The Week Behind

The performance of the major indices reflected an inconsequential week devoid of influential earnings or economic releases. Although the S&P 500 registered a new bull market close, marking a 20% increase from the October low, it only recorded a modest gain of 0.39% for the week. The Dow advanced by 0.34%. The NASDAQ managed 0.14%.

Highlights

- Economic data supported a dovish Fed outcome – a skip – by showcasing a slowing economy and slackening labor market without indicating an imminent recession.

- U.S. Services PMI came in below expectations: 54.9 actual v. 55.1 forecast.

- ISM Services also came in below expectations: 50.3% actual v. 52.3% forecast.

- Factory orders for April were weaker than expected: 0.4% actual v. 0.6% forecast.

- Initial jobless claims came in at 261k, exceeding both the forecast of 236k and the previous week’s figure of 233k.

The Shoe Is On The Other Foot

Remember the October low in 2022? The S&P 500 had officially entered a bear market, experiencing a 20% decline on a closing basis. Uncertainty surrounded the path of inflation, and fears persisted that Fed policy would result in a hard landing. Stimulus for consumers was running out, and earnings were expected to collapse.

Hope was in short-supply, overshadowed by fear.

Then, before the S&P 500 could settle comfortably into bear territory, the market unexpectedly surged higher in November at the smallest glimmers of positive news. With the benefit of hindsight, we know now that the market was well on its way to a bull market. If you waited for indicators to flash a green light for stocks, you missed a meaningful portion of the rally.

The takeaway is that when the market heavily favors one side of the bull-bear debate, it doesn’t take much to shift the tide.

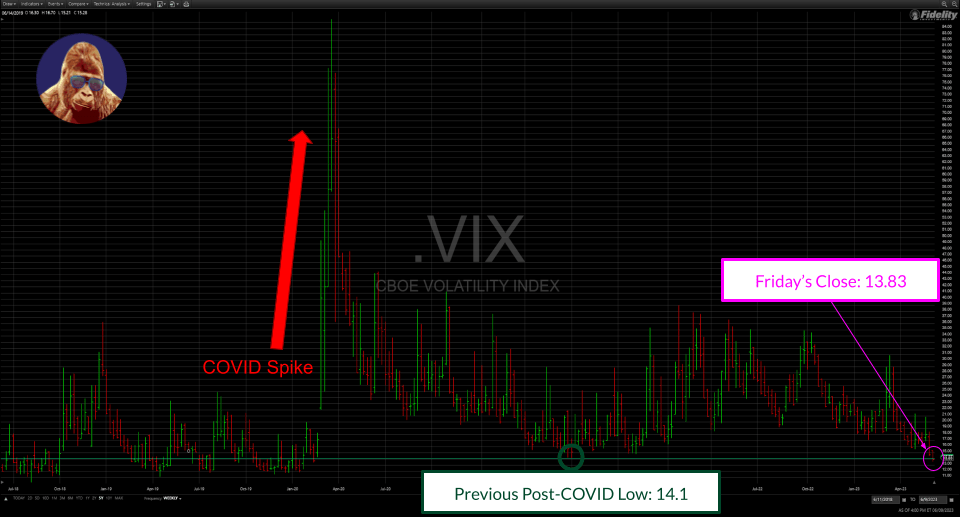

As of Friday, the S&P 500 is officially in a new bull market. The VIX – the “fear gauge” – is at its lowest level since the pandemic began. Inflation is in a downtrend, and the Fed is set to skip a hike. Consumers are spending on experiences and displaying resilience, defying the bear narrative. The earnings potential of AI offers support for index-level earnings during an economic slowdown.

Fear is in short-supply, overshadowed by hope.

The shoe is on the other foot.

By October’s logic, it would be wise to consider taking some profit in June, as it shouldn’t require much to disrupt the current state of market euphoria. With that extra cash in your portfolio, sharpen your pencils and do some homework. Have a list ready for what would be a healthy ~5% breather (pullback) in the S&P 500.

The Week Ahead

The FOMC meeting is the most consequential item on this week’s agenda. CPI and retail sales are also important as the former will shape expectations going into the FOMC, and the latter will shape expectations coming out.

CPI will update the inflation debate on Tuesday. Emphasis will be on the core figure. Consensus is 5.3%, down 0.2% from the prior month. The swing factor is likely to be in the food category, particularly the cost of beef. While this number is unlikely to alter the Fed’s preference to skip, it could influence Powell’s message at the press conference.

The FOMC meeting concludes Wednesday. Even if CPI shows meaningful progress on inflation, I do not anticipate a dovish stance from Powell. With retail sales scheduled to release the next day, Powell will be cautious about appearing dovish in case the report suggests a potential spike in inflation. Retail sales are expected to come in at -0.1%; ex-autos, the figure is expected to be 0.1%. Given the current state of market euphoria, any hawkishness from the chairman may generate unease.

In addition, there are a few corporate earnings reports that may make headlines. Oracle and Adobe report on Monday and Thursday, respectively. As the market’s interest in AI persists, these two names have been identified as potential winners. Additional earnings justification of AI-hype would help support the market against any potential waves generated by macro developments. Furthermore, Lennar reports on Wednesday. Despite being overshadowed by the performance of the Magnificent Seven, homebuilders have been a surprising bright spot, up 28% year-to-date as measured by the ITB. Continued strength in the sector is important to sustain the rally.

Hedging is Inexpensive

One benefit of the calmest market in three years, as measured by the VIX, is that options hedging is relatively inexpensive. Volatility and options prices are typically directly correlated:

Volatility is high; options prices are high. Volatility is low; options prices are low.

If you are familiar with using options to hedge and have concerns about the events happening this week, it may be a good opportunity to put on those hedges at a lower cost. However, it’s important to note that options are riskier and more complex than stocks. If you don’t have prior experience, this is not the time to learn on-the-fly.

For those interested in hedging but new to options, there is an alternative. In the past, I have used the VIXM, a volatility ETF, to capture short-term spikes in the VIX. I find this hedging vehicle easier to understand and implement compared to options. The VIXM is designed to profit from increases in the expected volatility of the S&P 500. However, it’s important to note that the VIXM does not track the VIX perfectly. You may see the VIX up 10% while the VIXM is only up 5%.

It’s essential to recognize that using the VIXM is closer to day trading than traditional investing. Active monitoring of the VIXM is necessary for effective use. It’s not suitable for everyone. My normal holding period on the VIXM is 1-3 days. However, I mention it because hedging is an important aspect of investing, and, in my opinion, the VIXM serves as a more accessible entry point for real-world application.

Leave a Reply