The Week Behind

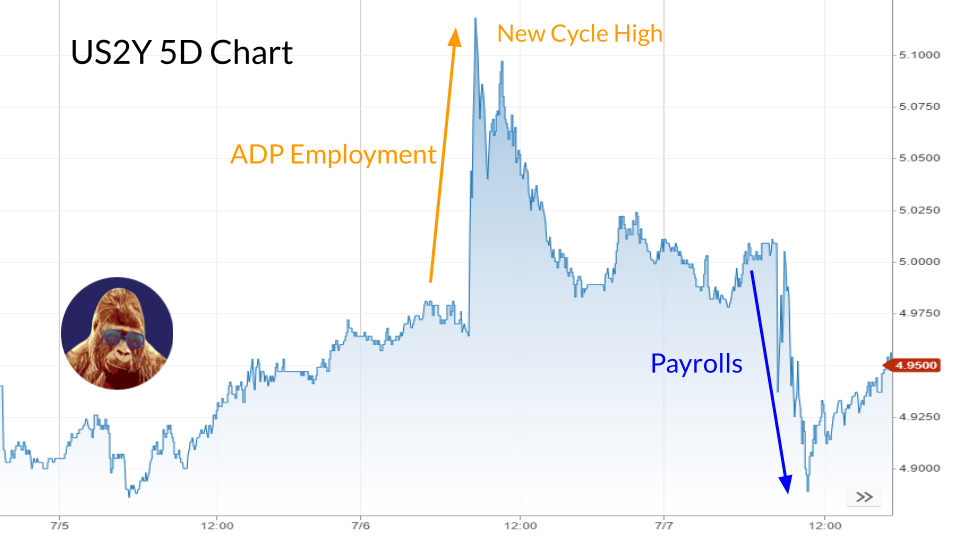

Despite Payrolls painting a more balanced inflationary picture, concerns about tighter monetary policy, fueled by hawkish FOMC Minutes and a remarkably strong ADP employment number, pushed yields to uncomfortably high levels. This upward move in yields put downward pressure on stocks, resulting in a ~1% decline for the S&P 500 and NASDAQ. The Dow underperformed, dropping ~2%.

Highlights

- The June FOMC Minutes indicated that “some” committee members wanted to raise 25 bps, implying that the decision to hold interest rates was more reluctant in reality than the unanimous vote on paper suggests.

- ADP Employment reported a staggering 497k jobs created, surpassing the median forecast of 220k. The strong number validated the hawkish sentiment expressed in the June FOMC Minutes, exacerbating Fed policy concerns.

- Payrolls, for the first time since March 2022, fell significantly short of expectations: 209k actual versus 240k median forecast. This report alleviated some of the Fed policy worries that had been mounting throughout the week.

Puzzling Labor Data

Visualize the labor market as a puzzle:

To get the full picture, you need every piece. However, you need to keep in mind that no one piece provides a comprehensive view of the entire puzzle.

Every data point has a role in describing the labor market, but no one data point can fully reveal its dynamics.

So, what happens when you come across a puzzle piece that doesn’t seem to fit anywhere? I raise this question because the disparity between Payrolls and ADP is so significant that they cannot be part of the same puzzle. These two reports cover the same time period but draw contradictory conclusions, particularly regarding job creation in the leisure and travel sector: ADP indicates 232k jobs were added, while Payrolls shows only 21k. There is no reality in which both of these reports can be correct. One of these reports is wrong.

Rather than determining which, my focus is on discerning which the Fed will prioritize. After all, that’s what matters for monetary policy and, consequently, the stock market. Payrolls is widely regarded as more credible than ADP, leading me to believe that Powell will rely on the Payrolls report to guide Fed discussions in the upcoming meeting.

That’s why I left Friday’s session with the belief that the Payrolls report will, at a minimum, counterbalance the hawkish movement in yields that has been silently occurring since mid-May. If next week’s CPI data shows benign results, I anticipate yields will retreat further, better setting up stocks to defend their current levels.

The Week Ahead

The upcoming week is packed with Fed speakers, inflation reports, and the start of earnings season.

On Monday morning, we will hear from Vice Chair Barr, President Daly, and President Mester. It will be interesting to see if they address the discrepancies between ADP and Payrolls, or if they highlight the report that supports their respective views.

CPI for June releases on Wednesday. The median forecast for headline is 3.1%, compared to last month’s 4%. As for core, the forecast is 5%, down from 5.3%. The softer Payrolls report initiated a minor reversal in yields. If CPI is benign, it should extend this reversal, which would be favorable for stocks. I will be monitoring treasury yields as an indicator of market sentiment. However, if CPI is objectively tame and yields counterintuitively advance, caution is warranted as it suggests the bond market perceives the Fed as dogmatic to their forecast rather than dependent on data.

PPI, a leading indicator for CPI, is released Thursday. While it may not receive as much attention as it did when CPI was at historic highs last year, it is still worth monitoring. PPI MoM is expected to increase by 0.2% following a 0.3% decline in the previous month.

Friday marks the start of earnings season. J.P. Morgan, Citi, Wells Fargo, State Street, and BlackRock will do the honors. Given concerns surrounding the banking system, the focus is likely to be on the money center banks. Citi’s quarter is likely to have minimal impact on broader markets due to chronically low expectations. On the other hand, there are reasons for optimism regarding J.P. Morgan and Wells Fargo, thanks to the stress test results and positive post-SVB trends. In fact, it’s possible that the strong performance of these two banks may set expectations too high for the rest of the cohort, potentially generating short-term headwinds when they report early next week.

Pass the Baton

As we enter earnings season, the market’s focus will shift from the macro to the micro. Instead of being driven by CPI, PCE, and Payrolls, the market will now be driven by earnings reports and commentary from major companies like J.P. Morgan, Apple, and Nvidia.

It’s important to consider the significant multiple expansion that has occurred due to AI as this earnings season begins. In 2022, earnings only needed to be better-than-feared to spark and sustain rallies. However, now that multiples have expanded, earnings need to justify that expansion.

The S&P 500 currently trades at ~21x trailing and ~20x forward earnings. In comparison, the equal weight S&P 500 trades at ~17x trailing and ~16x forward, which seems more reasonable given the macroeconomic environment. Concisely, the bar for a “successful” earnings report is relatively high, particularly for those companies where multiples have expanded the most: primarily, the Magnificent Seven.

Leave a Reply