers, I’d wait until after the report.

Beyond company-specific results, the market will react to commentary related to businesses, consumers, and M&A. While IPOs have performed well recently, there have been too few to significantly impact investment banks or raise concerns about a broad stock market bubble.

Leave a Reply