The Week Behind

Despite offsetting inflation readings, the key market mover was the CCP’s ban on iPhones for government employees. The news caused a 6% decline in Apple (AAPL) shares. As a result, the major indices ended the week in negative territory, with the NASDAQ, S&P 500, and Dow closing approximately 2%, 1.3%, and 0.75% lower, respectively.

Highlights

- Both factory orders and the S&P Services PMI painted a picture of an economy capable of fostering disinflation without indicating an imminent recession.

- ISM Services exceeded expectations, leaving behind inflationary tea leaves for August CPI.

- Thursday’s job data portrayed a labor market that may be incrementally tightening: initial jobless claims surprised to the downside, and unit labor cost was revised upward.

- The Manheim Used Vehicle Value Index (MUVVI) showed a 7.7% decrease from a year ago, leading to a significant drop in the US10Y yield to start Friday’s session. Although the US10Y yield rebounded, the decline in vehicle prices provides a dovish sign for CPI.

The CCP v AAPL

On Wednesday, Apple (AAPL) declined 4% after multiple sources reported that the Chinese Communist Party (CCP) had banned its employees from using iPhones for work and bringing them into central government offices. This initial drop, directly tied to a substantial development corroborated by credible sources, appears justified. When bad news threatens a company’s fundamental prospects, a corresponding sell-off is expected.

However, on Thursday, AAPL experienced another 3% drop. This second day of declines, almost as significant as the first, was driven by unsubstantiated speculation that the ban might extend to all state-owned enterprises. This additional sell-off seems hasty.

To be clear, I’m not commenting on the likelihood that speculation becomes reality. I’m emphasizing there is a difference between a news-driven decline and a speculation-driven decline. Speculation-driven declines, especially when without any source of merit, can create opportunity.

From a rational perspective, it doesn’t seem sensible for the CCP to escalate tensions with the U.S. through Apple. As a dictator, Xi Jinping’s authority rests on his ability to deliver economic prosperity and boost national pride. However, recent indicators, such as lackluster Chinese GDP, record-high youth unemployment, and historically low birth rates, suggest that Xi has struggled on both fronts. Disrupting Apple’s operations in China, which contributes significantly to job creation, supports Chinese-owned operations, and serves as a source of national pride as a luxury brand made in the country, would likely further undermine Xi’s position.

On the other hand, Xi’s COVID-19 track record, where the CCP opted for less effective alternatives to Western vaccines, demonstrates a willingness to suppress their people and damage their economy in the name of national pride. Short of sparking a political or civil revolution, the precedent set by the CCP’s actions during the pandemic indicates their readiness to play hardball with the U.S. at almost any cost.

The Week Ahead

While there are noteworthy company-specific events related to the AI narrative this week, our coverage begins with the critical inflation reports expected to dominate the tape.

Ahead of Wednesday’s open, CPI for August will be released. The forecast for the core stands at 4.3% YoY and 0.2% MoM. A higher reading might stem from the services component, as indicated by ISM services and the revision in unit labor costs. A cooler reading could result from relief in the new and used vehicles component, as suggested by the Manheim index. These opposing factors may offset.

One important development to watch for in future CPI reports is the UAW strike. An auto industry strike would raise prices for used and new vehicles as well as for repair parts. On the flip side, if auto manufacturers concede too much in an agreement to avert a strike, there could be enduring upward pressure on inflation from wages.

PPI is set to release the following morning. Unlike CPI, which is a lagging indicator of inflation, PPI is a leading indicator. Typically, the market looks to PPI to validate or challenge CPI. A cooler PPI implies disinflation for the next CPI report, while a hotter PPI suggests the opposite. However, it’s essential to note that the Fed places more emphasis on CPI as it measures inflation that consumers face.

Turning to earnings and corporate news, three events stand out. Oracle and Adobe, both of which have established themselves as true AI beneficiaries, report earnings on Monday and Thursday, respectively. Despite solid quarters and guidance from other bona fide AI beneficiaries, selling pressure has followed their reports. There is no reason to anticipate anything different for Oracle or Adobe, which could create an opportunity to build a position. Finally, Dreamforce, Salesforce’s (CRM) annual conference, takes place this week. This event typically serves as a positive catalyst for CRM. Despite a strong quarter, post-earnings gains have dwindled. Dreamforce has the potential to reinvigorate the stock and the cloud software sector.

Is it Energy’s Time in the Sun?

Energy had a cloudy start to 2023. At its lowest point, WTI found itself around $65, and natural gas dipped below $2. These prices reflected recession fears that were prominent in the first half of 2023. Enthusiasm was crushed as younger energy companies struggled with profitability, and more established names slashed variable dividends.

However, the sun may be breaking through the clouds. With the once-imminent recession on hold and the “Saudi put” allowing energy prices to reestablish positive momentum, several stocks in the sector are threatening to break back into elevated trading ranges.

The case for energy outperformance relies on rotation.

While WTI north of $80 is generally supportive for the energy sector, if energy prices continue to rise (regardless of the catalyst), it has the potential to stoke inflation concerns. This would likely lead to an uncomfortable rise in yields in anticipation of a more hawkish Fed.

The most significant impact of rising yields would be felt within the NASDAQ, home to companies at the forefront of the AI revolution. In my perspective, the path of least resistance would involve taking profits in technology and reallocating to energy. Therefore, adding energy exposure enables you to capture upside in energy prices and simultaneously hedge technology positions from the potential rise in yields that might accompany those higher energy prices.

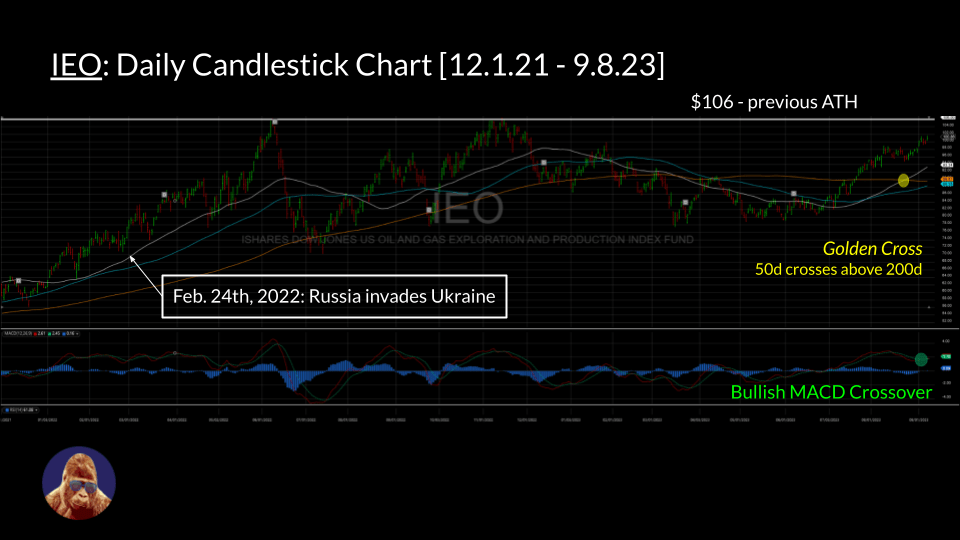

I view the iShares U.S. Oil & Gas Exploration & Production ETF (IEO) as the best and easiest way to add energy exposure to a portfolio. The IEO has performed impressively since June. A rotation could trigger a breakout to new highs. The IEO currently features an attractive P/E of approximately 6.65 and offers a solid 3.88% TTM dividend yield. The dividend pays you to wait for a breakout that valuation isn’t an obstacle for.

For full disclosure, I don’t personally own the IEO because I already hold individual stocks within its portfolio, including Coterra (CTRA), Pioneer (PXD), and Cheniere (LNG).

Leave a Reply