The Week Behind

The momentum in stocks continued as the ECB forum on central banking and PCE report failed to challenge the bull case surrounding monetary policy and recession. As a result, the major indices finished the week about ~2% higher, marking a small triumph for the catch-up thesis.

Highlights

- Surpassing the 1.6% median forecast, 1Q GDP was revised up to 2%, further postponing recessionary expectations.

- Year-over-year core PCE came in at 4.6%. Depending on the source of estimates, 4.6% either matched or slightly fell below consensus. The benign figure offset concerns that arose earlier in the week attached to stronger economic data, such as GDP, which had prompted fears of the Fed tightening more than anticipated.

- At the ECB Forum in Sintra, central bankers reiterated a unified message around their 2% inflation target and maintained their economic forecasts that exclude a recession.

Early Earnings Informants

Last week, I mentioned a few early 2Q reporters that would offer a glimpse into key market narratives. With earnings season approximately two weeks away, my observations from the early reports are now relevant enough to share.

Jefferies, an investment bank, missed the quarter due to ongoing weakness in deal making. However, based on the activity observed in June, management has grown increasingly optimistic about the prospects of a normalizing investment banking landscape. For my thesis on the revival of IPOs, two crucial factors are required: a pause by the Fed and declining recession odds. With both criteria met, I am inclined to embrace management’s optimism as more than just “talking their own book”. This bodes well for Goldman, J.P. Morgan, and Morgan Stanley. Full disclosure, I hold long positions in J.P. Morgan, Morgan Stanley, and Blackstone. While I firmly believe that the time is now, it should be noted that Jefferies’ performance ultimately fell short and can only provide anecdotal signs of improved capital market activity. It may still be too early.

McCormick had a mixed quarter, with earnings surpassing expectations but revenue falling slightly below. Revenue was driven by increased prices as unit sales declined. Notably, McCormick’s U.S. consumer segment experienced an 8.1% price increase alongside a 3.5% volume decrease in the second quarter (slide 13). The decline in volume suggests that consumers are not drastically shifting their behavior towards cooking at home. The price increase indicates that those who are cooking at home are financially capable enough to absorb McCormick’s price hikes. If a recession were upon us, we would observe the opposite.

Carnival reported a smaller-than-expected loss and issued strong guidance. While all travel and leisure spending can be considered discretionary, cruising falls on the far end of the discretionary bell curve. The fact that Carnival’s bookings remain strong is a solid indication that the bull market in travel is still thriving. Furthermore, it suggests that consumers are faring better and feeling more optimistic than one might expect based solely on inflation and interest rates.

In addition to providing top and bottom line beats, Paychex’s commentary did not indicate any significant obstacles associated with regional bank turmoil weighing on small-to-medium sized U.S. businesses.

Marked by the first earnings per share (EPS) miss in three years, Nike delivered a mixed quarter. Revenue, driven by sales in China that exceeded expectations, beat. Since the reopening, the strength of the Chinese economy has been inconsistent. This particular bread crumb supports the notion that recent government stimulus may be having the desired impact, which is a positive sign for stocks that rely on China’s market for performance.

The Week Ahead

This week will be dominated by macroeconomic events as influential economic reports take the spotlight.

Monday is a half-day, with markets open from 9:30 AM to 1:00 PM. During this time, investors will get an update on economic activity via S&P manufacturing, ISM manufacturing, and construction spending.

Tuesday is closed for the 4th of July holiday.

On Wednesday morning, the ADP employment report for June will be released. The median forecast for job creation is 220k, following last month’s figure of 278k. In the afternoon, the June FOMC minutes will be published. The minutes tend to reaffirm the message from the associated meeting. Given that the market responded positively then, perhaps the bulls will be allowed to double dip.

Thursday, alongside weekly initial and continuing claims, brings JOLTS (job openings) for May. Analysts expect 10 million job openings, similar to last month’s 10.1 million.

The main event of the week is the release of June Payrolls on Friday morning. Several key numbers will be closely watched. First, headline job creation is expected to reach 240k. The unemployment rate is anticipated to decrease by 0.1% to 3.6% from 3.7%. Year-over-year average hourly earnings are also expected to moderate by 0.1% to 4.2% from 4.3%.

While all three metrics will be monitored, I will pay particular attention to the unemployment rate. In May, unemployment jumped from 3.4% to 3.7%. 0.3% may not seem like much, but it represents an oversized move with respect to unemployment rate. I am looking for confirmation that the 0.3% increase was a blip and not the beginning of a more concerning trend.

Rate Expectations

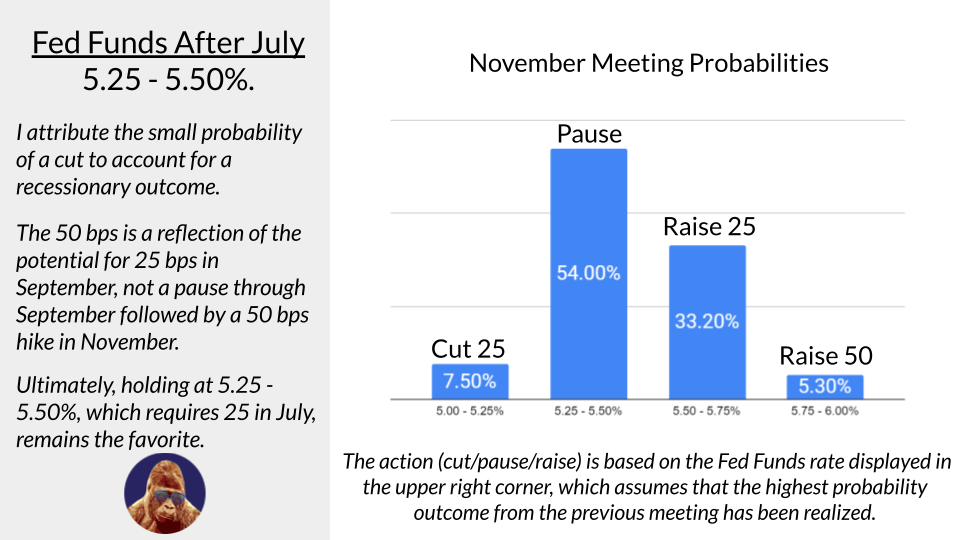

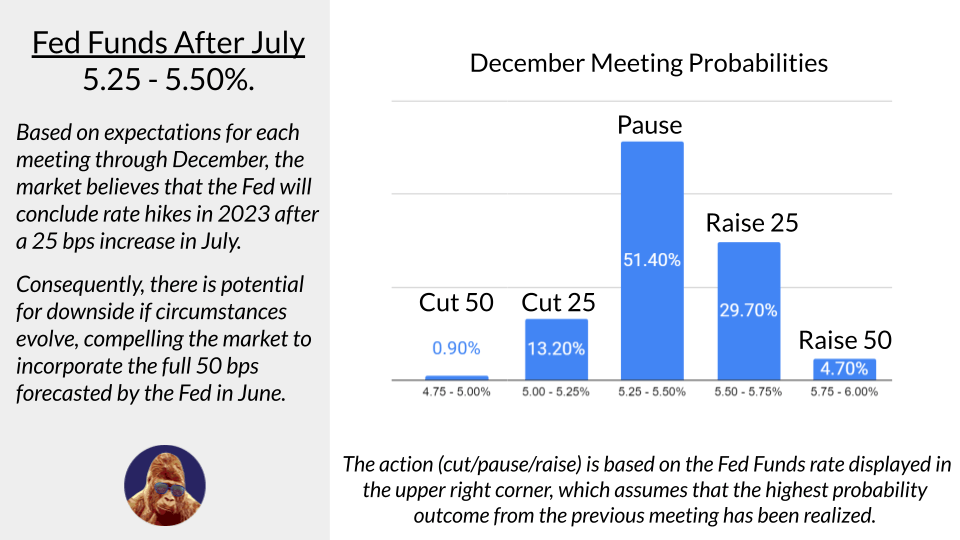

In the two weeks since the June FOMC, we have received CPI and PCE along with healthy doses of messaging from the Fed and central banks worldwide. As earnings season approaches, the focus on the Fed and macroeconomic factors may take a backseat. Therefore, it’s an opportune time to utilize the CME FedWatch Tool and assess the market’s expectations regarding interest rates.

To summarize the slides, the market anticipates that the Fed will only implement a 25 bps increase, instead of the full 50 bps projected at the June FOMC meeting. This 25 bps increase is expected to occur at the July meeting. If the market starts pricing in this additional 25 bps, it could lead to downside pressure on stocks. Interestingly, perhaps due to the rhetoric at Sintra, the market priced out rate cuts for 2023 without adversely impacting positive momentum.

Leave a Reply