The Week Behind

The US10Y yield touched 5% as robust economic data overpowered the Fed’s neutral posture. Yield pressure had the most impact on the NASDAQ, resulting in a ~3% weekly decline. The S&P 500 didn’t fare much better, dropping ~2.4%. While the Dow held up better, it also succumbed to the sell-off, shedding ~1.6%.

Highlights

- U.S. leading economic indicators signaled a weaker economy than expected, but other significant indicators – such as the Empire State survey, Philadelphia Fed survey, industrial production, and capacity utilization – all outperformed forecasts, which helped push the US10Y yield to new cycle highs.

- U.S. retail sales significantly exceeded the 0.3% estimate, registering 0.7%. This positive economic outcome implies that rates will need to remain elevated for an extended period to combat inflation. In turn, yields pushed higher, pressuring stocks lower.

- Both the home builder confidence index for October and housing starts for September fell short of expectations. This underperformance suggests that Fed policy is slowing the economy, but it also implies that investors shouldn’t anticipate significant relief from housing inflation in the near term.

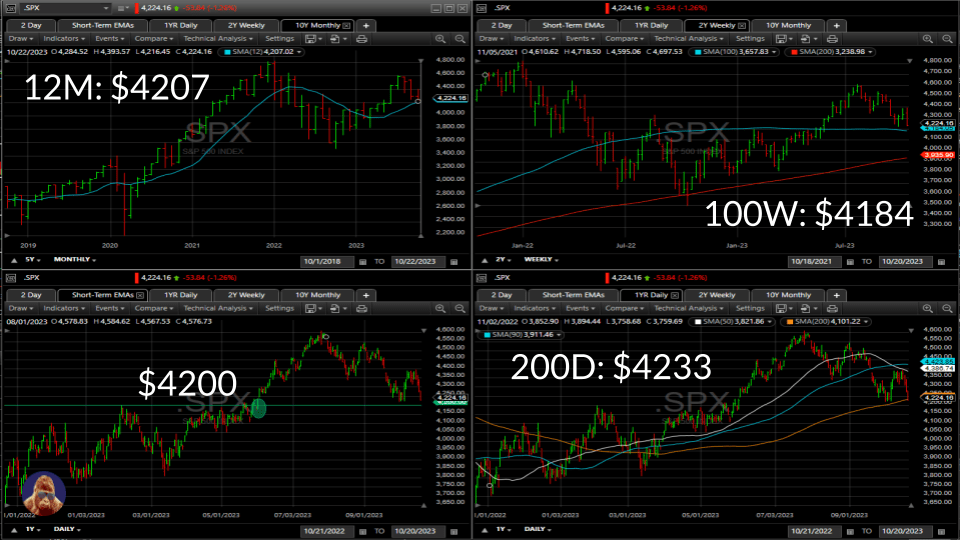

Converging on 4200

Although single-variable analysis is often insufficient, when multiple variables converge on a tight price level, it warrants attention. The S&P 500’s 200 day, 100 week, and 12 month simple moving average are all within ~1% of 4200. 4200 holds significance as it was the breakout point for the S&P 500 back in June when the AI-driven narrative emboldened the bulls. If the S&P 500 fails to maintain support at 4200, anticipate increased volatility as stocks enter no-man’s land from a technical perspective.

The Week Ahead

My market stance remains unchanged: everything is secondary to the US10Y yield. Consequently, despite being in the midst of earnings, we must keep an eye on macroeconomic developments. An economic data that drives bond yields higher has the potential to overshadow strong company results.

Macro Releases (Stuff That Influences Interest Rates):

- S&P Services and Manufacturing PMI (Tuesday):

Forecasts are 49.9 and 49.3, respectively. A reading above 50 indicates expansion, while below suggests contraction. Expect a soft result to push yields down, providing some lift to stocks.

- 3Q GDP (Thursday):

First estimate for the 3Q is 4.5%. Although it will be revised twice, above 4% GDP would be considered “above trend” growth. The Fed believes a period of “below trend” growth will be necessary to slay inflation. Though it seems counterintuitive, strong GDP will receive a bearish embrace as it implies a prolonged period of tighter monetary policy.

- September PCE (Friday):

Personal Consumption Expenditures (PCE) is the Fed’s preferred inflation measure. Core PCE is expected to rise by 0.3% monthly (compared to the previous month’s 0.1%) and 3.7% yearly (versus the prior month’s 3.9%). I do not expect the strikes to affect this print, but energy prices, which have remained elevated for two months, may finally influence core components.

Corporate Earnings (Stuff That Influences Stock Picking):

- Tuesday: Coca-Cola (KO), Alphabet (GOOG), Microsoft (MSFT)

KO: Down over 10% since the last quarter due to concerns about GLP-1s lowering consumer demand for “unhealthy” food. I believe the downside driven by GLP-1 concerns is excessive. These companies’ foundation and continued success are rooted in their adaptability rather than relying on an eternally unhealthy consumer. If preferences are shifting, I anticipate that these well-managed organizations will adjust accordingly. However, there is no compelling reason to assume that KO will perform significantly better than PEP, which has struggled to gain much momentum despite a decent quarter.

GOOG: Strongest technicals of the mega-caps reporting. A solid quarter positions a challenge of the $152 all-time high. If you’re considering a trade, use the 50-day SMA as your downside exit. Assuming cloud and AI meet expectations, I anticipate a bullish surprise from YouTube advertising, boosted by NFL Sunday Ticket.

MSFT: Having dropped roughly 5% since the last report, the stock is consolidating in the $320s with neutral technical indicators. There hasn’t been much news from the company recently, which may have caused investors to overlook the potential upside coming from AI-enhanced products (Teams and Bing search) and Azure (cloud).

- Wednesday: Meta Platforms (META)

On a weekly chart spanning two years, there’s a bullish cup and handle pattern. There’s potential for a challenge of the all-time high at $385 in 2024 if they demonstrate platform growth and AI-enhanced monetization of those platforms. In the short term, keep an eye on the $325 price level.

- Thursday: Amazon (AMZN)

As long as the AWS figures assure investors that growth is on track, I anticipate a positive response. My optimism extends to the retail business, which should outperform other retailers that have cited shrinkage/theft as an issue. Additionally, I expect robust advertising performance, driven by Thursday Night Football on Amazon Video.

- Friday: Exxon (XOM), Chevron (CVX)

While I consider XOM the superior operator, the difference in performance between XOM and CVX appears unsustainable. With elevated energy prices, both companies should share positive outlooks. Earnings could act as the catalyst for CVX to catch up, or for XOM to correct down.

Mega-Cap Recap

Last week, the first of the mega-caps, Tesla (TSLA) and Netflix (NFLX), reported. They went in starkly different directions.

Starting with the winner, Netflix (NFLX) delivered a stellar quarter, resulting in a 13% increase. Not only did Netflix exceed revenue and profit expectations, but it outperformed on subscriber growth as well: 8.76 million new subscribers compared to the 5.49 million estimate. Their new ad-supported tier contributed to these impressive results as it grew by 70%, which dispelled doubts about the platform’s ability to grow in a post-pandemic lockdown environment. Margin updates also played a role in clearing the dark clouds that gathered around the name, but the undeniable return of subscriber growth was the key driver behind the post-earnings pop.

Tesla (TSLA), on the other hand, had a rough week, dropping ~12%. This decline was driven by margin pressure caused by price cuts to their vehicles and increased R&D. Compounding matters, Elon Musk did not represent himself well on the call.

In my perspective, the primary reason for the steep decline was that the quarter made Tesla look cyclical for the first time in the company’s history. Prior to this report, demand for Tesla’s cars was seen as insensitive to economic conditions: people bought Teslas regardless of costs or the economic environment (idiosyncratic/inelastic). However, when management didn’t draw a hard line on price cuts, it hinted at the possibility that demand for their vehicles might be sensitive to economic conditions (cyclical/elastic), specifically financing costs such as car loans, which are influenced by rising interest rates. This implies that Tesla’s business could suffer as interest rates continue to climb.

The market typically assigns higher multiples to companies with idiosyncratic growth prospects compared to cyclical ones. Currently, Tesla still commands the valuation of a growth company, with a TTM P/E of ~70x. While I don’t believe valuation is the linchpin of any Tesla shareholder’s thesis, further compression will occur if Tesla’s business begins to appear more cyclical than idiosyncratic.

Leave a Reply