October 2023

-

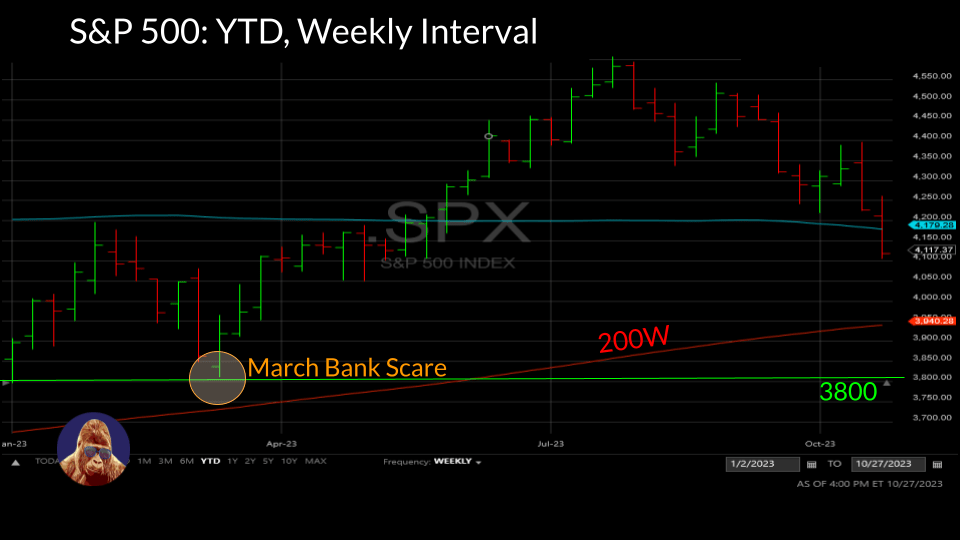

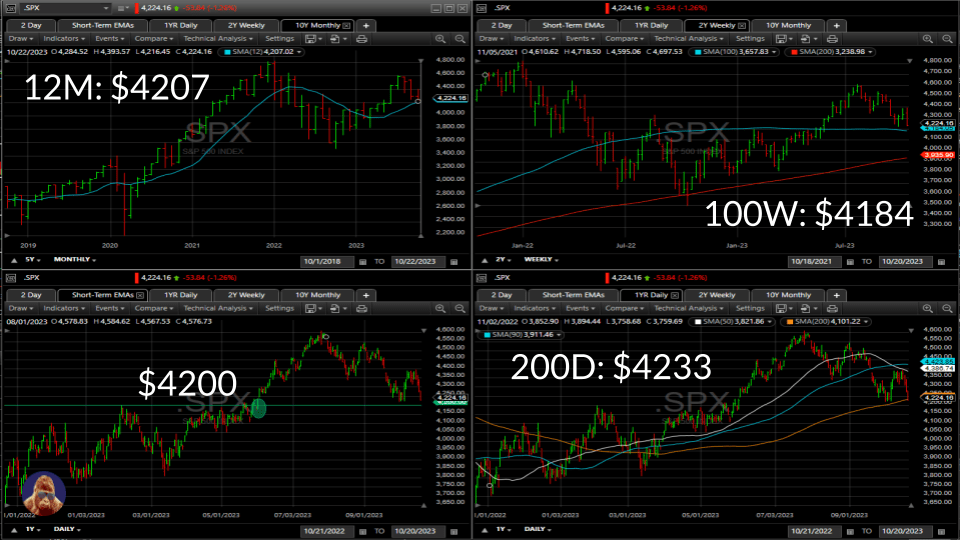

The Week Behind Fundamentally sound mega-cap earnings and downward pressure on the US10Y yield were insufficient to rescue stocks from a losing week. Each of the major indices lost over 2% during the week, with the S&P 500 surrendering the 4200 level in the process. Highlights Update on 4200 Although the US10Y yield backed off…

-

The Week Behind The US10Y yield touched 5% as robust economic data overpowered the Fed’s neutral posture. Yield pressure had the most impact on the NASDAQ, resulting in a ~3% weekly decline. The S&P 500 didn’t fare much better, dropping ~2.4%. While the Dow held up better, it also succumbed to the sell-off, shedding ~1.6%.…

-

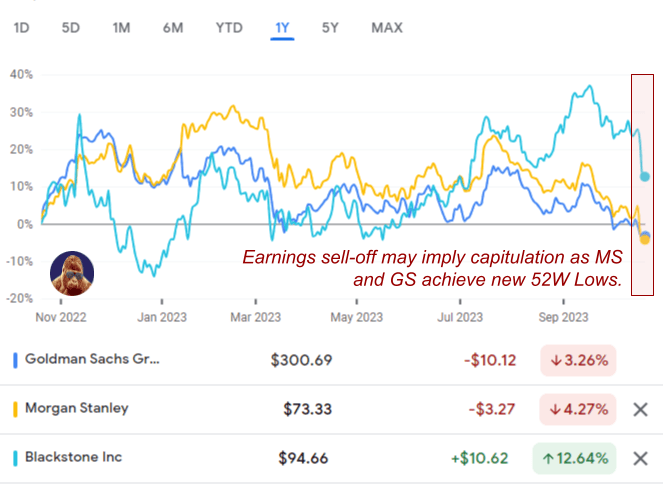

Big Banks: In the aftermath of the March Bank Scare, the “Goliath over David” thesis gained popularity. This thesis suggests that big banks like JPM, WFC, and BAC – the “Goliaths” – would benefit from the loss of confidence in regional banks – the “Davids”. The latest round of earnings solidified this thesis, revealing that…

-

The Week Behind While September’s CPI went the way of the hawks, events unfolding in the Middle East between Israel and Hamas proved the dominant market force. This conflict triggered a flight to safety, causing yields to retreat, gold to advance, and select ‘safe-haven’ stocks to outperform. The Dow and S&P 500 closed the week…

-

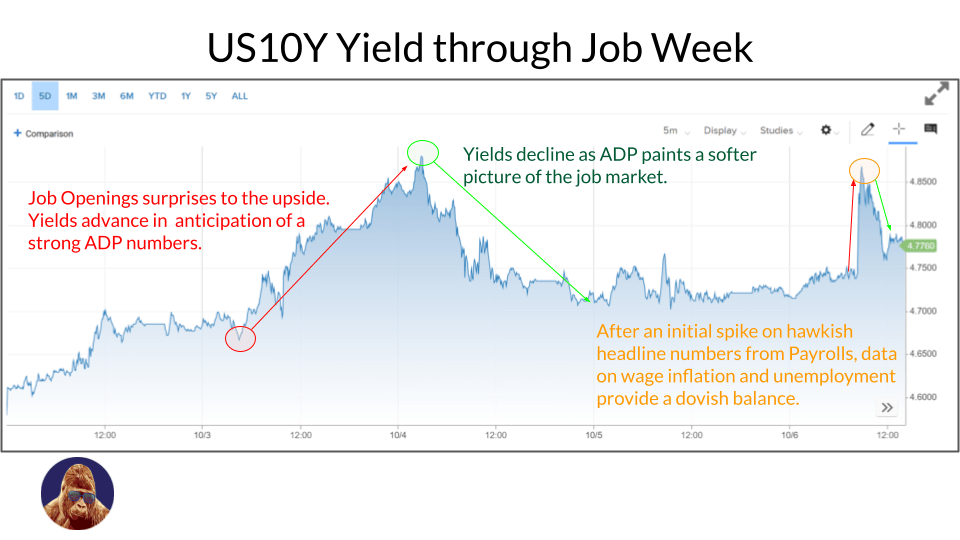

The Week Behind Labor data from ADP and Payrolls proved soft enough to temporarily halt the relentless advance of Treasury yields. For the second consecutive week, stock performance left much to be desired, but it felt as though the bear’s stranglehold on the market was loosening. The Dow ended the week 0.60% lower, whereas the…

-

Historically, the yield curve re-inverts only once the Fed is cutting rates in response to a recession. The rapid cuts bring short-term rates below long-term rates, re-inverting the yield curve. In my opinion, the recession signal is the Fed rapidly cutting short-term rates. A reversion of the yield curve is merely a natural consequence, not…

-

The Week Behind In the latter part of the week, WTI and the US10Y eased from their peaks, allowing stocks to bounce off oversold conditions. Although this week’s performance wasn’t impressive, it feels like the three-week sell-off has lost momentum. The Dow declined by 1.3%, the S&P 500 fell by 0.74%, and the NASDAQ managed…