The Week Behind

Take a breath. The busiest week of earnings season is officially behind us, and the major indices all ended the week with gains. Solid earnings and a nearly in-line Personal Consumption Expenditures (PCE) report gradually pushed stocks forward throughout the week. The Dow and S&P both rose approximately 0.85%, while the NASDAQ outperformed with a gain of around 1.30%.

Highlights

- Q1 U.S. GDP came in well below expectations, at 1.1% compared to the estimated 2.0%, which suggests that Fed tightening is slowing the U.S. economy.

- The employment cost index for the first quarter exceeded expectations, with actual figures at 1.2% versus a 1.0% estimate, indicating that wage inflation may not have moderated as much as anticipated.

- The Core Personal Consumption Expenditures (PCE) index rose to 4.6%, slightly above the forecasted 4.5%, but still below the previous month’s figure of 4.7%. Inflation is gradually decreasing, but not as fast as anticipated.

- Shares of First Republic (FRC) stock declined throughout the week, following reports that the bank may face FDIC receivership (bankruptcy).

Three Valuable Earnings Insights

Going into earnings season, my expectations were set for “better-than-feared.” With the most influential companies having already reported, I can confidently say that earnings have exceeded my expectations. Performance and commentary from bellwether companies suggests businesses and consumers are still going strong, even as they look to cut costs. Amidst the information overload common with the busiest earnings week, it is easy to lose sight of the bigger picture. That’s why I’ve taken a moment to reflect on my notes from the week and have compiled the three most valuable insights that I’ve made.

- Persistent AI hardware investment by Microsoft, Alphabet, and Meta is creating a multi-year tailwind for Nvidia, akin to the crypto-mining boom. This could create an AI bubble, similar to the crypto-mining bubble that burst in 2022.

- The lackluster advertising performance at Snap and Pinterest relative to Meta and Alphabet is indicative of budget consolidation to the biggest and best players. In my view, this trend will continue throughout the year and show up in other areas such as cybersecurity. This is bullish for blue-chips Palo Alto Networks and CrowdStrike.

- Earnings indicate that the regional banking event has not severely damaged the economy, which makes it easier for the Fed to hike another 25 bps.

The Week Ahead

The FOMC meeting and Apple’s earnings (AAPL) will be the most closely watched events of the week. Jerome Powell takes the podium on Wednesday to deliver the FOMC’s decision. Tim Cook will be on the hot seat Thursday after the close.

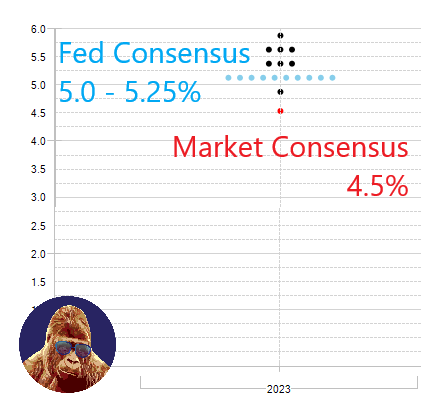

Although economic reports will be released ahead of Wednesday’s meeting, I doubt any will alter the well-telegraphed 25 bps hike. The stock and bond markets have already priced-in that outcome. Furthermore, it would bring the Fed Funds Rate to the Fed’s consensus target, which could be seen as a victory for Fed credibility. 25 bps is widely expected. Consequently, the press conference is the only source of uncertainty. Now that the Fed has reached their interest rate target, investors will look for Powell to signal a pause.

AAPL has risen more than 40% YTD. Consensus EPS for the quarter is $1.43, implying a YoY decline of around 6% from the $1.52 reported in the same period last year. Given China’s enduring strength and easing of supply chain issues, the estimate appears achievable. That being said, the stock has already increased by around 21% since their Q1 report and is trading at about 28.5x earnings, indicating that the market is anticipating positive results and bullish commentary on their expansion into India. AAPL’s contribution to the S&P 500 is significant, so the stock needs to remain strong to support an S&P 500 that is approaching 4200.

First Republic is a First Republic Problem

Early last weekend, the FDIC put FRC under receivership. The FDIC swiftly called on interested bidders for the best takeover offers. Multiple sources indicate that J.P. Morgan and PNC are likely to make the most competitive bids. If the winner has not yet been announced, we should know by the end of Monday. While the winning bank will likely experience a nice bump in their shares, there was a more important dynamic at play.

Price action told investors that the market views FRC as truly idiosyncratic. If this were a systemic event, the majors would have taken a gut punch, and the KRE would have been bloodied. Instead, as FRC declined on news of imminent receivership, the indices put together a nice Friday, and the KRE did better than that. The market has made it clear that the FRC problem is truly idiosyncratic and not a threat to the broader economy or even to other regional banks. FRC is an FRC problem, and the market seems ready to move on from it.

Leave a Reply