At the start of the year, I selected four ETFs that I believed would offer a positive return irrespective of the macroeconomic environment. We’re a quarter in, so it’s time to check in. To do so, we will compare the year-to-date (YTD) performance of each pick against the SPY (S&P 500 ETF) and update the investment thesis.

The YTD performance and dividend/distribution yield were calculated using the closing price on April 18, 2023. The YTD performance was obtained from Google Finance, and the dividend/distribution yield was obtained via Fidelity.

SPY: SPDR S&P 500 ETF Trust

- YTD: 8.75%

- Dividend Yield: 1.58%

Although the S&P 500 was not necessarily the benchmark for my selections, nor is it a proper benchmark for the ITA or IBB, it is a commonly held core position in retail portfolios. Therefore, it makes sense to compare my picks to what would likely be a reasonable alternative for investors who wish to remain invested.

RSP: Invesco S&P 500 Equal Weight ETF Trust

- YTD: 3.23%

- Dividend Yield: 1.80%

- Resistance: $150

- Support: $140

My original thesis remains unchanged. I still prefer the valuation safety and earnings power offered by RSP relative to SPY. The difference in valuation and earnings profile is primarily due to SPY’s ~26% exposure to information technology compared to RSP’s ~14%. This difference also explains RSP’s underperformance that began with the regional bank scare, which caused money to flow into mega-cap fortress companies in the IT sector such as Apple, Microsoft, Alphabet, Google, and Amazon. SPY’s larger IT exposure allowed it to capture a larger share of those upside moves compared to RSP.

A quarter into the year, despite the relative underperformance, I still prefer RSP to SPY. Nothing has changed to make me reconsider my position on which sectors have the best earnings potential. However, the SPY may continue to outperform if the Fed cuts, causing IT to outperform the rest of the market. I do not subscribe to that thesis. That being said, if you do, the QQQ with approximately 50% exposure to IT may be the best option for you, as it would be the direct beneficiary of tech outperformance.

ITA: iShares US Aerospace & Defense ETF

- YTD: 4.93%

- Distribution Yield: 1.03%

- Resistance: $120

- Support: $110

The ITA provides a way to invest in a world where armed conflict is no longer an impossibility and to hedge against potential conflict.

My thesis remains unchanged, and my conviction in these names has only grown stronger over the quarter. Defense companies had a great Q1 and are on track for a repeat performance in Q2. The fighting between Russia and Ukraine has depleted stockpiles and exposed the need to enhance military supply chains. To address these issues, governments worldwide are increasing military expenditures in their budgets. With persistent concerns surrounding China and Taiwan, I expect prioritization of military spending to continue. The demand for military equipment is growing, and supply cannot keep up. While it is an unfortunate situation for the world, it is a bullish one for the ITA.

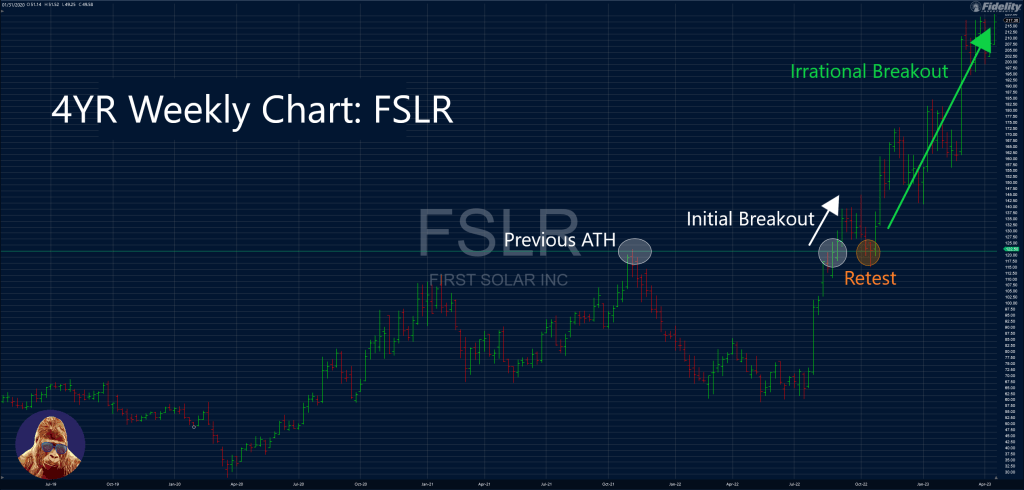

Despite its underperformance relative to the SPY, I am not dissuaded. First, the SPY is an inadequate benchmark for a basket of defense stocks; it is not an apples-to-apples comparison. Second, the ITA is on the verge of a breakout above its current all-time high of $120. Breakouts above ATHs can be particularly lucrative because there is no resistance to stop a stock’s advance. For example, in August 2022, FSLR had a similar setup, trading against its ATH from November 2021. The Inflation Reduction Act, which was essentially a clean energy bill, provided the catalyst for an irrationally bullish breakout.

While it’s true that FSLR provides an optimistic precedent, there’s no guarantee that ITA will experience a similar explosive and sustained breakout. Nevertheless, even an upside move that comes close to matching FSLR’s would still result in significant outperformance relative to any benchmark.

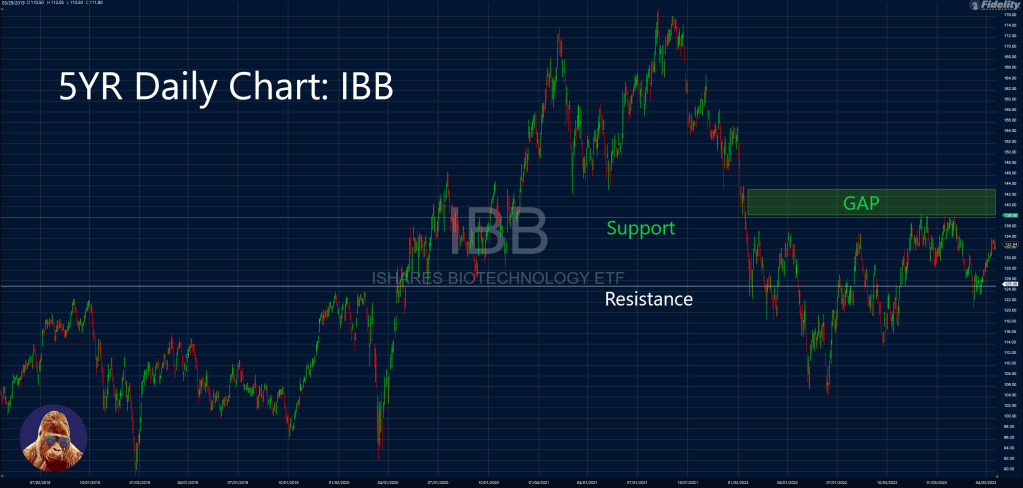

IBB: iShares Biotechnology ETF

- YTD: 1.61%

- Distribution Yield: 0.27%

- Resistance: $138

- Support: $125

My views on the IBB have not changed much since the beginning of the year. It still provides a prudent way to participate in the upside from cutting-edge developments in healthcare, without being exposed to disproportionately higher single-stock risk in biotech compared to other sectors. While I am optimistic about a potential short-term gain of around 10%, from $130 to $144, there needs to be a catalyst to break the resistance at $138 and fill the gap to $144. This catalyst could come from big pharma companies buying up promising biotech firms in the IBB, which would raise prices and valuations in the sector. However, such events are hard to time, especially under an anti-M&A administration.

So far this year, the IBB has underperformed the SPY. However, in a down quarter, I expect the IBB to outperform due to its economic insensitivity.

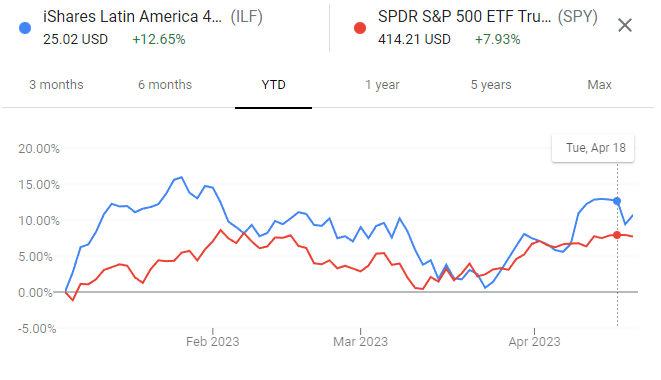

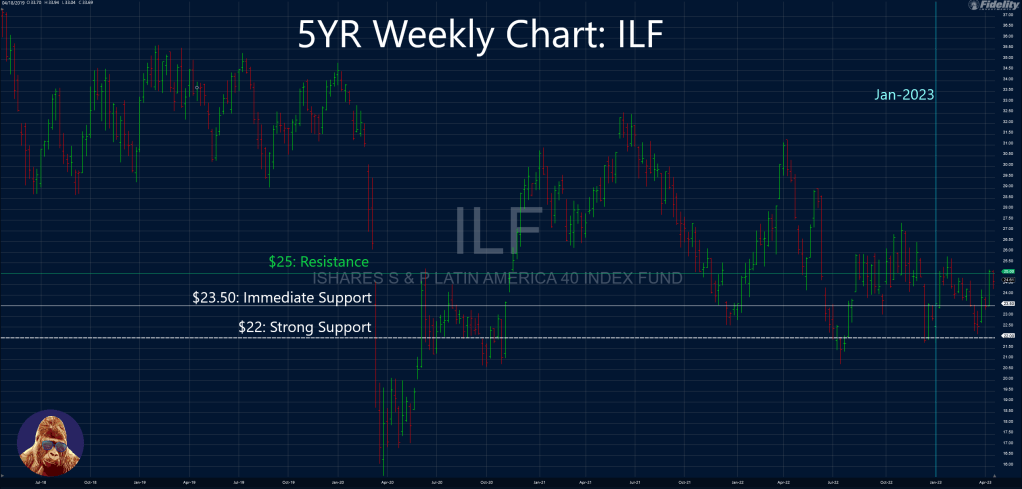

ILF: iShares Latin America 40

- YTD: 12.16%

- Distribution Yield: 12.19%

- Resistance: $25

- Support: $23.5

In the final quarter of 2022, I began searching for emerging market (EM) investments to take advantage of the potential peak in the U.S. Dollar. A peak in the U.S. Dollar represents a conversion of an overwhelming headwind into a meaningful tailwind. I believed this tailwind would prove powerful enough to propel EM outperformance relative to the U.S. The year is still young, but so far, that thesis has played out, as indicated by the ILF’s ~4.7% outperformance relative to the SPY. Furthermore, the 12.19% dividend yield dwarfs that of the SPY.

The iShares Core MSCI Emerging Markets ETF (IEMG), a broader emerging markets ETF, is only up 3.91%, which means the IEMG underperformed both the ILF and SPY. This makes the ILF’s performance even more impressive. The IEMG’s performance shows that emerging markets broadly underperformed U.S. markets, highlighting the ILF as the cream of the crop: better than EM peers and better than the U.S.

Clearly, I am proud of this one.

Latin America remains my favorite emerging geography due to its relative detachment from the Chinese economy, the pause of central banks in the region, and the region’s beneficiary role in near-shoring. This means that the ILF is less beholden to China and central banks and simultaneously positioned for long-term secular growth via near-shoring. Other emerging markets lack these supportive factors.

Given the run, I have already trimmed the position to bring it back into line with my discipline. If the ILF can power through $25, I’ll take incremental profit at $25.75. On the downside, while I can bless a position in the ILF starting at $23.5, more substantial support comes in between $22 and $22.5.

I am long the RSP, IBB, and ILF. I do not have a position in the ITA.

Leave a Reply