The Week Behind

The market managed to avoid all the potential pitfalls that provided bears and hawks the edge over the past two weeks. Treasury announcements alleviated concerns about mounting government debt, economic data showed signs of softness, ADP and Payrolls hinted at labor market slack, and bellwether earnings maintained investor confidence. Consequently, as the US10Y yield dropped 7% in a week, the doves and bulls reasserted themselves as the Dow, S&P 500, and NASDAQ gained 5%, 5.85%, and 6.61%, respectively.

Highlights

- Major economic releases – ADP, Payrolls, Unit Labor Cost, Productivity, etc… – painted a “goldilocks” picture of the economy for the Fed: not too hot to stoke inflation fears, and not too cold to stoke recession fears.

- Treasury announcements were constructively embraced, as the outlined structure appeared to alleviate mounting uncertainty regarding how the Treasury will meet debt obligations created by Congress.

- As anticipated, the Fed kept the Federal Funds Rate at 5.25 – 5.50%. During the press conference, Powell indicated that the committee now views the risks of “doing too much” and “doing too little” as more balanced, suggesting a preference within the committee to hold rather than hiking.

Technical Breakdown: US10Y Yield

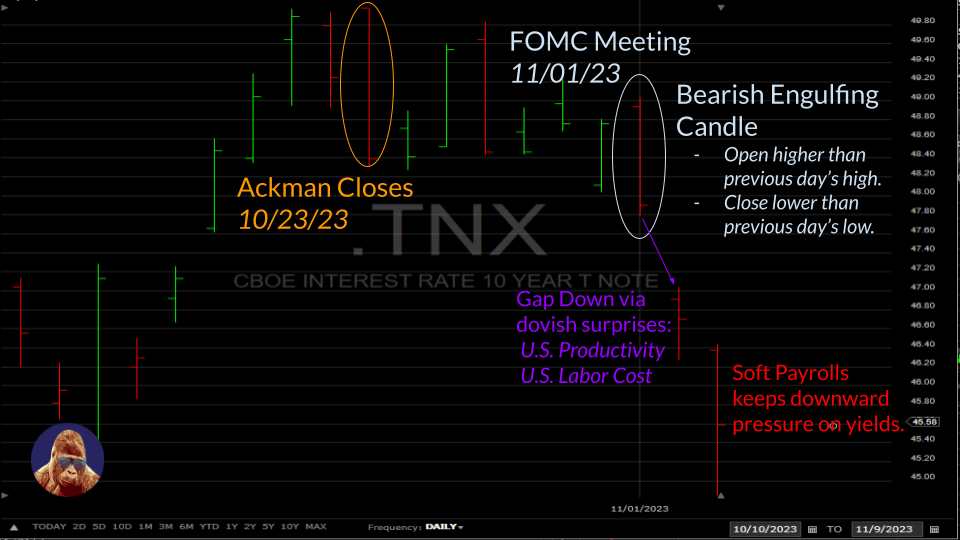

For the first time since early May, the US10Y yield recorded consecutive weekly declines. The initial weakness two weeks ago stemmed from Bill Ackman closing his short position on the US10Y. Last week, the dovish post-FOMC commentary transformed that initial weakness into a bona-fide technical breakdown.

As Powell elaborated on the committee’s inclination to hold rates rather than hiking, a bearish engulfing candlestick pattern formed on the US10Y yield’s chart. This pattern – open above the prior high, close below the prior low – often signifies the end of an upward trend. In the following two sessions, the US10Y yield both opened and closed lower, confirming this signal.

The significant point here is that this textbook technical breakdown reinforces my thesis that momentum players played a crucial role in driving the US10Y yield higher. I formulated this idea when I observed that the yield’s upward bias dwindled after Ackman closed his position. With Ackman’s de facto endorsement gone, there was no fresh conviction to press the short further. The breakdown didn’t happen at that moment because following him into the trade wasn’t enough reason to exit and momentum still favored the shorts. However, the situation changed rapidly as Wednesday’s bearish engulfing pattern was swiftly confirmed by Thursday’s dovish data. This shift in narrative led to a clear change in momentum, which, at this point, prompted shorts, who had artificially pushed and maintained the US10Y yield at artificial levels, to close their positions en masse, resulting in an unmissable ~34 basis point breakdown.

The Week Ahead

While there is an abundance of earnings scheduled, with the major companies having already reported and no significant economic releases this week, I anticipate that the primary focus will be on unpacking the implications of last week’s FOMC meeting and economic data. However, with the Fed blackout window no longer in effect, members have quickly taken to the microphone.

A Fed member is scheduled to speak every day except for Friday, due to Veterans Day. It’s worth noting that cuts have reappeared in the 2024 forecast, as indicated by the CME FedWatch Tool. Consequently, we should anticipate a more hawkish tone across the board, as it’s evident that cuts are contrary to the committee’s objectives. As chairman, Powell is the most important to monitor. He speaks on Wednesday and Thursday. That being said, given the bullish momentum witnessed in the sessions following the FOMC meeting, I don’t expect Fed speakers to significantly dampen the market’s optimism. Overall, this sets the stage for a relatively neutral environment for interpreting this week’s earnings.

Speaking of earnings, the market has responded more favorably in recent weeks. Now that the narrative has firmly shifted from the US10Y trend toward 5.5% to the US10Y trending toward 4.5%, the stock market can assess companies through a more lenient lens. Investing in stocks is as much an art as it is a science. For a number of reasons, both scientific and artistic, there are considerably more viable stocks in a 4.5% environment than in a 5.5% one.

Lock-In A Little Duration

For the past year, cash has been a lucrative investment thanks to money markets offering a risk-free 5% return. Investors could enjoy modest returns without adding risk or conducting extensive due diligence. This scenario will change as short-term interest rates decline alongside continued softening of economic data.

Historically, the Federal Reserve has cut interest rates to support a slowing economy. Consequently, as the economy shows signs of deceleration, I anticipate that the market will start pricing-in potential interest rate cuts to align with the Fed’s policies in a weaker economic environment.

If you, like me, believe that interest rates will settle at lower levels, it’s a wise move to invest in 1-5 year bonds to “lock-in some duration”. In a declining rate environment, bonds offer superior performance compared to money markets for two key reasons. First, when you purchase a bond, the coupon (dividend) is fixed for the duration, while money market dividends fluctuate with short-term interest rates. Second, as interest rates decline, bond values rise, whereas the value of money market holdings remains unchanged.

To summarize, assuming that interest rates settle at lower levels from where they are today, investing in bonds with some duration now will outperform cash in a money market, providing better dividends (coupon) and capital appreciation.

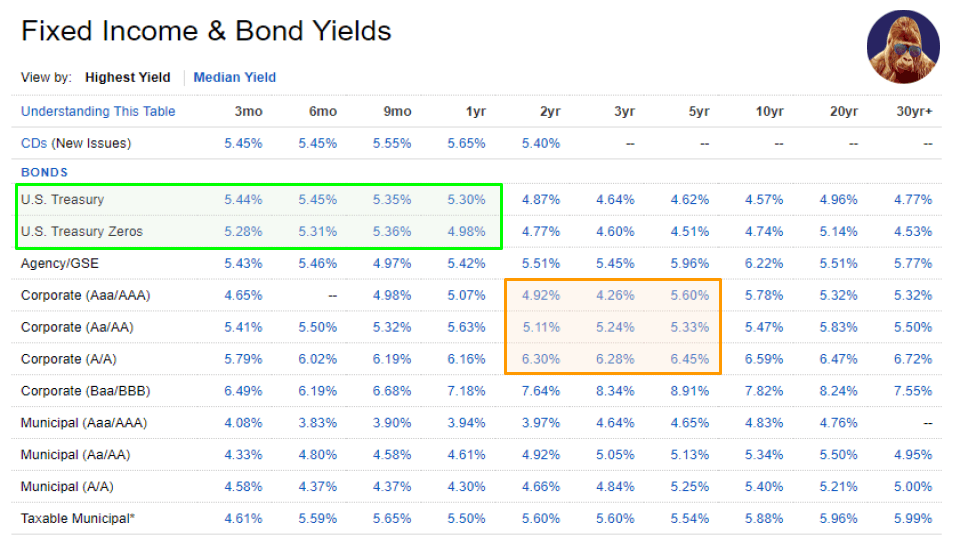

In light of this, I’ve decided to secure 5-7% in low-risk bonds through a 5-year ladder strategy. I funded this ladder by reallocating from my money market position. For the short-term portion, I’ve kept it straightforward with 3-12 month treasuries. Beyond the 12-month mark, I ventured into investment-grade corporate bonds to maintain a yield above 5%. Notably, all the bonds in the ladder are discount bonds, which means they trade below the $100 par or face value.

Leave a Reply