Weekly Performance

| S&P 500 | 1.37% |

| Equal Weight S&P 500 (RSP) | 0.05% |

| NASDAQ | 2.31% |

| DOW | 0.04% |

| Russell 2000 (VTWO) | 2.41% |

Talk of the Tape

Fed Chair Powell made it surprisingly clear the committee does not expect a cut in March. Two days later, January Payrolls ratified that view by portraying an indisputably strong labor market unlikely to foster disinflation. That being said, the Mega Caps – especially META, AMZN, and MSFT – provided support for stocks with pristine quarters.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| – | CPI Shopify (SHOP) Coca-Cola (KO) | – | U.S. Retail Sales Coinbase (COIN) Palo Alto (PANW) | PPI Housing Starts |

Macro Movers

CPI: Analysts anticipate a 0.3% month-over-month increase and a 3.7% year-over-year rise. Stocks prefer inflation to trend toward 2%. However, considering the strength in Payrolls and the futures market no longer pricing-in a March cut, the market may be braced for slightly higher CPI figures. The only risk is that CPI is so high that it implies additional Fed hikes will be necessary.

U.S. Retail Sales: This measure of consumer spending is expected to come in at -0.2%. The lower the number, the better it is for inflation sentiment as it pertains to goods. Fortunately, leading indicators, such as credit card data and weather patterns, point toward a soft outcome. Unfortunately, goods inflation isn’t the issue. Services inflation is. Nonetheless, it will be used to update on thoughts on the consumer and inflation.

PPI: This week’s most pivotal release carries significant weight for a couple of reasons. First, many regard PPI as a readthrough to PCE, the Fed’s preferred inflation measure. Second, PPI has consistently supported the notion that inflation is on a desirable downward trajectory. Therefore, a material upside surprise could plant seeds of doubt in the inflation argument. Analysts expect core PPI to register at 1.7% YoY and 0.1% MoM. Ideally, PPI meets or falls below these forecasts.

Housing Starts: Services and housing inflation remain the two thorns in the Fed’s side. Analysts anticipate 1.47 million new housing starts, slightly above the prior month’s 1.46 million. The more houses being built, the more downward pressure will be applied on housing costs. A larger number bodes well for the Fed and stocks as such would indicate a positive outlook for housing inflation.

Micro Movers

Last week saw spectacular earnings as investors found more juice to squeeze from the AI revolution. PLTR surged 40% by leveraging AI for cybersecurity, while GE Healthcare rose 11% by integrating AI into healthcare diagnostics. Notably, Arm skyrocketed 60%, emerging as a vital AI player, manufacturing chips capable of running AI “at the edge”, without an internet connection.

Shopify (SHOP): Following Amazon’s (AMZN) performance, I anticipate SHOP will deliver a strong quarter. The positive momentum in the stock indicates expectations are for exactly that. For those considering starting or adding to their position, I like putting some to work ahead of the earnings report.

Coca-Cola (KO): Unlike PepsiCo (PEP), which faced weakness primarily in its snack business, KO does not have a similar exposure. As a result, I like KO heading into the quarter. A good report may allow KO to benefit from flows rotating within the staples category. However, given the availability of other opportunities with greater upside, I cannot find a compelling reason to invest or trade the name at this time.

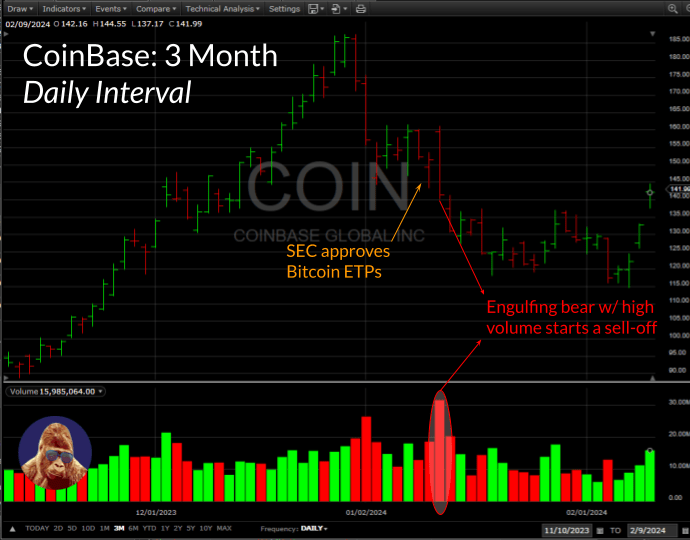

Coinbase (COIN): Traditionally, this stock’s performance correlates with Bitcoin (BTC). However, with the approval of BTC ETPs, the correlation may evaporate. Over 40% of COIN’s revenue comes from transactions. While COIN will earn fees as a custodian for many asset managers managing these ETPs, it’s uncertain if custodian revenue will offset a potential decrease in transaction revenue. The convenience of ETPs may attract investors away from using Coinbase accounts for crypto exposure. Judging by the price action on the day ETPs were approved, it seems I’m not alone in this belief.

For those interested in COIN, I would stay away until there is more clarity on the revenue picture. If you’re looking only for an equity play on cryptocurrency, MicroStrategy (MSTR) would be my pick.

Palo Alto Networks (PANW): Fortinet’s (FTNT) strong quarter further supports the notion of a secular bull market in cybersecurity. FTNT is secondary to PANW and CrowdStrike (CRWD). If the third player in an industry can thrive, the industry is booming. PANW is the leader and is trading at an all-time high. While I don’t anticipate any missteps, PANW is likely priced for perfection. Consequently, be on the lookout for a minor shortfall in a miscellaneous line-item to create a buyable decline.

There will be no 9:25 next week. I am traveling over the President’s Day Holiday and will be unable to give the newsletter the due time. The 9:25 will return on February 26th to put a bow tie on the month.

Leave a Reply