Weekly Performance

| S&P 500 | 1.38% |

| Equal Weight S&P 500 (RSP) | 0.41% |

| NASDAQ | 1.12% |

| DOW | 1.42% |

| Russell 2000 (VTWO) | -0.79% |

Talk of the Tape

Fed Chair Powell made it surprisingly clear the committee does not expect a cut in March. Two days later, January Payrolls ratified that view by portraying an indisputably strong labor market unlikely to foster disinflation. That being said, the Mega Caps – especially META, AMZN, and MSFT – provided support for stocks with pristine quarters.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| 2 Fed Speaker S&P Services PMI ISM Services McDonalds (MCD) Caterpillar (CAT) | 4 Fed Speaker Eli Lilly (LLY) Chipotle (CMG) Fortinet (FTNT) | 4 Fed Speaker CBO Briefing: Budget & Economic Outlook Uber (UBER) Arm (ARM) | 1 Fed Speaker Take Two Interactive (TTWO) | PepsiCo (PEP) |

Macro Movers

Fed Speak: Following an FOMC Meeting, Fed members take on speaking engagements to emphasize or downplay points discussed during the meeting. This week, we have 11 scheduled Fed speakers. Leading up to the meeting, there were cautionary remarks that March might be too early for cuts. Chief Powell doubled down at the meeting. January Payrolls ratified this view. There isn’t much reason to change rhetoric, reducing volatility associated with these speaking arrangements.

S&P Services PMI & ISM Services: Persistent services inflation remains a concern. 51 and 52 are the forecasts for S&P Service and ISM Services, respectively. Anticipate a bullish response to results below or at those forecasts.

CBO Briefing: This report is often ignored by the market. However, government debt vigilantes – market participants with influence that closely monitor government financing – have been more active over the last three months. Even though I do not expect volatility, if we notice a dip linked to interest rates around 3 PM Wednesday, this report is a likely culprit.

Micro Movers

Aside from Nvidia, earnings season is in its final innings. While the remaining reporters are still important, it’s crucial to recognize the stakes for the broader market – for price and sentiment – are less pronounced. Nevertheless, I’ll highlight some companies worth monitoring.

McDonalds (MCD) & PepsiCo (PEP): Recent price action indicates temporary relief from GLP-1 concerns. Strong payrolls’ wage metrics mitigate risk associated with their price hikes. Beyond company specifics, these giants’ ties with global supply chain players offer key insights into inflation and economic trends. I don’t like either for a trade, but MCD looks better from a technical perspective.

Caterpillar (CAT): A true workhorse in the industrial sector, CAT is anticipated to be a major Inflation Reduction Act beneficiary. Despite reaching a new all-time high at $315, I see life left in this workhorse. I believe the market’s underappreciation of industrial stocks means the full impact of the IRA is not priced-in. As its effects materialize in earnings, the stock could continue to build on upward momentum.

Eli Lilly (LLY), Uber (UBER), & Chipotle (CMG): Although each has had a unique journey, these stocks have all secured distinguished spots on the “new all-time high” list without being part of a “named group” like the Magnificent Seven, Super Six, AI 5, etc. While I’m not inclined to chase them at these levels, I don’t expect any to drop the ball at earnings. In the event of a “sell-the-news” scenario—where a stock sells off despite a strong quarter—we might have a chance to buy these standout names at a discount.

Take-Two Interactive (TTWO): Rumor has it a timeline for GTA VI’s release and preliminary revenue forecasts will accompany the quarter. For those considering the stock, acting ahead of the quarter may be strategic. I anticipate the next iteration of GTA – the highest-grossing video game franchise in history – will drive the stock higher. However, if the rumors are false and no new information on GTA is revealed, anticipate a potential sell-off.

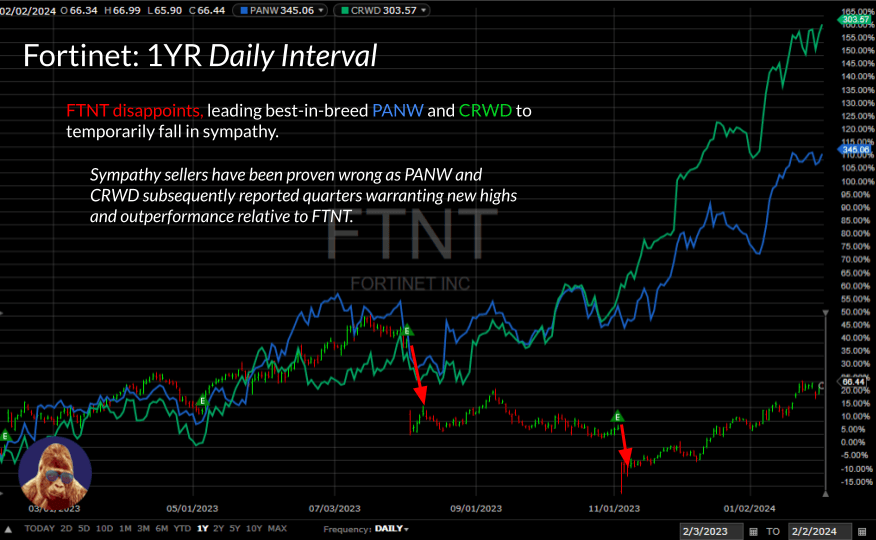

Fortinet (FTNT): Previous disappointments from this cybersecurity company triggered pullbacks in Palo Alto (PANW) and CrowdStrike (CRWD), cybersecurity’s best-in-breed companies. PANW and CRWD defied the sympathy sell-off, reporting better-than-expected earnings each time. I believe PANW and CRWD are gaining market share at FTNT’s expense. If FTNT’s disappointment creates weakness across the entire cybersecurity sector, history shows PANW and/or CRWD are buyable on the dip.

Arm Holding (ARM): Arm specializes in developing and licensing high-performance solutions for CPUs, GPUs, and more. With close partnerships to tech giants like Apple, AMD, Amazon, Qualcomm, Nvidia, among others, Arm went public last year and currently trades around 70x forward earnings. This valuation hinges on the company establishing itself as a key player in AI. The current valuation may not hold if the earnings do not substantiate that role. However, a strong earnings performance could make this an attractive investment, even if the price increases after. I’m reserving judgment until after they report.

Leave a Reply