The Week Behind

With the Fed blackout window in effect and economic data failing to sway expectations of a 25 bps increase, corporate earnings drove index performance this week. The Dow outperformed, gaining approximately 2%, bolstered by solid quarters from big banks, regionals, and healthcare. The NASDAQ underperformed, experiencing a 0.60% drop, as Netflix and Tesla did not live up to expectations elevated by valuation. The S&P 500 settled in the middle, closing with a 0.70% increase.

Highlights

- Retail sales fell short of expectations, indicating that goods inflation may have moderated in June.

- Housing starts, building permits, and initial jobless claims all came in below expectations, signaling that inflation in the housing and wage sectors may persist.

- The performance between technology and the rest of the market narrowed this week, supporting the ‘catch-up’ thesis: Zions, Comerica, and Johnson & Johnson delivered impressive quarters, driving positive results in areas of the market outside technology. Netflix and Tesla failed to live up to expectations, resulting in a rare down week for technology.

Expectation and Valuation

Why did Netflix (NFLX) and Tesla (TSLA) experience a negative response despite reporting decent quarters last week?

Over the past three months, NFLX and TSLA saw impressive gains of around 50% and 65%, respectively. Such remarkable performance led to higher valuations, leaving no room for errors. The phrase “priced for perfection” aptly describes this situation. While their quarters were solid, they were not flawless, leading to a correction to align the stock prices with their actual performance.

Is this the end of the bull market in these stocks?

No, not at all. Without their exceptional pre-earnings performance, one could argue that their quarters were phenomenal. However, these stocks provided years of average stock market returns in a single quarter, which resulted in understandably elevated expectations. Viewing their results with this in mind, the quarters can only be considered okay. “Okay” should not support further upside. The correction is a healthy market response and suggests that bullish sentiment has yet to reach “irrational” levels.

The Week Ahead

It’s a jam-packed week. On the macro side, we have the highly anticipated July FOMC Meeting and the release of June PCE. On the micro side, bellwether companies across industries report throughout.

The July FOMC Meeting is scheduled for Wednesday at 2PM. A 25 bp increase is expected. Given the mixed economic data since June’s FOMC, Fed Chair Powell’s commentary is likely to be net-hawkish but relatively neutral. On Friday, June PCE, the Fed’s preferred inflation indicator, will be released. Expectations for Core PCE stand at 0.2% MoM and 4.2% YoY.

While both events are significant, PCE holds a higher potential for market volatility due to the market’s aversion to surprises. Due to the Fed’s transparent approach, the risk of PCE catching the market off guard is more significant. Furthermore, the market’s strength has been fueled by steady progress on inflation and resilient corporate earnings. Any disruption to the inflation narrative, similar to the recent ADP report, should create unease.

Tuesday’s earnings lineup includes Microsoft (MSFT), Alphabet (GOOG), and NextEra Energy (NEE). MSFT’s focus will be on price increases, Azure performance, and AI implementation. For GOOG, attention will be on their search business, Bard-AI, and cloud profitability. NEE, a utility company with a renewable energy kicker that has underperformed YTD, seeks to revitalize their stock amid climate concerns.

Wednesday features reports from Meta Platform (META), Chipotle (CMG), and ServiceNow (NOW). META’s continued success hinges on Reels monetization with the future of Threads adding an additional avenue for upside. CMG’s insights on middle-class consumers and supply chain will be in focus. NOW is part of the cloud-software cohort. This cohort has lagged AI within technology. NOW has the opportunity to increase breadth within technology.

Thursday brings McDonald’s (MCD), Southwest (LUV), Mastercard (MA), and Ford (F). MCD’s offers insights on consumer activity and supply chains at a broader scale than CMG. LUV adds specific detail on domestic travel trends. Credit card use carries implications for household balance sheets, which is why MA’s quarter will be watched. F’s focus is on explaining the rationale and margin impact of decreasing prices on the F150 Lightning.

Exxon (XOM) and Chevron (CVX) wrap up the week. Recent momentum in oil and the persistently weak USD should act as tailwinds for these multinational, oil giants. XOM and CVX have the potential to reenergize the lagging energy sector.

Winners-Management

During the 2022 bear, there was little risk that any stock purchased at one point in the year could not be purchased at a lower price later in the year. However, in a durable bull market, this calculus changes, and you need a different playbook. Here are four rules to help you create a personalized “winners-management” strategy:

- Trim positions once they become larger than X% of the portfolio (where X can vary from person to person). This puts a cap on single-stock risk and allows winners to continue driving the portfolio.

- Trim positions that go hyperbolic: short squeezes or hype-driven price surges. Selling at inflated levels can be as important as buying at discounted levels.

- Avoid adding too much at the same level. Your cost basis ultimately determines your performance. Only add at prices that meaningfully average down your cost basis. In a bull market, that may not be possible, which leads to the final rule.

- Add once a stock proves a new higher level can be sustained. Look for fundamental events that justify elevated valuations and add when the price stabilizes.

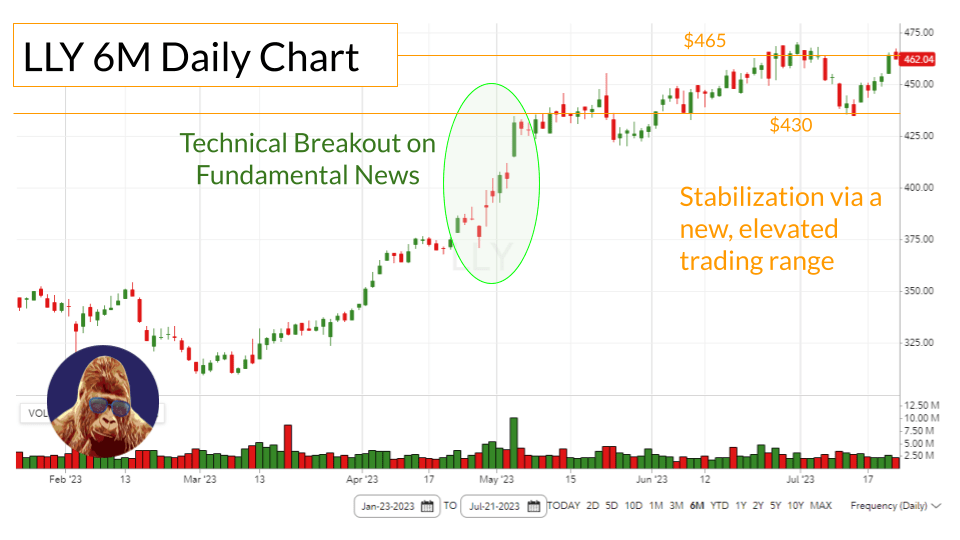

For example, after breakthroughs in Alzheimer’s and weight loss drugs, Eli Lilly broke out above $400. Over the last 2-3 months, LLY has established a new trading range between $430 – $465, which is well above the initial breakout level. By doing so, LLY has demonstrated the breakout as sustainable. My discipline suggests adding between $410 – $425 could be prudent as the price implies a correction and potential oversold conditions.

Leave a Reply