The Week Behind

Labor data from ADP and Payrolls proved soft enough to temporarily halt the relentless advance of Treasury yields. For the second consecutive week, stock performance left much to be desired, but it felt as though the bear’s stranglehold on the market was loosening. The Dow ended the week 0.60% lower, whereas the S&P 500 and NASDAQ respectively closed approximately 0.5% and 1.6% higher.

Highlights

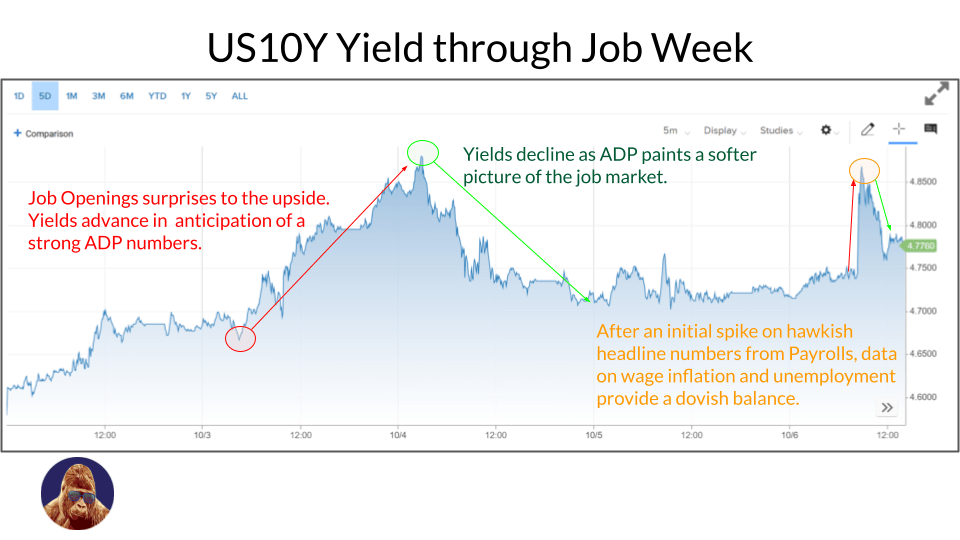

- ADP survey reported only 89k new jobs created, falling significantly short of the 160k estimate. This, coupled with a 12th consecutive monthly decline in annual wage growth to 5.9%, suggests Fed policy is sufficiently restrictive and working as intended.

- Nonfarm Payrolls presented a mixed picture. While headline job creation exceeded expectations at 336k versus the 170k estimate, average hourly earnings surprised to the downside: up 0.2% for the month and 4.2% from a year ago, compared to estimates of 0.3% and 4.3%, respectively.

A Point for the Doves and the Bulls

In my view, the most recent round of economic data focusing on the labor market and wage inflation clearly favors the dovish and bullish arguments for a prolonged Fed pause:

- ADP’s job creation numbers fell significantly short of expectations, and the underlying metrics suggest that wage pressures are moving in a disinflationary direction.

- According to Payrolls, wage inflation was lower than anticipated, and unemployment was higher than expected.

Together, these data points indicate that the labor market may not be as robust as yields currently imply, signaling to the Fed that maintaining the status quo in terms of policy is in line with their objectives of price stability and maximum employment.

I’m not overlooking the impressive headline figures in the Payrolls report. It exceeded expectations by a wide margin. However, it’s essential to remember that the Fed’s war is with inflation, not the labor market. They gauge the ‘heat’ of the labor market through the lens of inflation, not job growth. Consequently, I see Payrolls as a win-win scenario: investors can celebrate a strong labor market and softening wage pressure on inflation.

It seems the market shares this sentiment. Twice this week, the yield on the US10Y attempted to breach the ~4.9% mark: once before the release of ADP data and again before the Payrolls report. The yield surged in anticipation of a hot release but was promptly pushed back down by cooler than anticipated results.

The Week Ahead

With jobs in the rearview, the focus will briefly shift to inflation before earnings season steals the spotlight on Friday.

With respect to inflation, all eyes will be on September’s CPI, set to release on Thursday. The analyst consensus for core CPI is 0.3% monthly and 4.1% annually. It’s worth noting that last month’s core PPI, a leading indicator for CPI, came in at 2.2%, down from the prior month’s 2.4%. Despite elevated energy prices and ongoing labor disputes, I anticipate that September’s CPI will closely align with these estimates. As was the case with Payrolls, I’ll be keeping a close eye on the US10Y yield to assess the financial market’s reaction.

Less than 24 hours following CPI, the final earnings season of 2023 begins with J.P. Morgan, Citi Group, PNC Financial, and Blackrock. The commentary and results should help shape expectations for the economy in this new rate regime of elevated long-term yields. Ideally, the banks will be able to tell a compelling story on how the re-inversion of the yield curve at these levels allows them to make money on lending spreads on top of the persistent tailwind from net-interest income afforded to them by short-term rates remaining uncharacteristically high.

Don’t Let These Bears Scare You

As yields on long-term bonds continue their rapid ascent, a chorus of bearish analysts has emerged from hibernation to preach the gospel of the re-inverting yield curve and the imminent recession it supposedly foreshadows. It’s worth noting that these very analysts who now caution us to fear yield curve re-inversion are the same ones who have been invoking the inverted yield curve as a recessionary harbinger since early last year.

By the logic employed by these analysts, one would conclude that there will never be an opportune time to invest in stocks. These analysts have become perma-bears, constantly peddling fear, which is of no value. After all, the indisputable long-term performance of the S&P 500 stands as a testament to the flaws of such arguments. Don’t let these perma-bears scare you.

Follow your discipline; Form your own opinion: it’ll serve you better than any advice.

If you are curious for my take on the yield curve, click here.

Leave a Reply