The Week Behind

Although it was a busy week, net-net, major events aligned with consensus. As a result, the major indices ended the week roughly where they started. Oracle and Adobe both, as predicted, declined despite solid quarters. Arm Holdings’ successful IPO built on capital market enthusiasm. Inflation prints did not disrupt the Fed-inflation narrative. In summary, the Dow closed slightly higher, whereas the NASDAQ and S&P 500 ended slightly lower.

Highlights

- Both CPI and PPI indicated headline inflation in August increased due to higher energy prices. However, the core metrics showed that the energy impact had not yet affected core categories, which are the focus of the Fed.

- The successful Arm Holdings IPO boosted capital market sentiment, leading to positive weekly performances for companies in the sector, including Morgan Stanley (MS), J.P. Morgan (JPM), and Goldman Sachs (GS).

- Despite delivering fundamentally solid quarters, Oracle (ORCL) and Adobe (ADBE), similar to other AI beneficiaries, experienced post-earnings sell-offs.

The Market Is Fine So Long As It Isn’t Surprised

Bears may have been frustrated by the market’s resilience in the face hotter-than-anticipated CPI and PPI prints:

- YoY Headline CPI was 3.7% against the 3.6% estimate, up from the 3.2% prior.

- YoY Headline PPI was 1.6% against the 1.2% estimate, up from the 0.8% prior.

Clearly, from a headline perspective, inflation has flared up. A deeper dive reveals energy is responsible for the increase, which makes sense as WTI has risen ~30% in two months.

So, why did the market shrug off the apparent bad news on inflation?

First, the Fed has made it clear their concern is on core metrics, not headline. Core metrics from the same reports show the energy flare up has yet to materially affect core inflation.

- YoY Core CPI was 4.3%, in-line with estimates, down from the 4.7% prior.

- YoY Core PPI was 2.2%, in-line with estimates, down from the 2.4% prior.

Second, this outcome was consensus. WTI is public and widely tracked. Consequently, consensus had formed that energy would drive headline inflation higher, but it would not be an immediate issue unless it put the Fed on a more aggressive path by affecting core metrics. Broadly speaking, CPI and PPI aligned with consensus, generating no surprise to move the market.

In summary, this set of data does not disrupt the consensus narrative on Fed policy and inflation. Hence, the CPI and PPI reports failed to introduce fresh motives for buying or selling, which explains the subdued price action. Put another way, the market is fine so long as it is not surprised.

The Week Ahead

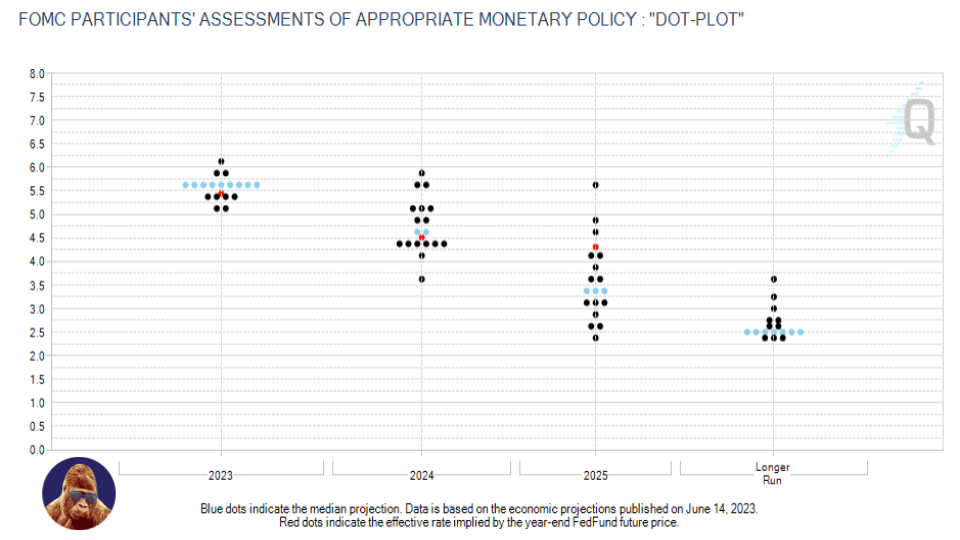

This week’s spotlight is undoubtedly set on Wednesday’s FOMC Meeting. According to the CME FedWatch Tool, expectations are for the Fed to maintain the Fed Funds Rate at 5.25 – 5.50%. I suspect the new dot plot will be the primary object of scrutiny. The current dot plot projects the terminal rate at 5.50 – 5.75%, implying one more 25 bps hike this year. If the Fed decides it wants to deliver a more hawkish tone, they could keep Fed Funds unchanged and use the new dot plots to adjust the terminal rate higher.

I anticipate an upward revision to the dot plot would trigger a negative response. Personally, I believe that the data does not warrant an upward adjustment to the terminal rate, rising energy prices and UAW implications notwithstanding. I believe my perspective aligns with consensus. To apply the logic of the previous segment, a hawkish revision could create a negative surprise, catalyzing a sell-off to price-in the new, out-of-consensus information.

Outside of the FOMC Meeting, there are several economic releases to watch this week:

- Tuesday: Housing Starts and Building Permits

- Thursday: Initial Jobless Claims and U.S. Leading Economic Indicators

- Friday: S&P Services and Manufacturing PMI

While it’s a light week for corporate earnings, there are three companies I’m keeping an eye on for broader insights. I’ll be listening to Autozone (AZO) to better my understanding of 2nd derivative effects stemming from the UAW strike. FedEx’s (FDX) results will provide valuable information on economic activity and how energy prices are impacting margins, especially for companies with extensive logistics operations like Amazon. Additionally, I’ll be analyzing Darden’s (DRI) quarter, a full-service restaurant operator, for tea leaves on inflation and consumer trends.

AZO is set to report on Tuesday, FDX on Wednesday, and DRI on Thursday.

UAW Strike and Inflation

Last Friday, the UAW, or United Auto Workers, initiated a strike against the big three auto manufacturers: General Motors, Ford, and Stellantis (formerly Fiat Chrysler). Bottom line, the longer the strike persists, the greater the potential upside risk to inflation. As time goes on, the overall supply of vehicles will decrease as inventory is sold without new vehicle production to replace the units sold. As the supply diminishes, the prices of both used and new vehicles, which are major components of core CPI, will rise.

How long can we expect the UAW to hold out?

Hard to say. The UAW’s strike fund sits at $825 million. Factors to consider include the number of union members on strike and the associated costs of healthcare. Estimates range from 5 weeks to 3 months. Given that Fed stories are likely to dominate this week’s tape and the negative effects of the UAW strike will take time to materialize, I do not think this story will evolve into a market-moving force until at least next week (September 25th).

Before concluding, it’s worth noting that this strike presents a headwind to GDP. If GDP begins to underperform, I would anticipate the Fed taking a more balanced stance on the economic impacts of the strike, categorizing it as a one-off event with transient inflationary impacts.

Leave a Reply