Introduction

In my newsletter, 9:25, I recently outlined a trade in Boeing (BA). As the downside exit price of $200 has hit on an intraday basis, it is only right to release an update to assist investors in evaluating their options from here. I will also disclose how I am handling the situation.

What’s Changed?

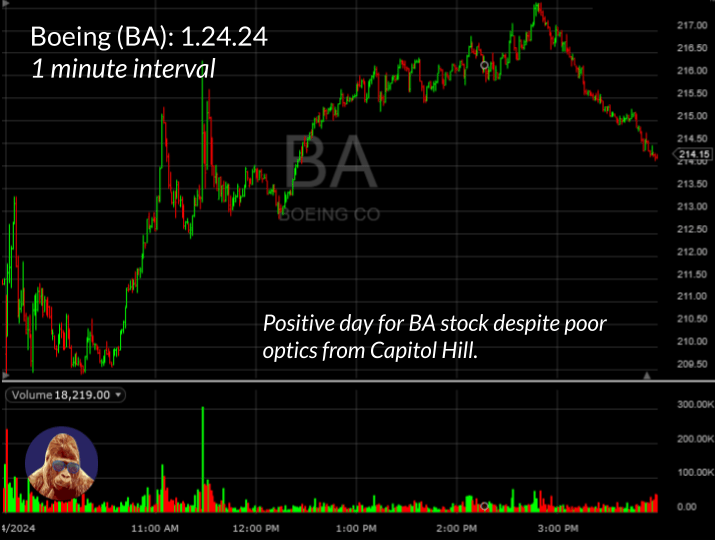

As Boeing CEO, Dave Calhoun, visited Capitol Hill to answer questions surrounding the 737-9 Max due to the Air Alaska incident, headlines surfaced, implying a negative outlook for the stock. Given the stock ended Wednesday’s (1/24/24) session with a 1.25% gain, it can be reasonably concluded the market’s consensus was that these incremental developments would not amount to much.

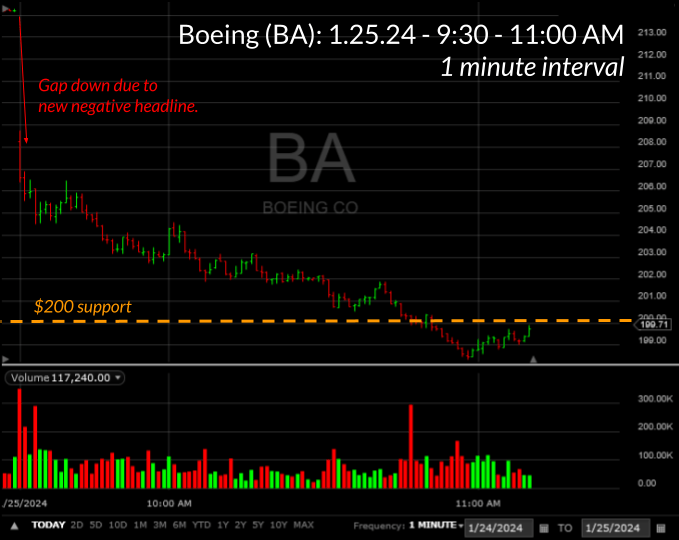

After the market closed yesterday, a consequential headline broke. Although the FAA has cleared grounded Max 9 planes to resume as soon as inspections are complete, they set a cap on 737-Max production rates. This production cap implies Boeing will not be able to deliver the guidance on plane deliveries and cash flow that my thesis requires to push the stock back to $260.

Price is an indicator of consensus in real time. If the consensus changes or is proven wrong, price will move quickly. It appears we are in the midst of a consensus shift as illustrated by the ~6.5% intraday drop that has brought BA to the $200 support level, which is our downside exit target.

What Not?

Stick to the trade thesis: exit the position if BA does not reclaim the $200 by the close.

A close under the $200 level is the exit trigger. This support level is a significant indicator of investor confidence. Failure to maintain it suggests a loss of that confidence and an indication that consensus is shifting toward the idea BA will disappoint when they report next Wednesday (1/31/24).

What Am I Doing?

Personally, I have protective puts – $200 strike puts expiring 2/02/24 – to hedge this position. Without this hedge, I would follow the strategy outlined above, exiting with a close below $200. However, I will stick with BA because my protective puts give me the coverage to play for the – admittedly, now – reduced chance earnings will be a positive event for the stock.

Although the FAA’s production cap is a major blow to my thesis, there was an unexpected assist from China, who granted BA permission to resume 737 Max 8 deliveries yesterday. Perhaps the China-bump will offset the FAA-pothole. However, considering this morning’s price action and the Bank of America downgrade, that may be wishful thinking.

Leave a Reply