January 2024

-

Earnings The quarter itself was impressive: a narrower than expected loss alongside beats on revenue and free cash flow (the money metric). Revenue: $22.02 billion v $21.2 billion expected. EPS: -0.47 cents v -0.78 cents expected. BA did not provide 2024 guidance, messaging a square focus on safety and quality. Gorilla Take The quarter went…

-

About 20 minutes out from the close, and Boeing (BA) is against battling $200 on negative headlines. The Recap To recap, I view it as a coin-toss going into tomorrow’s quarter. The money-metric is cash flow guidance: Guidance beats, stock goes up; guidance misses, stock goes down. On one hand, the FAA’s production cap, today’s…

-

Weekly Performance S&P 500 1.03% Equal Weight S&P 500 (RSP) 1.08% NASDAQ 0.94% DOW 0.65% Russell 2000 (VTWO) 1.75% Talk of the Tape While Netflix’s quarter personified prime-time, Tesla’s car crash reduced the Magnificent Seven to the Super Six. Meanwhile, the goldilocks scenario for stocks persisted as GDP showcased a strong economy, and PCE highlighted…

-

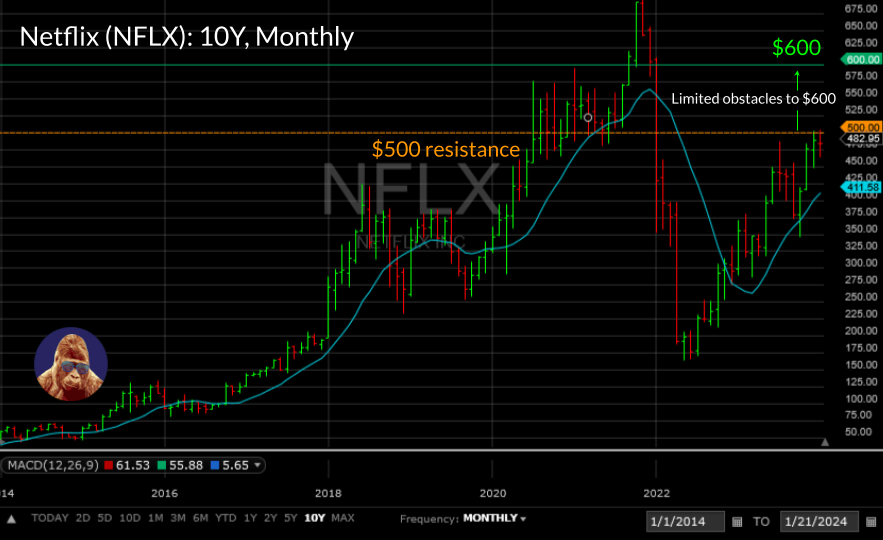

A lot of stock were on the move this week. Here’s a quick update on the three mentioned in my Monday newsletter: Netflix (NFLX) Netflix (NFLX) has cleared a path to $600 by effectively executing their tiered pricing strategy and cracking down on password sharing while simultaneously enhancing their platform, most recently by adding live…

-

Introduction In my newsletter, 9:25, I recently outlined a trade in Boeing (BA). As the downside exit price of $200 has hit on an intraday basis, it is only right to release an update to assist investors in evaluating their options from here. I will also disclose how I am handling the situation. What’s Changed?…

-

Weekly Performance S&P 500 1.17% Equal Weight S&P 500 (RSP) -0.56% NASDAQ 2.26% DOW 0.72% Russell 2000 (VTWO) -0.34% Talk of the Tape While regional banks did their part, hotter economic data challenged the “broadening out” thesis. At this point, the pullback in the equal-weight S&P and Russell 2000 can be viewed as “routine”. However,…

-

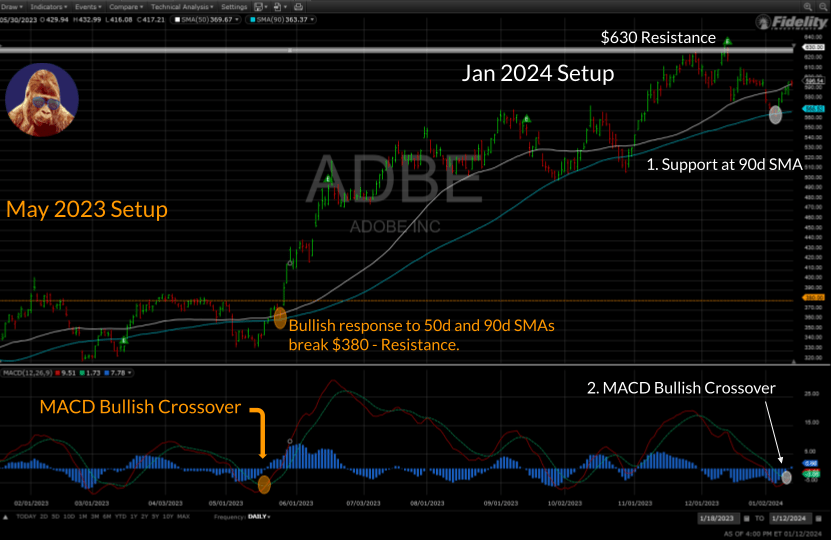

The Setup The stock market is a predictive instrument. It skates where the puck is going, not where it is right now. Technical indicators suggest ADBE is aiming to extend the 56% rally that started last May to better reflect its prospects as an AI-beneficiary, no longer encumbered by a costly acquisition (Figma). In May,…

-

Weekly Performance S&P 500 1.84% Equal Weight S&P 500 (RSP) 0.25% NASDAQ 3.09% DOW 0.34% Russell 2000 (VTWO) -0.01% Talk of the Tape A resilient response to CPI showed stocks can handle inflationary data so long as the “trend is our friend”. The following day, PPI, a leading indicator for inflation, was cool, supporting that…