Historically, the yield curve re-inverts only once the Fed is cutting rates in response to a recession. The rapid cuts bring short-term rates below long-term rates, re-inverting the yield curve. In my opinion, the recession signal is the Fed rapidly cutting short-term rates. A reversion of the yield curve is merely a natural consequence, not the primary trigger.

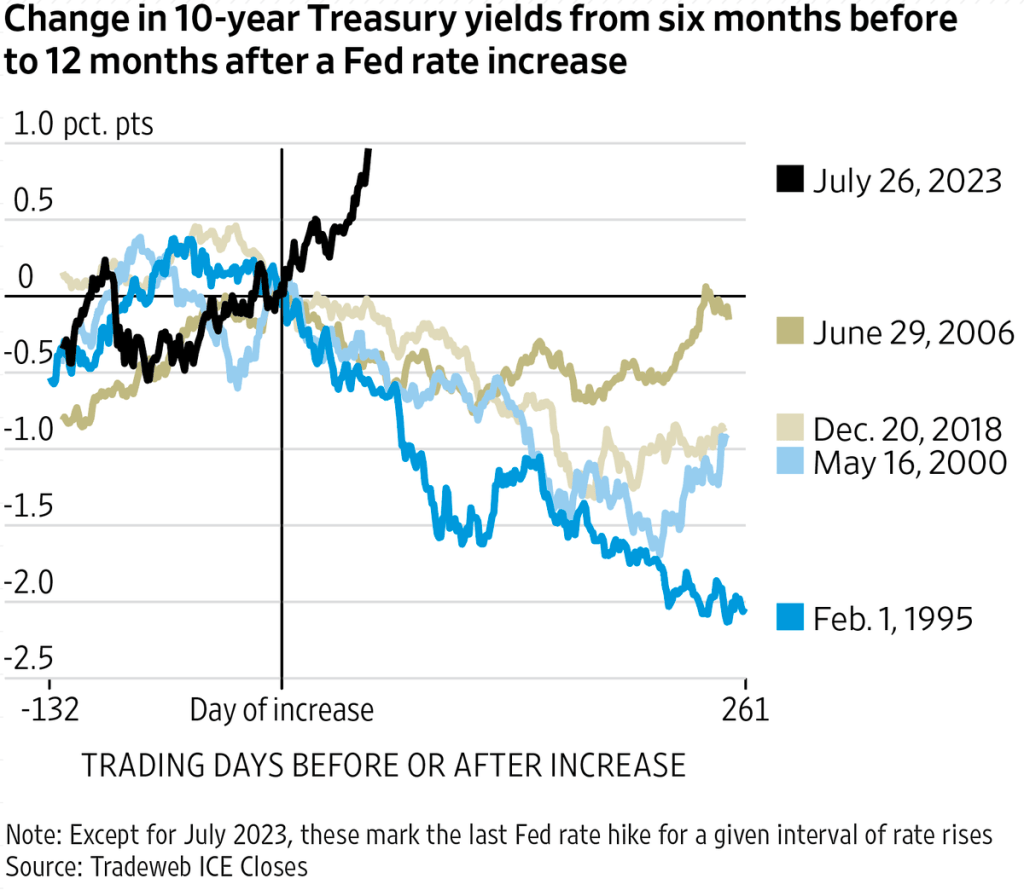

This time the yield curve is reverting because long-term rates are rising above short-term rates, which leads me to believe the focus should be on what the long-term rates are signaling.

The US10Y yield tends to move on fears of rising inflation or on signs of a strengthening economy. While the fight with inflation is far from over, it no longer makes sense to argue the US10Y is moving on inflation fears: July 2022, CPI reported 9% inflation; August 2023, CPI reported 3.7%. Furthermore, recent action shows the US10Y has been sensitive to economic data. If my thoughts on the US10Y yield are correct, this implies that the bond market is pricing-in a strengthening economy, which means it is not a good time to dump stocks, especially if the Fed is nearly finished raising interest rates. However, earnings need to hold up and yields need to stabilize before stocks have a chance to pricing in that positive outlook

Leave a Reply