The Week Behind

It was a good week for stocks as CPI showed that inflation moderated more than anticipated in June. The soft number extended the downward reversal in yields and the dollar that started with June Payrolls. Lower rates and a weaker dollar created additional runway for stocks to run. For the week, the Dow and S&P 500 gained a little more than 2%, while the NASDAQ again outperformed, adding 3.3%.

Highlights

- The NASDAQ 100 (NDX) underwent a special rebalance to reduce concentration in the Magnificent Seven. The rebalance reduces the index’s individual-stock risk and should expand breadth to other stocks within the index.

- The court rejected the FTC’s injunction request on Microsoft’s acquisition of Activision. MSFT’s victory represents a challenge to the Biden/Khan Administration’s interpretation of antitrust legislation and, by extension, paves the way for consolidation (M&A) that has been hindered by an overly aggressive FTC.

- Both core and headline CPI came in slightly below expectations. PPI, which also came in below estimates, validated the CPI print. The cool inflation data extended the reversal in yields and brought the USD to its lowest level in months

Inflation and Valuation

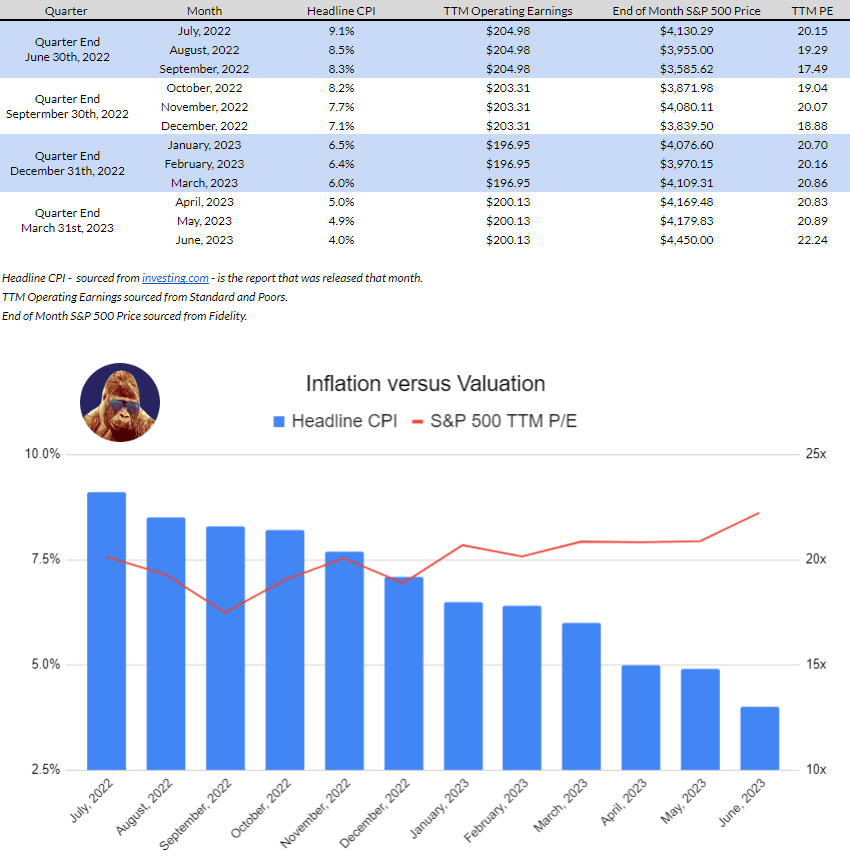

Bulls, bears, and even gorillas like myself have been debating whether the recent valuation expansion in the market is solely due to AI and FOMO. However, a different perspective emerged during CNBC’s Halftime Report. Jenny Harrington (@GilmanHill on Twitter) pointed out that the increase in market multiples can be linked to the decrease in headline CPI.

I ran the numbers and reached a similar conclusion. Since the beginning of the year, the expansion of the S&P 500 price-to-earnings (PE) multiple has aligned with the decline in inflation. As inflation decreases, stocks become more attractive to investors. Thus, lower inflation provides good justification for higher valuations.

This analysis undermines the bear argument that stock gains are purely driven by sentiment and emotion. Instead, it suggests that the multiple expansion is grounded in the real progress made in combating inflation, by highlighting that stock valuations are moving higher as one of their major threats is moving lower. On a related note, it also implies that the market believes meaningful progress has been made on inflation, notwithstanding the stance of Fed hawks and bearish analysts who declare the contrary.

The Week Ahead

As we head into the first full week of earnings season, economic releases are expected to take a back seat. However, there are still some important data points to keep an eye on. Retail sales will be closely watched. Expectations are for a 0.5% increase after last month’s 0.3% rise. A strong number could raise concerns about monetary tightening, but the market has already factored in a 25 bps increase at the July Meeting, which implies the impact may be limited.

The big banks start the week for earnings with Bank of America, Morgan Stanley, and Goldman Sachs. While their results should not send ripples through the market, regional bank results have the potential to stir unease. Zions and Comerica report on Wednesday and Friday, respectively. Deposit levels and guidance are the focus. Stable deposit levels would alleviate concerns about bank runs and indicate a healthier financial environment. Guidance can help shape expectations regarding the anticipated increase in FDIC insurance costs, providing valuable insights into the industry’s outlook.

Among the big names reporting this week are Tesla, Netflix, and United on Wednesday, followed by American Airlines, Johnson-n-Johnson, and Taiwan Semiconductor on Thursday. Tesla’s margins will be in focus after reducing prices to undercut competition. Netflix’s emphasis will be on password sharing monetization efforts. United and American Airlines will provide an update on the bull market in travel. Johnson-n-Johnson investors will be eager to hear about their medical devices business, spin-off plans, and talc litigation. Last but not least, Taiwan Semiconductor’s report is highly anticipated, as they produce 60% of the world’s semiconductors, including chips for AI-chip manufacturers including, but not limited to, Nvidia, Broadcom, and Marvell.

The FTC’s Loss is Your Portfolio’s Gain

Mergers and acquisitions (M&A) are inherently risky endeavors: transaction price, personnel decisions, and potential legal costs. Under Lina Khan’s leadership, the FTC’s strict antitrust policy has further increased execution risk, hindering natural M&A in overpopulated and/or distressed industries. Companies have been reluctant to pursue M&A due to the additional hurdles and time associated with facing the FTC in court. However, the recent court decision rejecting the FTC’s injunction on Microsoft’s acquisition of Activision challenges this strict interpretation, paving the way for a more constructive M&A environment. This could present opportunities for investors to benefit from the potential resurgence of M&A activity. Here are some beneficiaries that could make a lucrative addition to your portfolio:

- Investment Banks and Alternative Asset Managers

M&A is a high-margin business. These firms have lacked these accretive earnings drivers for 12-24 months. The return of M&A means better earnings performance against comps and the estimates. I have long positions in JPM, MS, and BX.

- Pharmaceuticals and Biotech

Big pharmaceutical companies rely on acquiring promising biotech firms to ensure revenue between blockbuster drugs or as blockbuster drugs lose exclusivity. Biotech companies depend on acquisitions as exit strategies to attract the early investor necessary to fund their research. While it is more lucrative to accurately identify the target than the acquirer, this relationship is mutually beneficial to stockholders of either company. I have long positions in the IBB, JNJ, and PFE.

- Regional Banks

Regional banks are integral to financing small-to-medium sized businesses that propel U.S. growth. I am rooting for any outcome that benefits their position. Consolidation could be an answer. Regionals merging with each other could remedy the fragility by offsetting concerns about deposit levels and margins. Personally, I am not looking for opportunities in the space, but it is worth noting as a potential beneficiary.

Leave a Reply