Big Banks:

In the aftermath of the March Bank Scare, the “Goliath over David” thesis gained popularity. This thesis suggests that big banks like JPM, WFC, and BAC – the “Goliaths” – would benefit from the loss of confidence in regional banks – the “Davids”. The latest round of earnings solidified this thesis, revealing that the Goliaths continue to benefit from the deposit migration that left the Davids scarred. Despite facing competition from high-yielding alternatives and regulatory uncertainty, the Goliaths have effectively leveraged their increased deposit bases, outperforming Wall Street’s expectations at the expense of the Davids.

In terms of the macroeconomic outlook, each of these big banks provided a similar perspective: the economy and consumer are slowing down but remain healthy. However, given these banks’ stock prices seem to reflect a 2024 recession, it appears as though the market is not buying into the banks’ perspective. If you do not have a recession in your 2024 forecast, consider forming a strategy to add one of these Goliaths, and other cyclical stocks, to your portfolio as the Israel-Hamas situation and the US10Y yield stabilize.

Regional Banks:

While volatility in the US10Y distorted post-earning reactions, it appears as though the market is no longer treating all the regional banks as a homogenous group. Differentiation is emerging between those that posted strong quarters and those that reported weaker quarters. In my view, this is a constructive sign for the broader market. That being said, I remain steadfast in my position that the regionals are uninvestable.

Capital Markets:

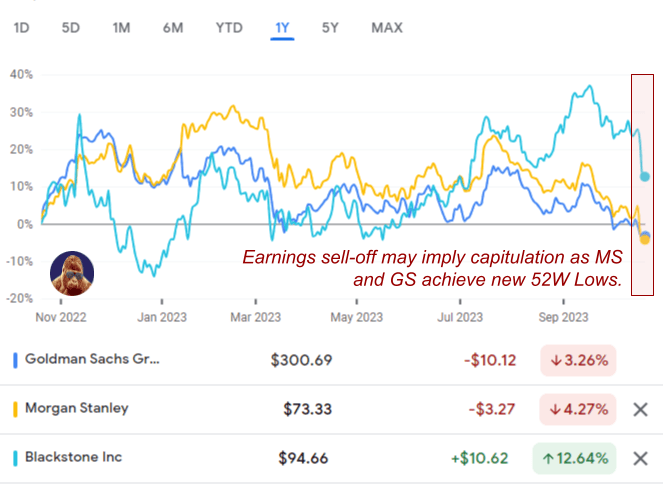

While each of the capital market companies I monitor – MS, GS, BX – had their unique reasons for their post-earnings declines, the underlying message concerning capital markets remained uninspiringly consistent: segment results fell short of expectations, but there are still grounds for optimism moving forward.

The capitulation in these stocks implies that investors have lost confidence in a robust IPO market over the next 6-12 months.

I can understand why investors might be looking for the exit after these results. We were led to believe that the recent round of IPOs was a success. If these IPOs were indeed successful, they should have encouraged other highly-anticipated private companies to go public.

Of course, higher interest rates and instability in the Middle East are significant challenges. However, external factors notwithstanding, for those who invested 3-6 months ago with the expectation of a significantly profitable IPO business resurgence by 4Q23 – 1Q24, these earnings reports undermine that thesis by pushing the start of a new IPO cycle further into the future. When a thesis fails to materialize, you sell the stock. I think that is what happened here.

Leave a Reply