Nonfarm Payrolls, which is the most influential job report of each month, will be released on Friday morning. Historically, Payrolls has had an impact on market expectations regarding the Fed and interest rates. A little less than 48 hours out, it is the opportune time to review current expectations and assess risks attached to the event.

As the market factors in more tightening, stocks tend to decline.

As the market factors out tightening or factors in easing, stocks tend to rise.

At the June FOMC Meeting, the Fed delivered a “hawkish pause” by keeping the Fed Funds rate unchanged and simultaneously adding 50 bps of additional tightening to their dot plot forecasts.

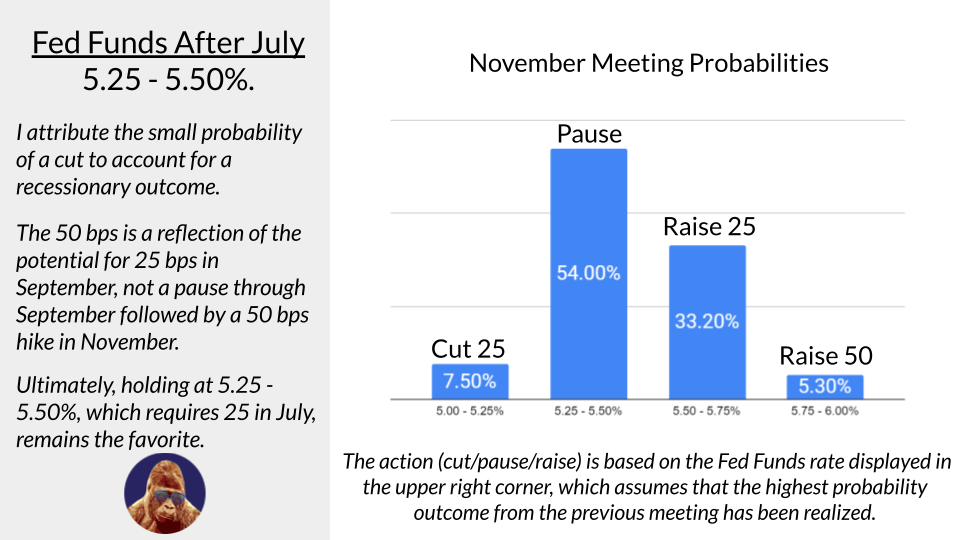

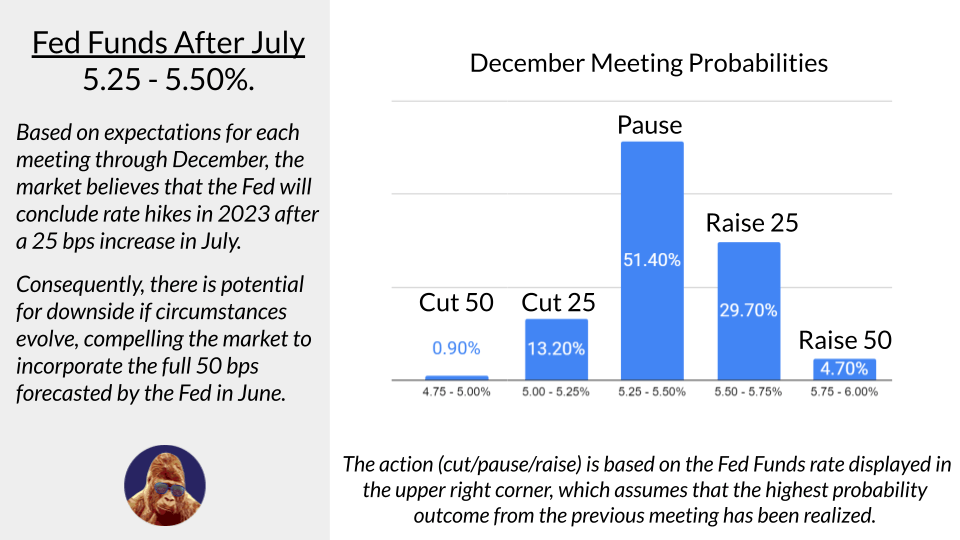

As per the slides, the market has priced in 25 of those 50 bps. Therefore, I believe the risk associated with June Payrolls is minimal.

A strong report could initially cause a downward reaction, but I anticipate any weakness to be short-lived because the market has already accounted for 25 bps. To generate significant downside, Payrolls would need to indicate the full 50 bps will be required.

Although influential, I suspect that one report alone, barring an exceptionally surprising number, will not be enough to convince the market that 50 bps is necessary.

Leave a Reply