The Week Behind

Benign labor data, solid corporate earnings, a surprisingly clean debt ceiling resolution, and dovish Fed reporting created a “goldilocks” feeling in the stock market. Notably, the rally’s breadth expanded beyond the technology sector, encompassing other parts of the market that have struggled in the past three months. This broadening was reflected by the relatively equal performance among the major indices, each gaining ~2% on the week.

Highlights

- Nick Timiraos, the Fed Whisperer, reported that the Fed is likely to “skip” at the June Meeting, unless May Payrolls is “sizzling” hot. This “skip” would provide the Fed with an extended period to analyze the cumulative effects of tightening.

- May Payrolls did not present an immediate need to tighten. In combination with Nick Timiraos’ reporting, the likelihood of a June “skip” increased. The market responded with a noteworthy broad-based rally to conclude the week.

- The U.S. Congress successfully passed a bipartisan debt ceiling resolution. President Biden announced during a Friday night speech that he would sign the resolution over the weekend.

Goldilocks Jobs Data Across The Board

Despite ample opportunity to derail the rally, all three of last week’s labor reports appear to have gone the way of the bulls. Each report was not too hot to exacerbate inflation concerns for the Fed, nor too cool to aggravate recession fears for the bears. The market saw them as just right: a ‘Goldilocks’ scenario.

The beat on U.S. job openings sufficiently alleviated recession fears without implying the economy was incapable of disinflation. ADP job creation featured a robust headline number but indicated wage growth, albeit resilient, was slowing. Similarly, May Payrolls showcased a strong headline number, but an increase in unemployment and below-expectation yearly average hourly earnings dampened the overall picture.

While I believe part of the market’s interpretation can be attributed to Nick Timiaros’ report expressing the Fed’s preference to “skip”, the initial consensus is that each highlights a resilient economy – mitigating the probability of a recessionary earnings collapse – capable of fostering disinflation – enhancing the likelihood of a Fed “skip” and, by extension, eventual pause.

The Week Ahead

With labor data favoring the bulls and a relatively light schedule, I expect the market’s focus to shift to CPI, releasing June 14th. However, before CPI sucks the air out of the room, there are two important events on Monday that will get oxygen: the OPEC+ meeting and Apple’s Worldwide Developer Conference (WWDC).

Speculation surrounding the OPEC+ meeting generated positive momentum for energy stocks towards the end of last week. The market’s expectations for the meeting remain uncertain, making Monday’s headlines crucial in determining whether the recent multiday move will continue or reverse. While the energy sector was favored to start the year, recession fears have dampened its performance. For 2023, the energy sector, as measured by the XLE (SPDR Energy ETF), is down approximately 5%. Building on the new-found momentum could expand the rally’s breadth and performance.

The bears have been unable to touch Apple in 2023. Up 45% year-to-date, Apple closed at a new all-time high of $180.95 on Friday. The upcoming WWDC is rumored to highlight a new VR headset, Mac, and iOS 17. Trading at an all-time high, expectations for the event are also high, which increases the possibility of a ‘sell the news’ reaction. However, I anticipate that any dip would be quickly bought up.

Additionally, Nio (NIO), a Chinese electric vehicle manufacturer, is scheduled to report earnings on Friday. The stock recently made a new 52-week low at $7, which suggests negative sentiment is already priced-in. Considering the Chinese government’s recent stimulus measures, I anticipate that Nio will improve its guidance at earnings, unlocking some value.

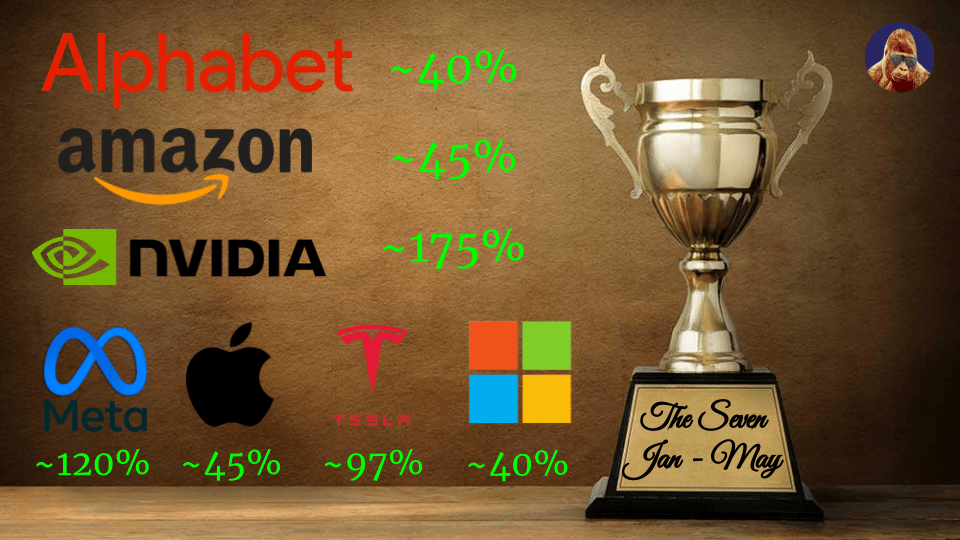

Interpretations of the Performance Gap

Since the beginning of the year, a group known as the Magnificent Seven (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla, and Alphabet) have been responsible for the majority of gains in the S&P 500. The other 493 stocks are relatively flat, up only ~2% as measured by the equal weight S&P. Opinions about this dynamic are mixed. Some express concern; others are less worried. I’ll give you both perspectives and let you decide.

Those who find the narrow breadth worrisome point out that the S&P 500 is a market-cap weighted index. These indices assign influence based on market capitalization. Therefore, any weakness in the Magnificent Seven could topple the entire index, bringing all in it down in the process. This camp sees narrow rallies as fragile at best and fraudulent at worst.

Those who are less skeptical argue that the Magnificent Seven have been instrumental in sustaining the broader market during a period marked by fear, uncertainty, and doubt. They contend that the tremendous earnings potential associated with AI justifies the narrowness. Additionally, they point out that the previous, narrow leadership under the FAANG stocks (Facebook, now Meta, Apple, Amazon, Netflix, and Google) did not define a fraudulent bull market. This camp is not bothered by the narrow breadth and believes that once the “easy” money has been made in the Magnificent Seven, the positive momentum will extend to the other 493 stocks in the S&P 500.

Leave a Reply