Markets look a little sluggish today as Powell meets with the House for the first day of the two-day Biannual Report on U.S. Monetary Policy. Tomorrow, Powell will conclude the biannual event with a meeting with the Senate.

While some attribute today’s weakness to related headlines, I disagree. In my opinion, Powell’s prepared remarks and testimony align with the message conveyed during June’s FOMC meeting.

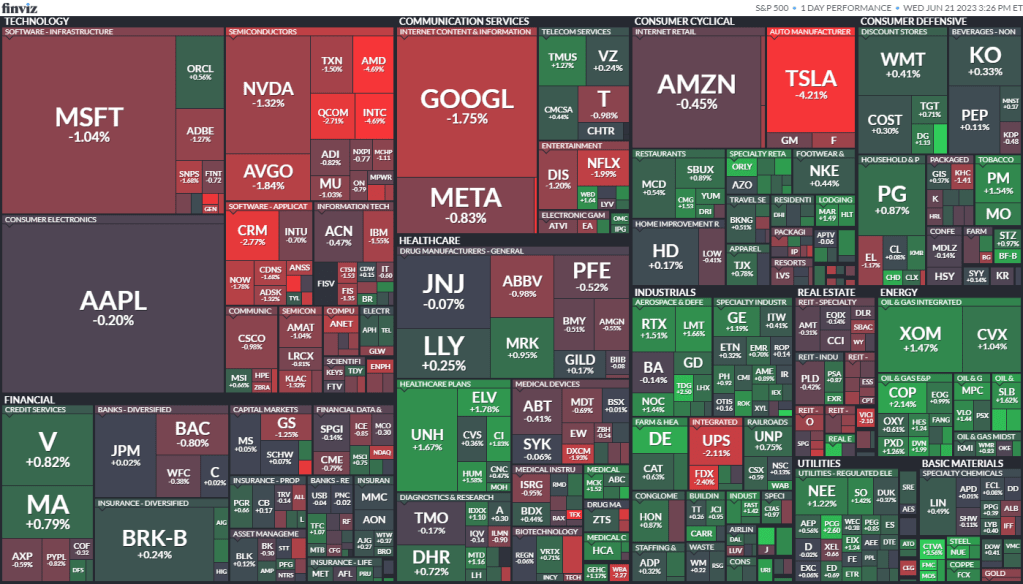

Let’s not make news out of nothing. This feels like a rotation triggered by profit-taking:

- Weakness is concentrated among year-to-date outperformers (tech).

- Strength is concentrated in the year-to-date laggards (everything else).

- The equal-weight S&P is outperforming the cap-weight S&P.

- The Dow is outperforming the NASDAQ.

If this rotation continues, I believe the next significant trade will center on a “catch-up” thesis, which proposes that the relatively cooler sectors of the market will catch up to the hotter sectors, while the hotter sectors at least maintain their current levels.

Leave a Reply