The Week Behind

It was shaping up to be an uneventful week until Thursday threw a curveball. A lackluster 30-year U.S. Treasury (US30Y) auction, coupled with Powell’s IMF remarks, pushed interest rates higher and stocks lower. However, the following day brought a ray of hope in the form of Taiwan Semiconductor, the world’s leading semiconductor manufacturer. Their upbeat guidance carried substantial macroeconomic implications, managing to overshadow the previous day’s gloom. This optimistic surge propelled the major indices to close the week on a positive note: the Dow nudged up 0.65%, the S&P 500 gained 1.31%, and the NASDAQ surged 2.37%.

Highlights

- Poor demand at the US30Y Treasury auction triggered a spike in interest rates, catalyzing Thursday’s downside reversal. This served as a clear reminder that U.S. debt obligations remain a longer-term concern.

- Remarkable guidance from Taiwan Semiconductor played a pivotal role in shifting sentiment: the potential for an economic recovery in the semiconductor sector hints at a broader uptick in economic activity. This fosters a more positive outlook for 2024 earnings, which overwhelmed the bearish implications of the US30Y auction.

Poor Action after a Poor Auction

The S&P 500 and NASDAQ were on the cusp of making history heading into Thursday’s session. The S&P 500 and NASDAQ had notched eight and nine consecutive positive sessions, respectively. One more day in the green would have broken both records set in November 2021.

What ended these impressive streaks? Interest rates.

The poor demand at the auction resulted in the US30Y being priced lower. As bond prices drop, bond yields rise. Higher yields exert downward pressure on stocks, bringing an end to a remarkable run for stocks.

In all fairness, stocks had been overbought for multiple sessions ahead of Thursday’s auction, indicating extreme euphoria. This heightened state of optimism meant that any obstacle had a chance to disrupt these streaks. However, the undeniable fact remains: yields concluded the best runs stocks had seen since November 2011, serving as an outright reminder of the inverse relationship between interest rates and stocks.

The Week Ahead

Keeping in mind the continued importance interest rates are playing in today’s stock market, we’ll start with the major macroeconomic releases of the week.

Macro Releases:

- Consumer Price Index (CPI, Tuesday): The spotlight will be on the core CPI with forecasts of 0.3% and 4.1% for the month and yearly basis, respectively. The market hopes for CPI to underperform these expectations. Such an outcome would be accretive to Friday’s bullish momentum. As the most important release of the week, expect the results to set the tone for the rest of the week and beyond.

- Retail Sales (Wednesday): Analysts are anticipating -0.1%, a significant shift from the prior month’s 0.7%. This release is critical. The Fed believes inflation cannot be cured without a period of “below trend” growth. Given the service-heavy nature of the U.S. economy, arguing for “below trend” while consumer spending metrics outperform would be near impossible. Hence, lower figures would favor the bulls.

- Housing Starts & Building Permits (Friday): Simply put, housing costs remain too high. A better-than-expected number would benefit the market, as increased future housing supply tends to lower future housing costs. However, given elevated mortgages discouraging homebuilding, temper your expectations which are set for 1.35 million and 1.45 million for housing starts and building permits, respectively.

Micro Releases:

- Housing: Home Depot (HD) reports on Tuesday. With its significant ties to professional contractors, Home Depot provides unique insights into housing inventory (new construction) and housing investment (contracted renovations).

- Retail: Target (TGT) and Walmart (WMT) report on Wednesday and Thursday, respectively. Interacting with a diverse consumer base, investors will use details from these quarters to size up consumers’ budgets, offering valuable insight on overall consumer health.

- Cybersecurity: Palo Alto Networks (PANW) reports on Wednesday. Although the stock traded down on a bad quarter from competitor Fortinet (FTNT), it has since recovered. In my view, the recovery makes sense. In fact, I believe PANW has more room to run. Looking back at the past two quarters, PANW has delivered upside surprises while FTNT floundered. It appears to me as though PANW is stealing market share from FTNT. If that story picks up steam after the quarter, Elliott Wave analysis suggests PANW could have a 3-handle – $300 – price.

Powell to Blame?

Following last Thursday’s downside reversal, many blamed Powell. According to this story, Powell was supposedly more hawkish at Thursday’s IMF than at the prior week’s November FOMC. I find this story a convenient work of fiction. During CNBC’s Halftime Report, Scott Wapner carefully analyzed Powell’s words. You can listen to the clip and decide for yourself. I do not think Powell was incrementally hawkish.

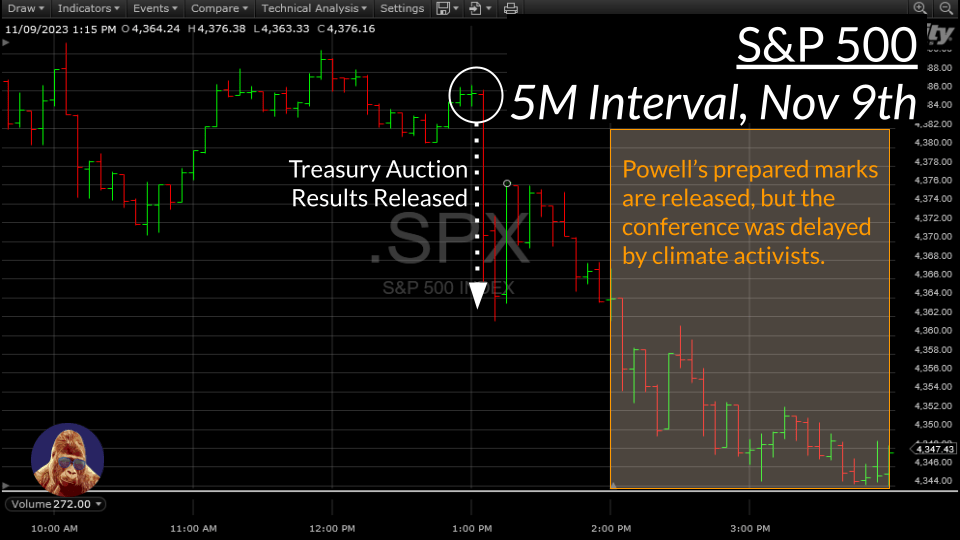

Moreover, the timeline doesn’t align with the story implicating Powell. The movement in interest rates that sparked Thursday’s reversal originated with the US30Y auction that concluded at 1 PM. Powell’s prepared remarks were not released until 2 PM. Delayed by climate activists, Powell didn’t begin speaking until later.

In short, I believe the interest rates are the culprit. Blaming Powell is more convenient than compelling.

Leave a Reply