Veeva Systems (VEEV) didn’t disappoint investors with its latest quarterly report, which was released last Wednesday. If you read the 9:25, then this one would have been on your radar.

On Monday, I wrote…

VEEV offers industry cloud solutions for life sciences companies. Although it hasn’t participated to the same extent as other cloud companies in the current rally, it presents potential. With its customers in resilient sectors and the potential to enhance its product through AI, VEEV could outperform over the next 3-6 months if it delivers on the quarter.

9:25 on 5/30/23

In short, I pitched it as a company that was in the right place at the right time but had not yet been rewarded.

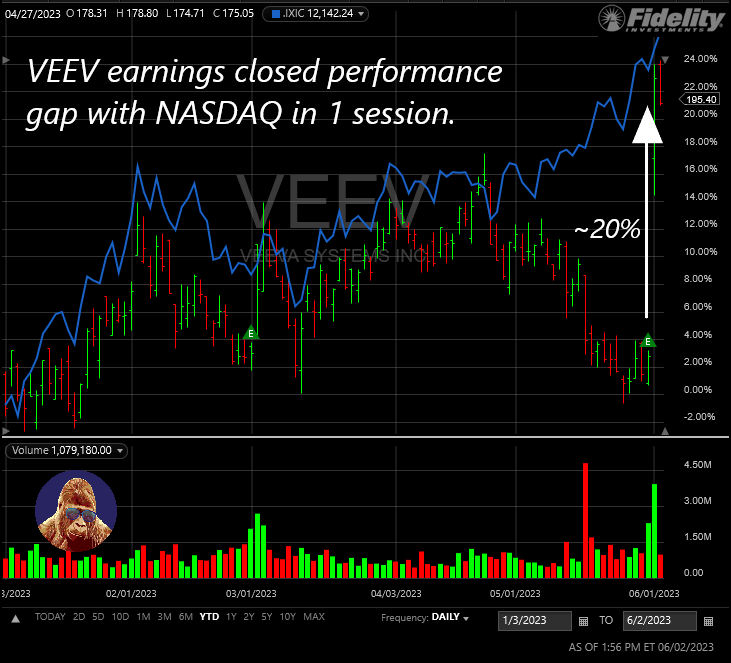

Heading into the report, VEEV was about flat for the year, whereas the NASDAQ, the tech-heavy index, was up 25%. Although I was not certain what force was depressing the price, my thesis was that earnings, which I estimated would be as good or better than NASDAQ peers, would eliminate the bearish overhang and drive outperformance.

The report validated my thesis. Not only did VEEV exceed expectations on the top and bottom lines, but management also convinced investors that AI integration would drive value, client retention, and growth. What I didn’t expect was a 20% rally to follow, rectifying the underperformance in just one trading session by bringing it more in-line with peers in the NASDAQ.

I thought earnings would provide the spark, not the entire fire.

What did I do next?

Although earnings left me with the impression more upside remains, my thesis had played out. I stuck to my strategy and closed the trade.

A disciplined strategy is integral to successful investing. Bulls make money; bears make money; hogs get slaughter. Discipline is what separate the bulls and bears from the hogs.

I approached, sized, and researched this investment as an “earnings play”. The thesis played out favorably, resulting in a 20% gain. At that point, to continue holding onto the shares without a new thesis would have been an act of greed, which goes against discipline investing principles.

Leave a Reply