Valuation and Expectation

Valuation plays a significant role in shaping expectations for each company’s quarter. There is a direct correlation between relative valuation and expectation:

The higher the relative valuation; the higher the expectation.

The lower the relative valuation; the lower the expectation.

Priced for Perfection

When a stock experiences rapid price increases before its fundamentals (such as revenue, earnings, cash flow, and margins) have a chance to update, its valuation rises simultaneously.

In certain instances, the valuation reaches such high levels that the shares are considered to be “priced for perfection”. This means the market has already factored in the best possible scenario for the quarter and beyond, implying that anything less than a flawless quarter will fail to justify the elevated valuation and stock price.

To identify if a stock is “priced for perfection”, look for one trading at a new high or an exceptionally elevated valuation compared to its historical levels.

In practice, if you suspect a stock in your portfolio is “priced for perfection”, it might be prudent to trim a portion of your position before the quarterly release. The reason is that the odds are skewed against the quarter meeting the elevated expectations (which may be different from analysts’ forecasts), leading to potential price pullback after the results are reported.

Priced for Disaster

The inverse can also occur. When a stock’s price decreases before its fundamentals have a chance to update, the stock’s valuation falls simultaneously.

In certain instances, the valuation reaches such low levels that the shares are considered to be “priced for disaster”. This indicates that the market has already factored in the worst possible scenario for the quarter and beyond, suggesting that any positive news from the quarter has the potential to challenge the depressed valuation and price.

To identify if a stock is “priced for disaster”, look for one trading at a new low or an exceptionally depressed valuation compared to its historical levels.

In practice, if you suspect a stock in your portfolio is “priced for disaster”, it might be prudent to hold the position through the quarter. The reason is that the odds are skewed in favor of the quarter actually being better than the depressed expectations, which could lead to a relief rally, reinvigorating shareholders or forcing short-sellers to close their positions.

Crucial Consideration: Relative Valuation & Hindsight

The emphasis here lies in comparing valuation to its own historical levels. This analysis does not involve comparing valuations across companies, even if they are peers.

To identify if a stock is priced for perfection or disaster, you’re essentially looking for stocks trading at their own, unique peak or trough valuations.

It’s essential to remember that it is the fundamental data within the quarter that ultimately determines whether valuations have peaked or troughed. You can only identify a peak or trough with the benefit of hindsight. A compelling narrative can get better, leading to further valuation expansion. A distressed narrative can get worse, leading to further valuation compression. Therefore, merely identifying stocks with high or low relative valuations is insufficient; you need a thesis that suggests a potential shift in a company’s performance.

As we delve into the following case studies, you’ll see that this exercise is more of an art than a science and requires a deep understanding of a company’s unique narrative.

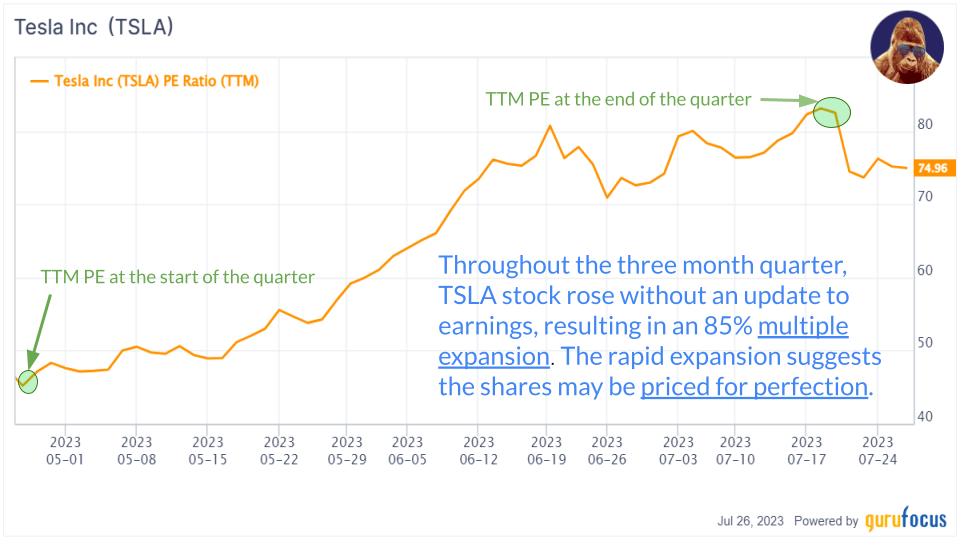

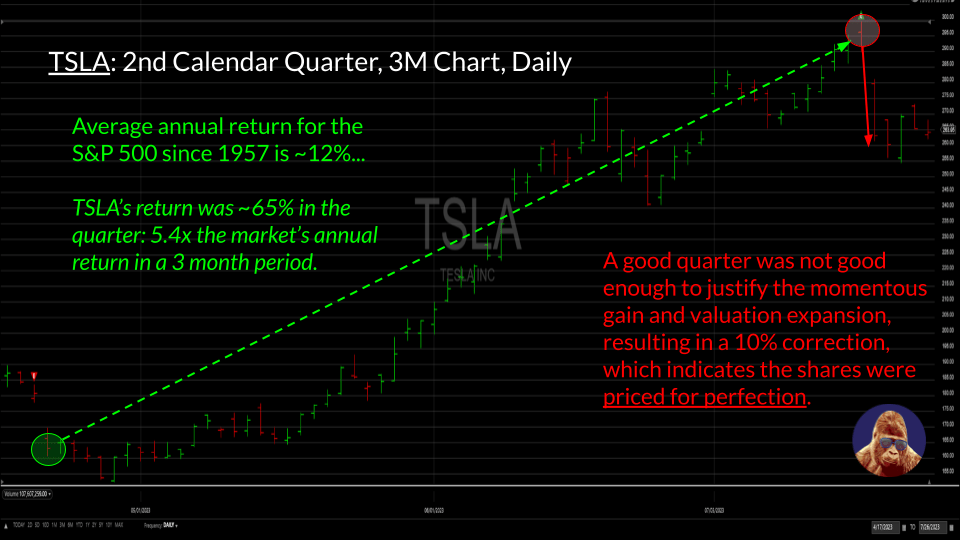

Priced for Perfection: Tesla

During the last quarter, Tesla (TSLA) shares experienced an impressive 65% return, driven by significant progress in production capabilities, successful market share defense, and strategic charging agreements with Ford and GM. Additionally, any lingering negative pressure surrounding Twitter had finally dissipated. Over the same period, Tesla’s P/E multiple soared to a 9-month high, experiencing an 85% increase from 44.5x to 82.6x. Such significant multiple expansion demanded a flawless quarter to validate, suggesting that the shares were likely priced for perfection.

When Tesla reported its earnings on July 19th, despite delivering strong top and bottom line results, the stock dropped by approximately 10% in the following session. Investors took issue with the rise in R&D costs, which increased to $943 million from $711 million, related to AI computing. The major increase in AI spending, although essential for the company’s long-term growth, somewhat dirtied a once clean story of improved production and market share defense. Good simply wasn’t good enough. The decline showcases how high expectations were going into the quarter and indicates the shares were indeed priced for perfection.

Nonetheless, if you invested in Tesla last quarter, you would still be significantly in the green. Moreover, this quarter’s results did not give any reason to sell or reconsider your investment thesis. The market may have propelled the shares too high too quickly, but with the stock now stabilizing, it has the potential to continue its upward trajectory through consistent execution.

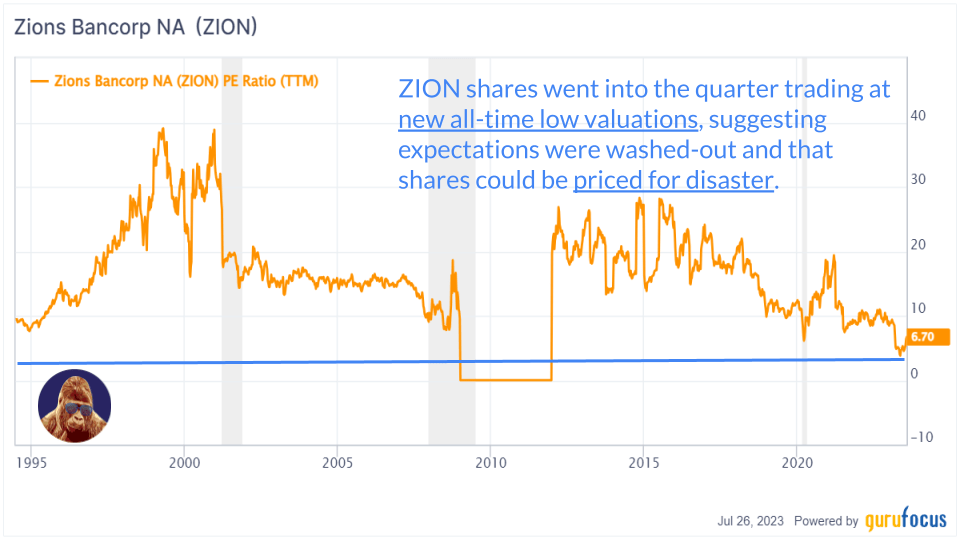

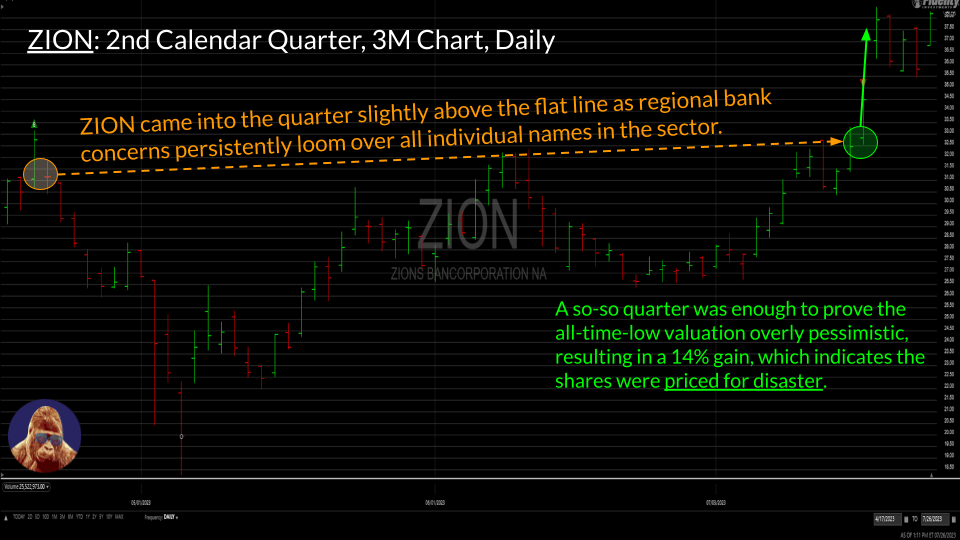

Priced for Disaster: Zions

Quarter-over-quarter, Zions (ZION) was coming into their earnings flat after recovering from an early quarter slump. Broadly speaking, sentiment surrounding the regionals, although off the lows and improving, is still lousy due to uncertainty surrounding deposit levels and the impact of FDIC regulation on margins and loan growth. With respect to valuation, excluding a period of negative earnings following the GFC, ZION was trading at new all-time low valuations. The historically depressed valuation is a signal that the shares may be priced for disaster.

When ZION reported the morning of July 19th, guidance, especially with respect to margins, was disappointing. Typically, a bad guide, even with a top and bottom line beat, would be the final nail in the coffin for a stock, but shares have rallied ~14% as of the July 25th close. Investors have rallied behind total deposits levels, which recorded a quarterly increase: $74.32B versus $69.21B. The quarter soothed a major concern – deposit levels – challenging the trough valuation. Consequently, the so-so quarter was enough to catalyze a respectable gain, indicating the shares were indeed priced for disaster.

If you invested anytime during the quarter, chances are you are up better than 25%. However, you had to take the risk of investing before it was clear the deposit story, which had been weighing on the stock, was improving. If ZION had not presented good news on the deposit front, then it is possible this challenged story could have become increasingly difficult, pressuring the price and valuation lower.

The Takeaway

Valuation and expectation are closely intertwined. Although it is impossible to definitively determine if a stock is priced for perfection or disaster in real time, valuation can be used as a tool to gauge the market’s expectations. This understanding provides actionable insights for traders and long-term investors alike.

Leave a Reply