The Week Behind

Fundamentally sound mega-cap earnings and downward pressure on the US10Y yield were insufficient to rescue stocks from a losing week. Each of the major indices lost over 2% during the week, with the S&P 500 surrendering the 4200 level in the process.

Highlights

- Bill Ackman closed his well-known short position on the US10Y in anticipation of economic weakness manifesting in the data, which implies a potential peak in yields.

- S&P Services and Manufacturing PMI both came in above the estimate. Notably, Manufacturing PMI registered 50, marking the first non-contractionary reading since April 2023.

- Despite 3Q GDP outperforming, the miss in 3Q PCE stole the spotlight, leading the US10Y yield to reverse and close the day lower after an initial upside pop.

- September PCE was in-line with expectations, supporting the case for a continued pause through the November FOMC meeting.

Update on 4200

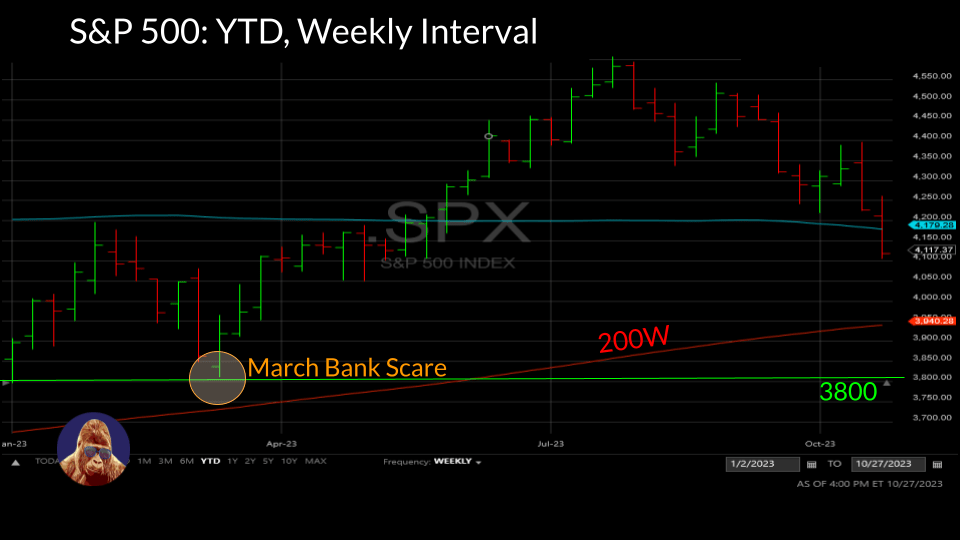

Although the US10Y yield backed off the highs, the S&P 500 couldn’t hold 4200. In my assessment, this indicates equities are not cheap enough given the backdrop of interest rates, earnings, and global uncertainties.

I anticipate the next line in the sand is the 200-week moving average (200W). The 200W is where stocks bottomed last October and usually acts as a substantial support level. As of last Friday’s close, the 200W was ~3940. If the 200W fails to hold, then I consider 3800 the subsequent support level. This is where stocks started the year and where stocks found a bid amid the bank scare in March.

The Week Ahead

This week’s events will significantly shape market sentiment as we approach the year-end. Not only are the November FOMC Meeting and October Payrolls on the docket, but the most influential stock in the S&P 500, Apple, is set to report.

Macro Releases:

- ADP Employment (Wednesday): While the job creation forecast stands at 150k, the central focus will be on wage insights. In the previous month, employees who remained in their jobs experienced a 5.9% increase, while job changers saw a 9% increase. Expect a positive reaction to wage insights printing below the prior month.

- November FOMC Meeting (Wednesday): The press conference takes precedence as the market has already factored in a continued pause for this meeting. Bullish sentiment hinges on Powell’s remarks suggesting that the increase in long bond yields is aiding the Fed’s efforts, thus implying a reduced need for incremental action.

- October Nonfarm Payrolls (Friday): The job creation forecast stands at 175k, with unemployment expected to remain at the prior month’s level of 3.8%. Most significantly, the monthly hourly wage is projected to increase by only 0.3%. Although I could not locate the consensus estimate for yearly hourly wages, the preceding month recorded a figure of 4.2%. In terms of wage statistics, bulls are hoping for downside surprises, as they imply disinflation and support the case for the Fed’s policy hold.

Corporate Earnings:

- McDonalds (MCD, Monday): MCD is often used as a gauge of consumer health. Traditionally, the better they perform, the worse it suggests the overall consumer health is. The conventional wisdom here is that MCD tends to thrive when consumers opt for more affordable dining choices during times of economic hardship. Though I no longer fully adhere to this view due to their “strategic menu price increases” that began in 2022, MCD’s exposure to a wide array of consumers and supply chain partners still offers valuable macroeconomic insights.

- Eli Lilly (LLY, Thursday): Eli Lilly is known for its weight loss and Alzheimer’s medications. One point of interest will be progress on expanding Mounjaro’s FDA approval beyond diabetes to include weight loss.

- Apple (AAPL, Thursday): Apple, alongside Nvidia, is among the market’s most beloved and widely held stocks. Due to its substantial weight in various indices and investor portfolios, a negative response to Apple’s earnings poses a broader risk to stocks. Focus on demand for the iPhone 15, which serves as the platform for their services business, which is the key growth driver for the company right now. As for AI, don’t expect much. Apple is strategic about new product ventures. It will enter the space when fully prepared and on its own terms.

A Post-Earnings Playbook

With continued unrest between Israel and Hamas and interest rates offering a competitive risk-free alternative, the bar was high for companies reporting this week. However, I didn’t anticipate the level of risk aversion in the market. This is evident in the market’s reluctance to reward even the highest quality quarters and its eagerness to punish at the slightest hint of weakness.

In my view, Microsoft (MSFT) delivered the best quarter thus far. They beat both revenue and earnings expectations, provided positive guidance, and their management was on point during the call. While the stock started the following session up 5%, it closed up only 3%. Investors trading out of MSFT despite the bulletproof quarter illustrates how challenging it is for stocks to perform in the current market environment.

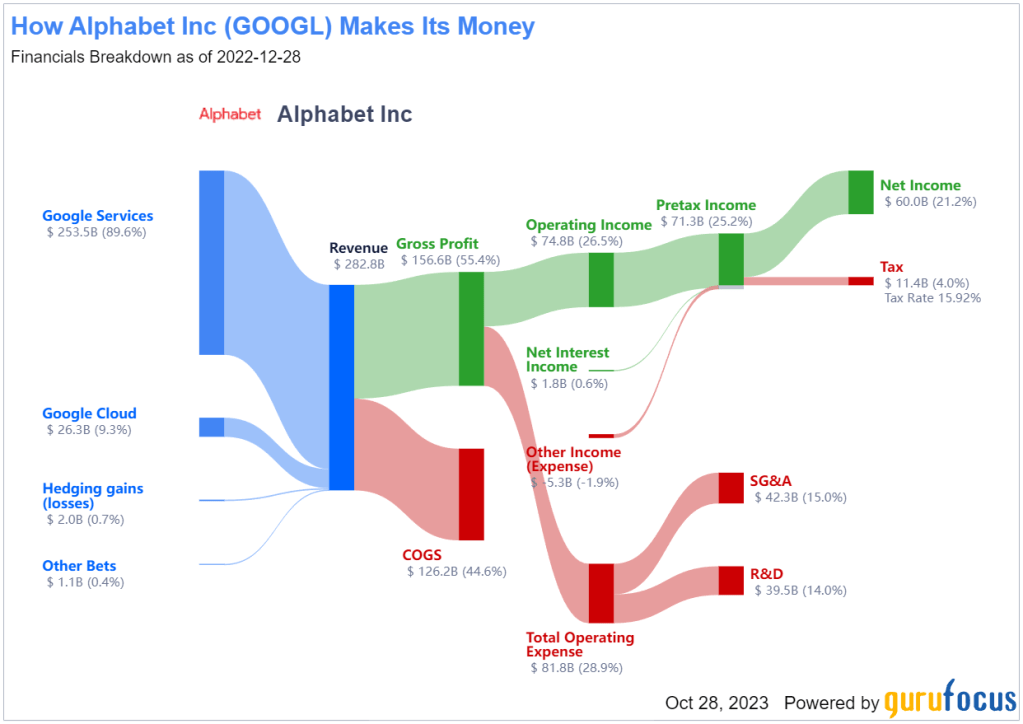

Alphabet (GOOG) also exceeded Wall Street’s revenue and earnings forecasts. Their core revenue driver, search, remained strong, accounting for approximately 90% of their revenue and 98% of their operating income. However, their cloud division, which represents a smaller portion of their revenue and operating income, underperformed. The market embracing this fundamentally phenomenal quarter with an 8% decline – choosing to focus on the single negative instead of the numerous positives – further underscores the scrutiny stocks are facing.

Due to the intense – and, at times, unfair – scrutiny stocks currently face, the risk-reward clearly favors waiting for the post-earnings dust to settle before putting new money to work. The market is barely rewarding high quality quarters, punishing good quarters, and demolishing poor quarters. No reason to include FOMO (fear of missing out) in your lexicon. Additionally, Apple and Nvidia, both significant index components, have yet to report. A negative market reaction to either could have a broad impact.

Given the backdrop, I am implementing the following “post-earnings” playbook when analyzing opportunities this earnings season:

- Wait for the company to report earnings.

- Review the quarter and listen to the earnings call.

- If I still have a favorable view of the stock, wait for the price action to stabilize as analysts update their coverage.

- Accumulate the stock in small amounts at different price levels, ensuring each purchase is no less than 5% away from the previous one.

This strategy allows me to accumulate quality stocks in a systematic way to navigate this difficult environment for stocks.

Leave a Reply