The Week Behind

While September’s CPI went the way of the hawks, events unfolding in the Middle East between Israel and Hamas proved the dominant market force. This conflict triggered a flight to safety, causing yields to retreat, gold to advance, and select ‘safe-haven’ stocks to outperform. The Dow and S&P 500 closed the week with modest gains of ~0.80% and ~0.45%, while the NASDAQ experienced a slight loss of ~0.20%.

Highlights

- September’s PPI and CPI reports indicated slightly higher inflation than anticipated.

- Conflict between Israel and Hamas catalyzed a “flight to safety” trade, benefiting assets like treasuries, gold, and mega-cap technology stocks.

Banks Show-Up and Show-Out

J.P. Morgan (JPM) and Wells Fargo (WFC) both delivered exceptional quarters, surpassing Wall Street expectations in terms of revenue and earnings as well as providing reassuring guidance. As a JPM shareholder, I will provide some additional context from their report:

Despite Jamie Dimon’s (CEO) warning that this is one of the “most dangerous times” for the world in decades, his firm remains optimistic about the future. Once again the firm raised their guidance, this time to $88.5B, up from the previous $87B. Jeremy Barnum attributed the upward guide to continuous “over-earning” from net interest income and growing capital market optimism (M&A, IB).

Regarding American consumers and businesses, Jamie pointed out that they remain in good health. However, he also noted that tighter labor markets and the extreme government debt suggest the potential for further interest rate increases as households continue to spend their cash savings.

While his warning about interest rates and consumer behavior should not be disregarded, it’s worth noting that he has been emphasizing these concerns for over a year. Therefore, his continued caution should not cause undue alarm. Personally, I find his commentary on the strength of U.S. businesses aligning with the consensus that the fourth quarter is expected to be fundamentally sound for earnings. This bodes well for a potential catalyst to drive stocks higher into year-end.

The Week Ahead

There is no shortage of macro and corporate events this week. That being said, it’s crucial to note that market sentiment may still be swayed by headlines related to the Israel-Hamas conflict. Consequently, even good economic or corporate news could face a negative market reaction if released at an inopportune time.

Macro Releases:

- U.S. Retail Sales (Tuesday): Expectations are set at 0.2%. The market might respond more favorably to a downside surprise than an upside one. While an upside surprise would signal a healthier consumer, a downside surprise could suggest consumers are tightening their budgets, implying a disinflationary economy.

- Housing Starts (Wednesday): The forecast is 1.37M. Housing inflation has been stubbornly high. The market needs a figure exceeding 1.37M. Over time, the increased supply will have a downward impact on housing costs.

- Powell’s Speech (Thursday): Scheduled for noon, Powell’s speech will be closely monitored for hints on how recent development in the economy and in the Middle East are affecting their approach to monetary policy.

Corporate Earnings:

- Big Banks: Charles Schwab, Bank of America, Goldman Sachs, and Morgan Stanley represent the big banks in the first half of the week, while Zions, KeyBank, and Huntington lead the regionals in the latter half.

A bullish response to these results is important, as strong financial performance indicates a solid economic foundation, making it hard to maintain a bearish outlook on the economy and short the stock market.

- Mega-Caps (Wednesday): Tesla (TSLA) and Netflix (NFLX) quarterly results.

Tesla (TSLA): According to Reuters, Tesla’s market share recently slipped to its lowest levels on record despite record high U.S. EV sales in the 3Q. While this may be a concern for investors, I expect TSLA to tell a compelling story, especially as their primary U.S. competitors in the Big Three are dealing with the UAW strike with the potential to meaningfully dilute Big Three margins.

Netflix (NFLX): The stock has been on a downward trajectory since management lowered margin guidance on September 13th, dropping approximately 20% to levels not seen since last May. Management will need to rekindle investor confidence with their results and outlook.

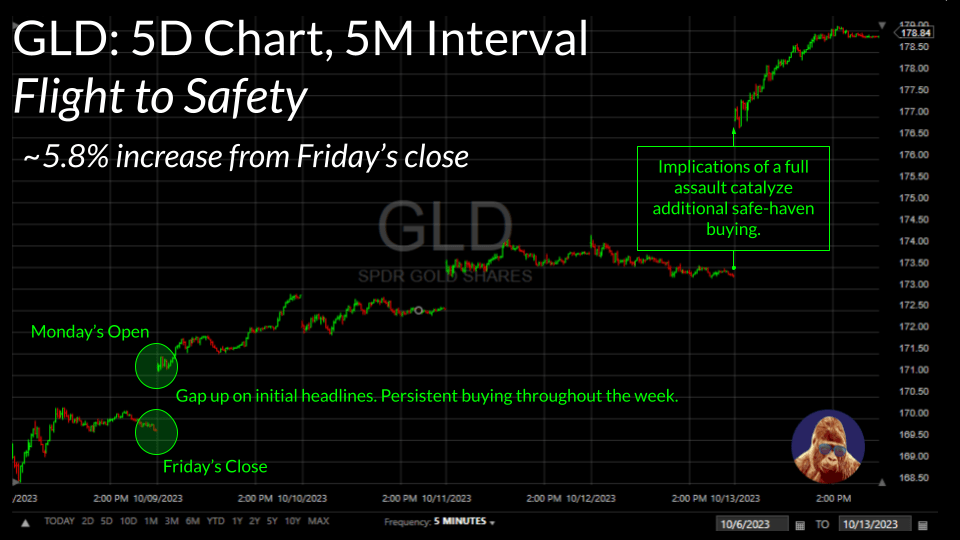

Safe Havens

In less than two years, two separate land wars have erupted. In times of great uncertainty and peril, global investors tend to flock to safe-haven assets. With recent developments in the Israel-Hamas conflict, it’s an apt moment to explore three common safe-haven assets.

U.S. Treasury: This is the quintessential safe-haven asset in the financial world. It’s widely recognized as a risk-free investment and sets the ‘risk-free’ rate for discounted cash flow (DCF) models. The U.S. Treasury holds this status for two primary reasons: the U.S. dollar’s status as the world’s reserve currency and the U.S. government’s backing, which has never defaulted on debt, even during economic crises. Additionally, the government has the ability to tax a substantial base of wealthy taxpayers.

Last week, we witnessed two instances of a flight to safety. Initially, on the first headlines, and later, as further headlines suggested an escalation in conflict. Money flowed into treasuries on both occasions, driving bond prices higher and yields lower. Remarkably, even hotter-than-expected CPI data couldn’t overcome the second flight to safety.

Gold: Often regarded as the ultimate safe-haven asset, gold’s intrinsic value is believed to be uncorrelated with other financial assets, making it an ideal hedge from an academic perspective. However, in my trading experience, gold’s price appears indirectly correlated with the U.S. Dollar’s value. As the dollar’s value falls, gold’s value tends to rise. In essence, hard assets like gold become more valuable when financial assets, such as currency, come under pressure.

Another way to look at it is the direct link between interest rates and currency. When interest rates decrease in a country, the value of its currency typically drops. As the currency’s value decreases, gold’s value tends to increase.

Mega-Cap Technology: Over the past decade, mega-cap technology companies have earned a reputation as a safe haven for many investors. Their consistent fundamental and price (stock) performance regardless of the economic backdrop adeptly justify why investors associate ‘safety’ with these reliable compounders. Although this group faded at the end of last week, history suggests it will be the first sector equity investors return to once the situation stabilizes. If I were considering adding to my equity holdings in the near future, I’d wait for these safe-haven mega-caps to demonstrate strong performance first.

Leave a Reply