A lot of stock were on the move this week. Here’s a quick update on the three mentioned in my Monday newsletter:

Netflix (NFLX)

Netflix (NFLX) has cleared a path to $600 by effectively executing their tiered pricing strategy and cracking down on password sharing while simultaneously enhancing their platform, most recently by adding live entertainment via WWE, to their content portfolio.

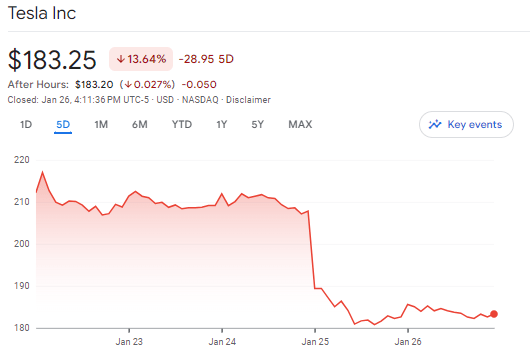

Tesla (TSLA)

Tesla (TSLA) results and commentary were both poor: demand appears cyclical, competition pressure overseas is intensifying, Elon’s justification for a dual-class structure was less than compelling… The stock stopped the bleeding at ~$180, but don’t expect this stock to move independently of the broader market until the fundamentals turn.

Humana (HUM)

Humana (HUM) dropped further as the full earnings report revealed issues greater than the pre-announcement indicated.

Perhaps, a silver lining can be found in that this report is so bad that it implies a large degree of the earnings shortfall is more likely company-specific than industry-endemic. While I still believe the negative influence of election headlines has yet to be priced-in to the sector, the relative performance from the best-in-breed competitor United Health (UNH) shows there may be pockets of value for short-term trades. That being said, I do not find the risk-reward compelling.

Leave a Reply