July 2023

-

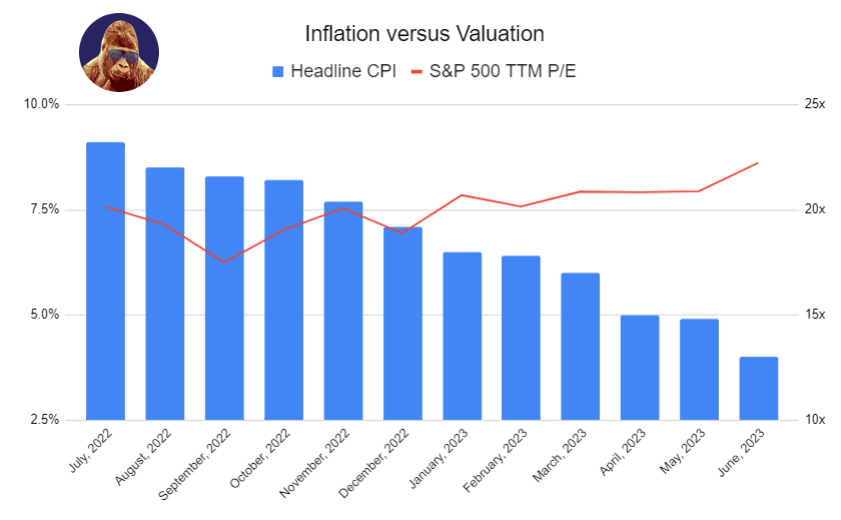

The Week Behind While GDP stoked the inflationary fires on Thursday, Friday’s PCE dampened inflationary embers, allowing the majors to tally winning weeks on the backs of strong corporate results. The Dow finished the week ~0.6% higher; the S&P 500 added ~1%; and the NASDAQ gained ~2%. Highlights Monitoring the Macro Despite abundant micro data…

-

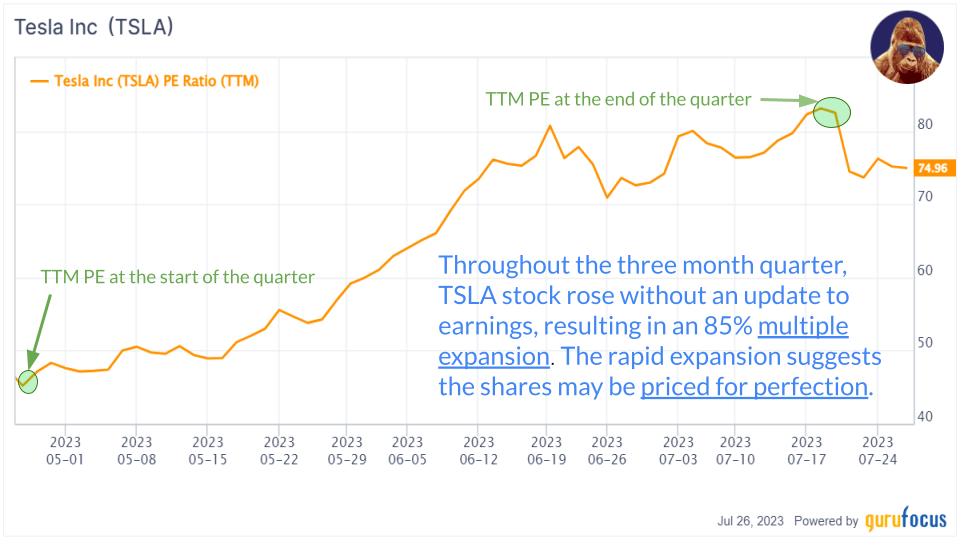

Valuation and Expectation Valuation plays a significant role in shaping expectations for each company’s quarter. There is a direct correlation between relative valuation and expectation: The higher the relative valuation; the higher the expectation. The lower the relative valuation; the lower the expectation. Priced for Perfection When a stock experiences rapid price increases before its…

-

The Week Behind With the Fed blackout window in effect and economic data failing to sway expectations of a 25 bps increase, corporate earnings drove index performance this week. The Dow outperformed, gaining approximately 2%, bolstered by solid quarters from big banks, regionals, and healthcare. The NASDAQ underperformed, experiencing a 0.60% drop, as Netflix and…

-

The Week Behind It was a good week for stocks as CPI showed that inflation moderated more than anticipated in June. The soft number extended the downward reversal in yields and the dollar that started with June Payrolls. Lower rates and a weaker dollar created additional runway for stocks to run. For the week, the…

-

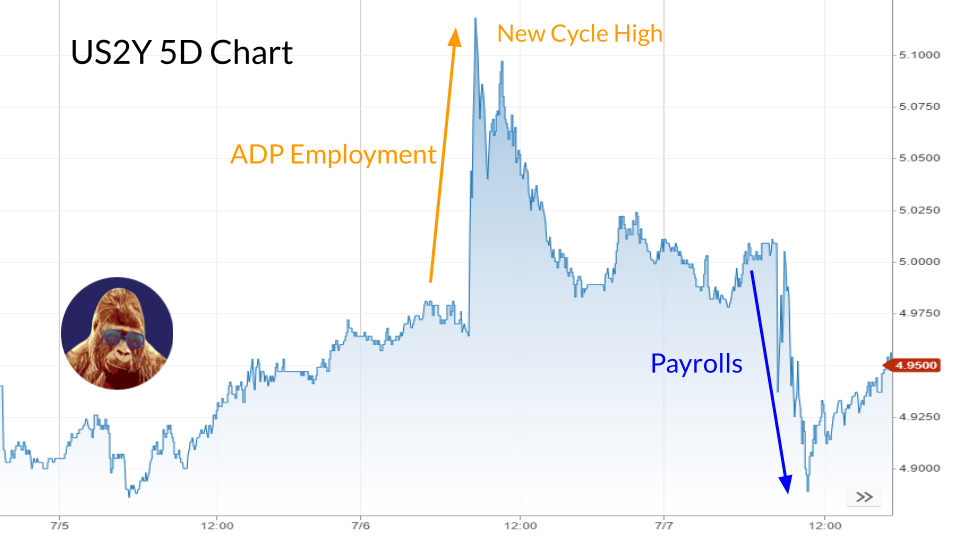

The Week Behind Despite Payrolls painting a more balanced inflationary picture, concerns about tighter monetary policy, fueled by hawkish FOMC Minutes and a remarkably strong ADP employment number, pushed yields to uncomfortably high levels. This upward move in yields put downward pressure on stocks, resulting in a ~1% decline for the S&P 500 and NASDAQ.…

-

Nonfarm Payrolls, which is the most influential job report of each month, will be released on Friday morning. Historically, Payrolls has had an impact on market expectations regarding the Fed and interest rates. A little less than 48 hours out, it is the opportune time to review current expectations and assess risks attached to the…

-

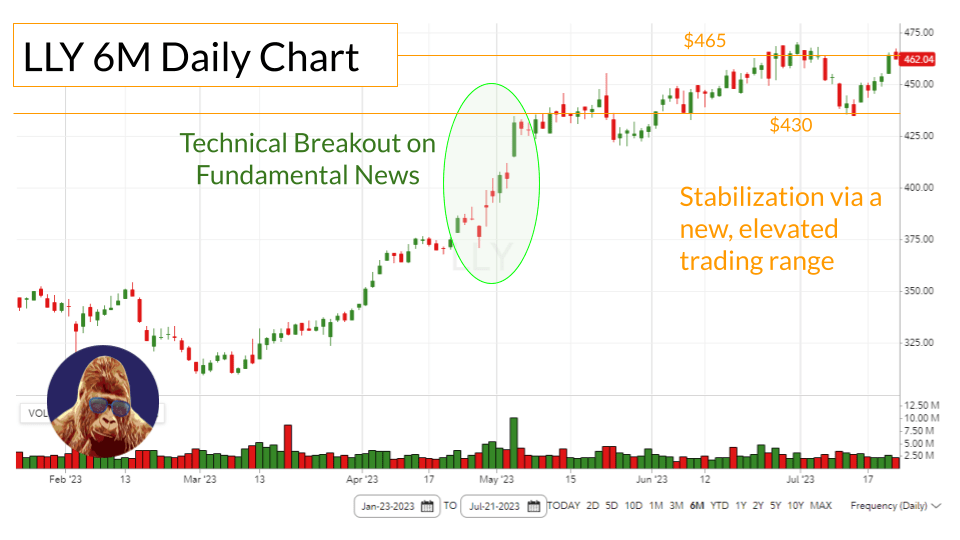

The Week Behind The momentum in stocks continued as the ECB forum on central banking and PCE report failed to challenge the bull case surrounding monetary policy and recession. As a result, the major indices finished the week about ~2% higher, marking a small triumph for the catch-up thesis. Highlights Early Earnings Informants Last week,…