📈📉 Apple (#AAPL) and Amazon (#AMZN) investors, take note! As these tech giants prepare to report their earnings on the eve of July #Payrolls, a highly influential macroeconomic report, it’s crucial to be aware that Apple and Amazon may see their stocks fall, despite even phenomenal quarters, if July Payrolls is too strong. An inflationary payrolls report could push interest rates higher, creating selling pressure for stocks. The pressure is greatest for high-growth sectors like technology.

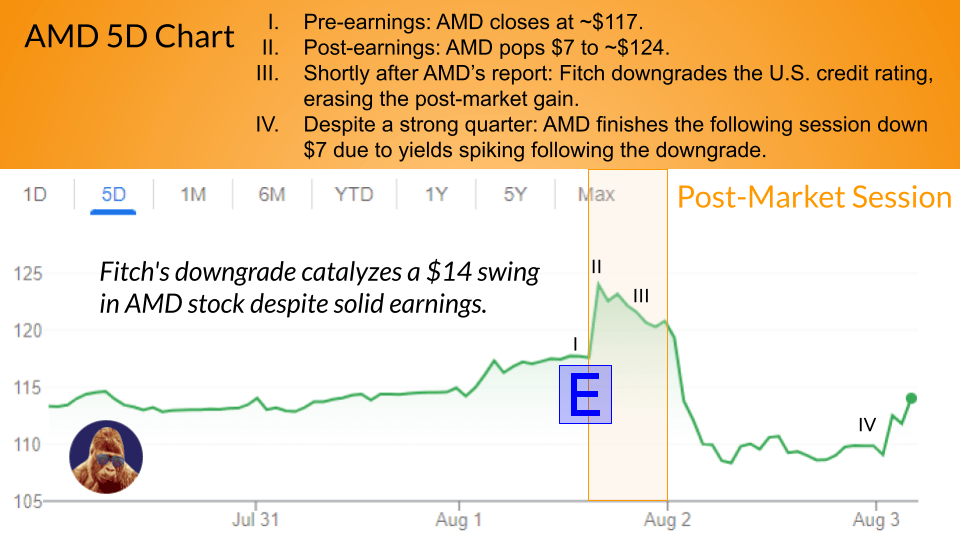

Don’t just take my word for it. We saw a recent example this week with AMD. After releasing a solid quarter, AMD’s stock jumped $7 in the post-market. However, Fitch’s U.S. credit rating downgrade erased those gains, and AMD ended the following session down $7: a $14 swing, ~11%. This illustrates how micro-oriented optimism can be dashed by macro-oriented pessimism.

For a more comprehensive analysis of the market’s macro-driven inclination and a preview of what to expect from tomorrow’s July Payrolls, check out the most recent edition of my newsletter: 9:25 on 7/31/23 – Monitoring the Macro.

Leave a Reply