The Week Behind

The first week of earnings did not reveal any significant revelations, which may explain why it was a slow week for the indices. I believe that the “business-as-usual” reporting week, along with the resilient economic data, supports the notion that the regional bank scare is contained and the economy can sustain further interest rate hikes. Consequently, while the Dow, S&P, and NASDAQ all finished the week only slightly lower, the NASDAQ underperformed due to firming expectations of a May interest-rate hike.

Highlights

- Housing data – starts, permits, existing sales – was slightly weaker than anticipated.

- For a third consecutive week, initial jobless claims increased. The 245k figure continues the streak of figures above 200k that began in February.

- Overall, bank earnings did not provide any new information to fuel concerns about contagion.

- The preliminary manufacturing PMI was 50.4, marking the first expansionary reading (above 50) since November of last year.

Micro-Focused Market

Daily stock market movements appear to be primarily influenced by the quality of earnings from the night before and the morning of. Good news results in up days, while bad news leads to down days. Overall, last week’s earnings did not produce any significant surprises, explaining the relatively quiet week.

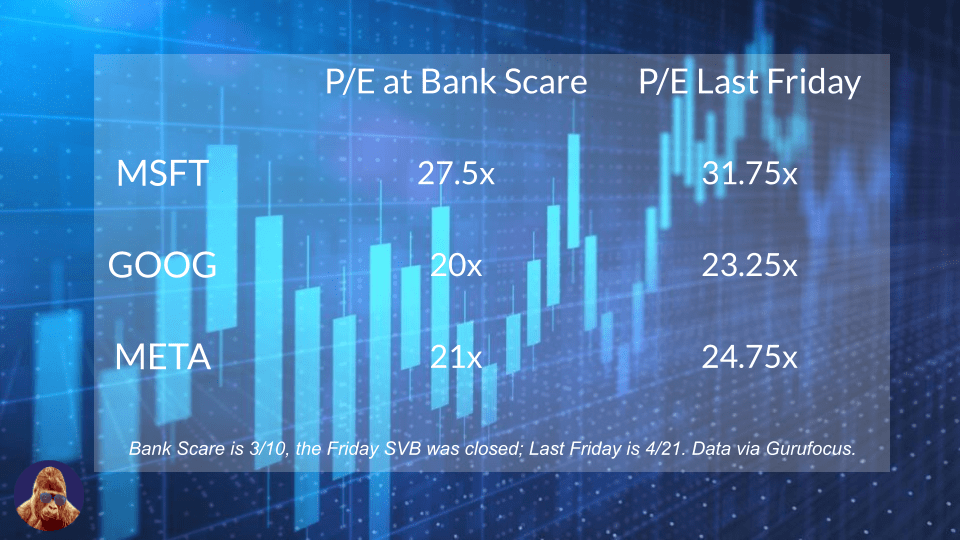

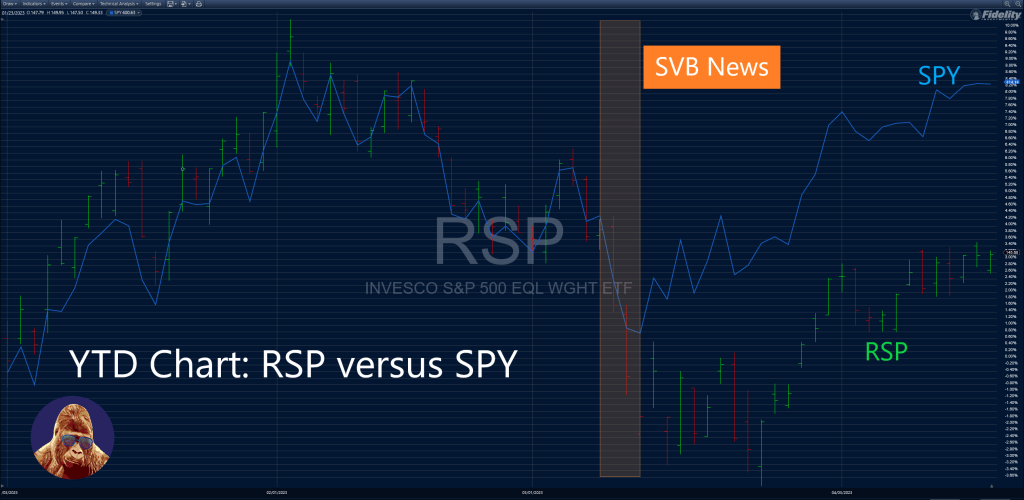

This trading dynamic makes sense because, at this point in earnings season, there is more micro-level (corporate earnings) data available than macro-level data (economic reports). However, this suggests that current stock prices may not fully reflect the increased probability of a Fed hike in May, signaled by the US2Y’s ~20bps increase since earnings began on April 13th. Additionally, the remaining mega-cap names, besides Apple, report their earnings. Many of these companies have already experienced significant stock price appreciation, leading to higher valuations, which sets higher expectations for earnings.

This is particularly important because the outperformance of technology stocks has contributed significantly to the index’s strength since the regional bank scare. The divergence between equal-weighted and cap-weighted indices further illustrate this point. Therefore, if the mega-caps fail to meet expectations, it could lead to broader weakness in the market. In short, I believe this week’s setup is challenging and warrants caution.

The Week Ahead

While earnings will dominate the week, I believe the macro will steal the show with PCE.

On Monday, the poster child for regional bank issues, First Republic (FRC), reports. So far, I believe earnings have ratified the view that Silicon Valley Bank (SVB) was an idiosyncratic event with limited contagion to the broader banking system. I will elaborate more on the regional bank story in the final segment of this article.

Tuesday will be dominated by Microsoft (MSFT) and Alphabet (GOOG). MSFT will look to justify the cost of buying and integrating OpenAI (ChatGPT) with Bing by marketing it as a tide-turner in the advertising and search markets. In a weird twist of fate, at the same time on a separate call, GOOG will try to downplay Bing’s competitive threat and convince investors they are not behind in the AI race. Chipotle (CMG), my burrito bull market favorite, also reports. I will be looking at their margins to see if they have been able to manage labor and food costs that are too high and stubborn for the Fed’s liking.

Once the F in FANNG, Meta Platforms (META) somehow managed to find a quiet day to bring the noise. Investors have fallen in love with Zuckerberg’s “year of efficiency”. Since bottoming around in November ~$88, META has rallied ~140%. The gains from November to January were entirely due to cost-cutting measures and CAPEX reductions. However, since February, the reacceleration in growth has carried the stock higher. At 23x earnings, META is priced for a print that reflects the positive impacts from layoffs on the cost-side and Reels on the revenue-side. If Meta delivers, then it becomes a name you buy in a broad market sell-off because it will cement itself as a baby that has no business being thrown out with the bathwater.

On Thursday, Amazon (AMZN) and Eli Lilly (LLY) are scheduled to report their earnings. Amazon’s layoffs are seen as a good start to cost-cutting measures, but it will not be enough to significantly impact earnings. In my view, the recent rally was the market pricing-in a potential pivot to efficiency. If AMZN ratifies the pivot through their guidance, I expect the stock to breakout above its 200-day SMA of $107. In the case of LLY, a healthcare company on the cutting-edge of weight loss and Alzheimer’s medicine, the stock has broken above its previous all-time high. LLY is now trading in uncharted bullish territory. Thursday’s report has the potential to further catapult the price.

Oil is the spotlight on Friday. as the two most well-known multinationals report. Given oil’s recent rally, I will be looking to see if Chevron (CVX) and Exxon (XOM) can add to the bullish momentum that is beginning to pick up steam in the energy sector.

PCE, the Fed’s preferred inflation indicator, releases Friday morning. The estimate for Core PCE is 4.5%, which is 0.1% lower than the prior 4.6% figure. Based on the US2Y’s move since early April, the bond market is telling us to expect a 25 bps hike in May. A near-forecast result shouldn’t do much to change that expectation. That being said, a surprisingly hot read could tempt the market to price-in a 50 bps hike, resulting in a sell-off. On the other hand, a surprisingly cool read could induce the market to price-in a pause, resulting in a rally. Given what the market is pricing in today, PCE has the power to overwhelm any positive or negative momentum that earnings creates throughout the week. As a result, if you are looking to allocate money this week, I would wait for PCE.

Earnings’ Update on the Regional Bank Scare

Last week, the market received the first regional bank earnings reports since the bank scare began. While I acknowledge that this event will make it harder for small-to-medium-sized businesses to secure loans for growth, I believe that there is no new evidence to suggest that the scare poses a systemic risk to the banking or financial system.

Charles Schwab’s solid earnings report validated a bullish scenario for the economy, suggesting that the regional banking crisis is contained within regional banks. Throughout the week, we heard from several regional banks such as Zion (ZION), Trust Financial (TFC), Key Corp (KEY), Comerica (CA), and Regions Financial (RF). While some exceeded expectations, others missed. If contagion was real, then all of these banks would have dramatically missed the estimates. In my view, the mixed bag of results further supports the idea that SVB was idiosyncratic with limited contagion. This does not mean we are out of the woods, but perhaps it’s time we downgrade the regional bank scare to a regional bank situation.

In conclusion, while the fear of systemic risk is understandable, earnings provided no evidence to support it. Moreover, with no new incidents occurring in recent weeks, it’s uncertain what else is needed to ease these concerns. However, First Republic (FRC), the company at the center of concern, is reporting today (Monday). A better-than-feared result could be what is needed to genuinely shift sentiment and restore faith in the banking system among those who are fearful.

Leave a Reply