Weekly Performance

| S&P 500 | 1.17% |

| Equal Weight S&P 500 (RSP) | -0.56% |

| NASDAQ | 2.26% |

| DOW | 0.72% |

| Russell 2000 (VTWO) | -0.34% |

Talk of the Tape

While regional banks did their part, hotter economic data challenged the “broadening out” thesis. At this point, the pullback in the equal-weight S&P and Russell 2000 can be viewed as “routine”. However, should hot economic data translate to hot inflation data, this “healthy” pause may evolve into a more worrisome sell-off.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| Zions (ZION) | Netflix (NFLX) | Tesla (TSLA) | Gross Domestic Product (GDP) Humana (HUM) | **Personal Consumption Expenditures (PCE)** |

Macro Movers

GDP: Thursday morning brings the initial 4Q23 GDP read. Although the final 3Q23 GDP came in at 4.9%, the consensus for 4Q23 is a modest 1.7%. The market still interprets bad news in the economy as good news for stocks. Given strength in retail sales, I think GDP will beat the estimate, which may pressure stocks. That being said, I believe a sub-3% should keep both the Fed and sellers on the sidelines.

PCE: The Fed’s favored inflation gauge, PCE, will be the most important release of the week. Attention is on the core metrics. Projections stand at 3% annually and 0.2% monthly. The last PPI, a leading indicator, resulted in a dovish surprise, which suggests a similar outcome for PCE. While the setup seems promising, an inflationary print likely has the influence to materially alter rate cut expectations, which will pressure all stocks downward.

Micro Movers

Last week, the regionals delivered strong quarters, supporting the “broadening out” thesis. When ZION reports on Monday, I expect their results to contribute positively. Unfortunately, resilient economic data undermined ambitious rate cut expectations. Fewer expected rate cuts imply fewer instances of single-stock outperformance. In turn, this increases the likelihood that investors abandon a majority of stocks for the safety of the highest quality names in the market.

Speaking of high quality, NFLX and TSLA will report this week.

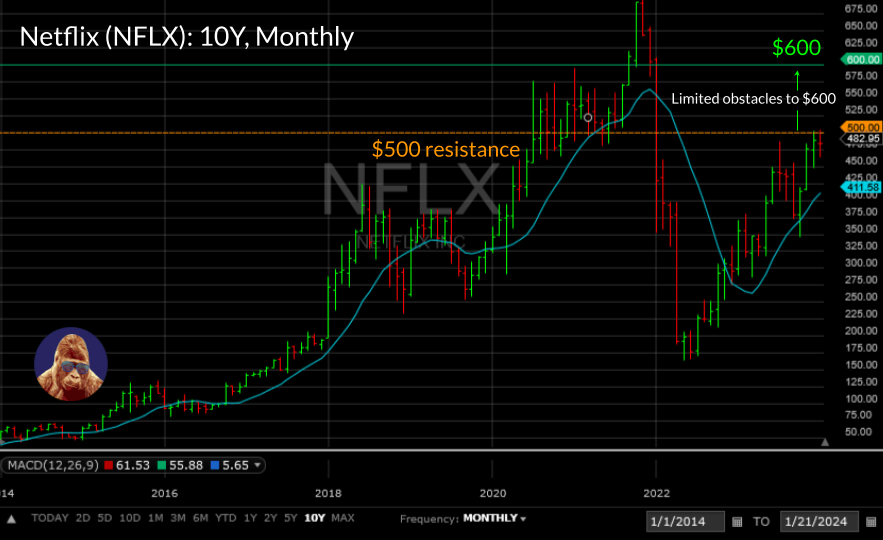

NFLX is not one of the Magnificent Seven, but it has the potential to outperform over the next 3-6 months. In my opinion, the streaming wars are over, and NFLX is the winner. With a profitable platform and a growing subscriber base, neither Paramount, Warner Brothers, nor Disney can make the same claim. NFLX is knocking on the door at $500. Tuesday’s earnings could be the force that slams that door open, clearing a path to $600.

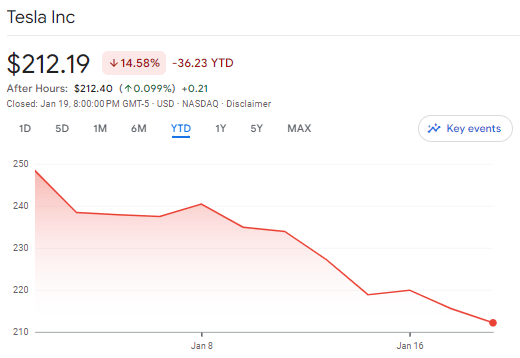

Tumbling ~15% to start 2024, TSLA has not been in control of their own destiny since its last quarter hinted that demand for their vehicles might be cyclical: subject to economic forces such as interest rates. While TSLA is part of the Magnificent Seven, only three members survived. If Wednesday’s earnings cannot reshape the demand story, TSLA might not be among the survivors when the credits roll.

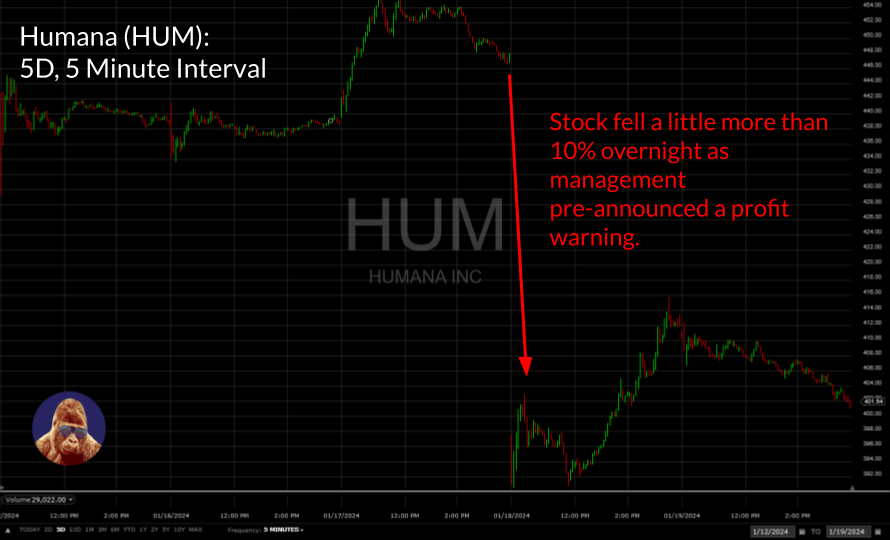

Otherwise, HUM is scheduled for Thursday. Don’t expect much at earnings after last week’s pre-announcement sent the stock down better than 10%. While this may seem like an attractive entry point, I believe it could still be too early for HUM and the peer group. Election years have many stock market implications, one being presidential candidates slamming health insurers for high medical costs. Consequently, if you are looking to add a health insurer to your portfolio, I would wait for more election-related developments to be priced in.

Gorilla Tactics: Boeing (BA)

Thesis

After a faulty door plug incident on an Air Alaska flight using a 737-9 Max, BA stock swiftly plunged 23%. BA caught itself at $200: solid support level over the last 12 months. With the selling pressure on hold as the news flow has improved, I believe the stock is a prime candidate for a “fill-the-gap” trade back to $260.

Technicals

After falling from $260, BA eventually found support at $200. The $200 bottom coincided with a bottom in RSI and OBV, two indicators of momentum. Since bottoming at $200, the stock has recovered to the 200d SMA with a corresponding move in RSI and OBV. The improving technical picture suggests any positive catalyst has the potential to ignite a rally from the 200d SMA at $215 to reclaim $260.

Catalyst

Earnings is the catalyst. BA will report 1/31 after the market closes. If management can reassure investors that the door plug incident is a minor setback, the gap to $260 should fill quickly. However, if earnings indicate a more significant issue with long-term implications, expect the $200 support to be broken.

As for earnings, there have been some positive developments. First, the Indonesian transport ministry has already begun putting the 739-9 Max back into service, suggesting any fundamental damage to their cash flow may be short-lived. Second, Airbus, their rival in the aviation duopoly, announced plans to double sourcing from India due to soaring demand for aircraft, which is encouraging for BA’s ability to provide a bullish future guide.

The Trade

This is a fill-the-gap trade. As such, the upside target is $260. The critical support level of $200 is the downside target.

With an entry price of ~$215, the upside is ~21% to the ~7% downside.

3-to-1 risk-reward.

I entered the trade as of last Wednesday’s 1/17/24 close. To protect my position, I bought puts at the $200 strike that expire 2/02/24 that coincide with the earnings release.

Leave a Reply