The Week Behind

Despite last week’s strong macroeconomic data validating the Fed’s hawkish tilt, the major indices managed a decent overall performance. While the Dow declined by approximately 1% and the S&P 500 remained flat, the NASDAQ surged 2.5% thanks to impressive quarters from Nvidia and Marvell boosting technology stocks further.

Highlights

- May Services and Manufacturing PMI printed above 50, indicating economic expansion.

- The second read on Q1 GDP was revised up to 1.3% from 1.1%, suggesting a stronger Q1 than thought prior.

- Core PCE came in roughly in-line, exceeding consensus by only 0.1%.

- Nvidia’s guidance for the next quarter surpassed analysts’ expectations by 50%, with a $11 billion guide compared to the $7.5 billion forecast. This impressive performance was driven by “surging” demand for data center products essential for AI.

The Only Two Narratives That Matter… For Now

In the investing world, narratives can hold significant power. Currently, the market is driven by just two narratives that seem to overshadow everything else. If your business revolves around AI or weight loss medication, investors are willing to “buy now” and “ask questions later”. Otherwise, even with stellar earnings and guidance, a stock is met with a resounding “meh”.

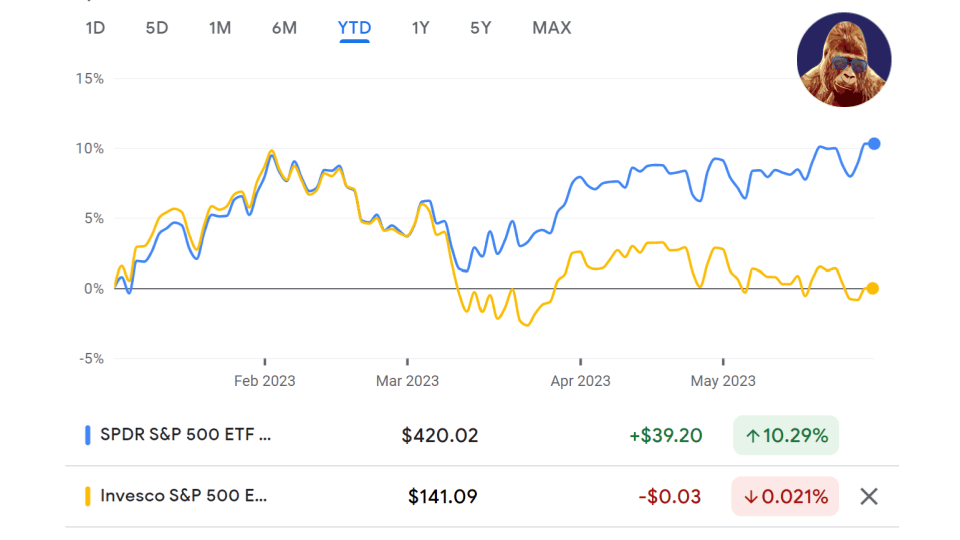

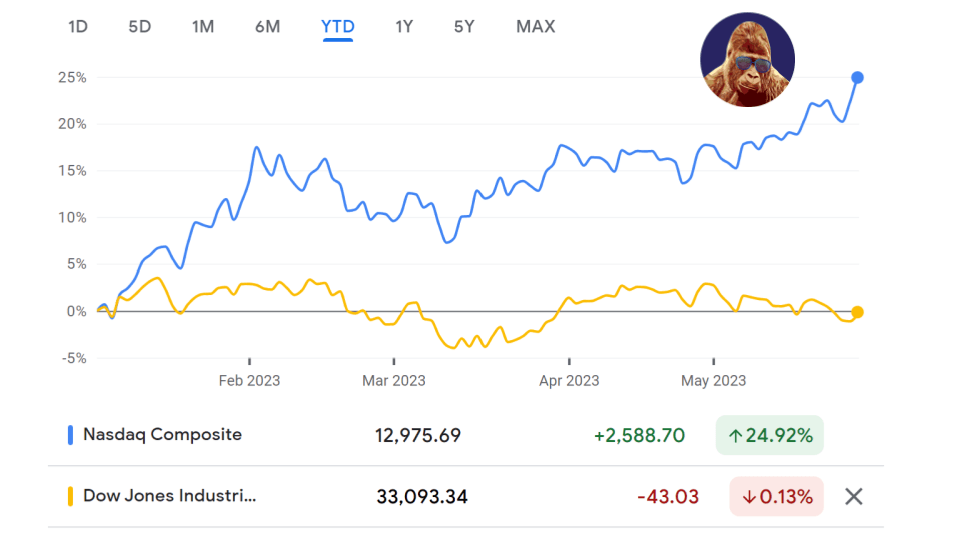

This attitude is evident by the performance gap between different indices. The market cap-weighted S&P, with its greater exposure to technology and AI, is outperforming the equal-weighted S&P by around 10%. Similarly, the NASDAQ, with a higher concentration of semiconductors and software, is outperforming the Dow by approximately 25%.

The strength of these bullish narratives has temporarily overshadowed the bearish narratives surrounding the Fed and the debt ceiling. For now, it seems that the market views the earnings potential of AI- and weight loss-related companies as less susceptible to the real-world impact of a potential recession caused by Fed policies or a government default. Stocks outside of AI and weight loss simply are not worth the risk.

As an investor, I am always trying to go where the puck is going, not where it is right now. While it’s unlikely that the true winners in the AI and weight loss sectors will return to prices before their meteoric rise, a shift back to any of the known negatives may create buyable dips. This could happen once the debt ceiling issue is resolved. Although a relief rally might follow, the market may refocus on the implications of regional bank fragility and the historic tightening by the Fed on future earnings. However, it’s worth noting that the narrative of earnings collapse is becoming tiresome. Therefore, the market is likely to remain relatively resilient to this particular narrative until there is clear evidence in corporate earnings.

The Week Ahead

Even though this is a short trading week, there is a full week’s worth of reports that investors should pay attention to.

In terms of the macro, the labor market is in focus with three significant reports on the docket: job openings, ADP, and May Payrolls. Bulls are hoping these reports come in slightly below expectations, indicating a slowdown in the economy. This would indicate that inflation is cooling and that the Fed can pause because they are successfully combating inflation, rather than being forced to react to a recession of their own making.

The previous month’s job openings figure of 9.6 million alarmed the market as it was the worst since the COVID-recovery. With consensus ranging between 9.35 – 9.5 million, analysts have projected further downside. While a significant miss could startle the market, consensus has already prepared the market for additional downside.

Regarding ADP, its position in the overall labor data mosaic is uncertain, especially after the recent methodology change. However, since the Fed watches this figure, it’s worth paying attention to. The consensus forecast for ADP is 180k.

On Friday, the highly anticipated May Payrolls report, the most important labor report of the month, will be released. Headline job creation is expected to be between 188 – 195k, down from last month’s 253k. Unemployment is expected to tick up to 3.5% from 3.4%. Yearly average hourly earnings are expected to come in at 4.4%, down 0.1% from the previous month.

Turning to corporate earnings, Salesforce (CRM), Crowdstrike (CRWD), and Veeva (VEEV) will report after the bell on Wednesday. Broadcom (AVGO) is scheduled for Thursday.

CRM, which now features a small army of activists, seems to be on the path of cost-cutting similar to Meta Platforms. If CRM can show investors that revenue growth is not a concern, this stock will continue to move higher.

In the cybersecurity space, CRWD holds the second position after Palo Alto (PANW). PANW had a strong quarter, but it might not provide a direct readthrough to CRWD. It’s possible that PANW’s performance was driven by stealing market share. While I believe the industry is big enough for more than one dominant player, if the thesis on PANW is true, then CRWD may not meet expectations.

VEEV offers industry cloud solutions for life sciences companies. Although it hasn’t participated to the same extent as other cloud companies in the current rally, it presents potential. With its customers in resilient sectors and the potential to enhance its product through AI, VEEV could outperform over the next 3-6 months if it delivers on the quarter.

Second to Nvidia, AVGO is well-positioned as a supplier of data center products necessary to run AI applications. AVGO rallied 20% after Nvidia’s quarter, which suggests to me the upside from the quarter is already in the stock. Although it is possible AVGO delivers additional bullish surprises, I am not sure what would be necessary to generate another double-digit gain overnight. That being said, an argument could be made that the market is irrationally bullish on AI, so such an outcome should not be ruled out.

An Unspoken Narrative

There is a concerning development in China: a new wave of Covid resulting in 50-65 million cases per week. Surprisingly, this narrative has received little media coverage, which leads me to believe it has not been priced into U.S. equities. Currently, a return to zero-Covid is not the base case, which might explain the lack of attention. Nevertheless, it is crucial to monitor this situation closely. The reopening of China plays a vital role in the growth strategies of many companies, and this development could pose a significant obstacle. On the other hand, it likely decreases the probability of any immediate actions on Taiwan.

Leave a Reply