The Week Behind

It seems that the market opted for a holding pattern leading up to the final CPI and FOMC meeting of the year. Despite dovish economic readings, major indices recorded only slight gains. However, these small gains felt like a bigger win as they propelled all the majors to achieve new 52-week highs.

Highlights

- ADP job creation fell short of forecasts. Pay metrics indicated another month of wage disinflation. Overall, ADP data shows labor market slack, supporting a continued Fed pause.

- Payroll metrics, excluding unemployment, closely matched consensus estimates. The initial hawkish interpretation faded as the full report contextualized the move in unemployment with returning strikers and increased labor force participation.

- The University of Michigan consumer sentiment survey showed significant decreases in both the 1-year and 5-year inflation outlooks compared to the previous month. The 1-year outlook dropped from 4.5% to 3.1%, while the 5-year outlook declined from 3.2% to 2.8%.

- While Broadcom’s quarter wasn’t as clean as I anticipated, it left me with the impression that management is executing on their plan to meaningfully increase their software business through the VMWare acquisition. Consequently, I remain bullish, maintaining my expectations of a 4-digit stock price within the next 3 months.

Stock-Picking and 2024 Rate Cuts

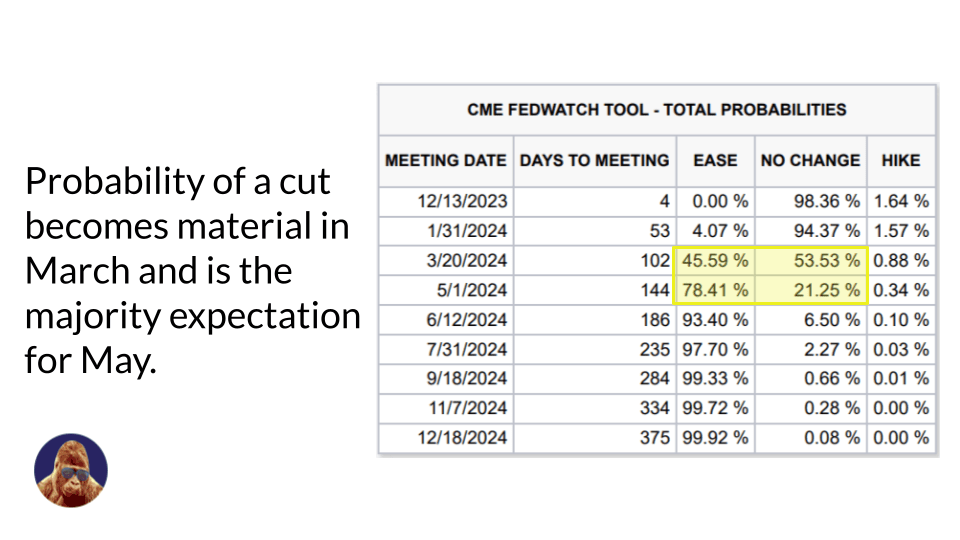

Although payrolls did not appear to change the overall consensus on the Fed or inflation, the probabilities of cuts in March and May fell on the print. Personally, I believe the timing of the first cut is entirely dependent on unemployment. So, although this explanation may be subject to some degree of confirmation bias, I view the reduced probabilities as an acknowledgement that the decrease in unemployment is a delay for the first rate cut.

Nonetheless, the market still expects ~100bps of cuts between now and December of next year. Unless you think the soft-landing will play out without any turbulence, you need to be cognizant that the increased breadth has everything to do with rate expectations. The easier monetary policy is expected to be in the future, the greater the number of stocks that can perform today.

This holds greater significance for stock pickers than index investors. For active stock pickers, it implies that your selections must perform even if the data allows the Fed to hold rates for longer than currently priced-in.

The Week Ahead

With the last FOMC meeting of the year and November CPI scheduled in a 24-hour window, all attention will focus on macro-narrative. Although these events will likely overshadow earnings, this week’s corporate results could signal an inflection point in earnings performance from hardware AI beneficiaries (like semiconductors) to software AI beneficiaries.

Macro Releases:

- Consumer Price Index (CPI, Tuesday): Emphasis will be on the core, which is forecasted to come in at 0.3% on a monthly basis and 4.0% on an annual basis. Although I expect a benign print, the FOMC Meeting the following day has the power to build or quash any momentum, bullish or bearish, this print generates.

- Federal Open Market Committee Meeting (FOMC Meeting, Wednesday): Given the Fed’s messaging and data since the last meeting, the market has already factored in no action at the upcoming meeting. I share this view. The main focus will be on how the Fed adjusts its language to acknowledge the clear progress made on inflation, which suggests that the next Fed action is more likely to be a cut than a hike. Investors will keenly watch for any changes in the prepared remarks released at 2PM and the subsequent press conference at 2:30PM.

- Retail Sales (Thursday): Analysts predict a -0.1% reading. In terms of inflation, a beat could stoke concerns, while a miss should achieve the opposite. However, considering the robust Black Friday and Cyber Monday numbers, it is possible that a hot number be dismissed as an outlier.

Micro Release:

- Software: Two significant AI beneficiaries are set to report this week – Oracle (ORCL) on Tuesday and Adobe (ADBE) on Wednesday. Relative to AI-hardware companies like Nvidia and Broadcom, AI-software firms have yet to fully realize the earnings impact of reduced costs and increased pricing on AI-enhanced products. As this software cohort – ORCL, ADBE, CRM, NOW, SNOW (to name a few) – begins demonstrating the returns on their AI investments in the coming quarters, I anticipate these stocks will find a new bullish gear, similar to the action that played out in the hardware cohort in the third and fourth quarters of 2023.

- Retail: Costco (COST) reports on Thursday. Given the market often gets this stock wrong post-earnings and that expectations are elevated due to trading near the all-time high, I anticipate a short-term negative earnings reaction. For those holding the stock, it’s crucial to remember that Costco operates on volume, not margins. Consequently, their success should be measured by sales and membership numbers. If these metrics hold up and the stock goes down, you have to consider adding or evening starting a position in this top-tier retail stock.

Commodity Communique

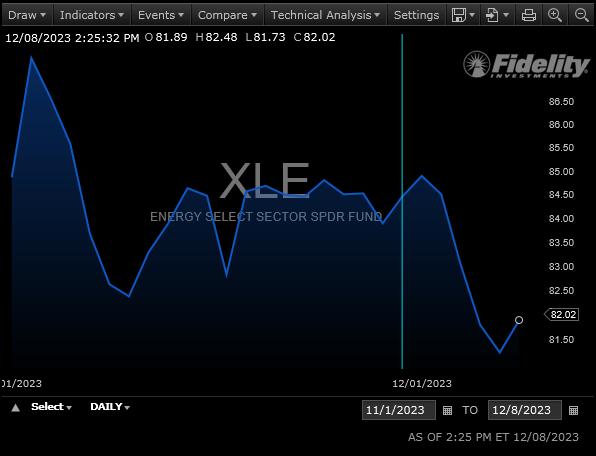

November’s phenomenal equity performance, dubbed the “everything rally”, notably snubbed the energy sector. Soft economic data and a mild winter contributed to subdued industrial and energy prices during the month.

Typically, softness in commodities is interpreted as a recessionary indicator as the low demand for commodities implies a decrease in economic activity. Provided commodities remain within their established ranges, I do not foresee this commodity weakness evolving into a recessionary omen. Instead, I interpret it as a positive factor for inflation sentiment and consumer discretionary stocks.

According to GasBuddy, since peaking in September, the average U.S. gasoline price has steadily declined to a new yearly low. Lower gas prices translate to increased disposable income. This effective gas-rebate puts more cash in consumer pockets at the peak of holiday spending, potentially fueling performance for consumer discretionary stocks.

Leave a Reply