Friday morning, the financial sector kicked off earnings with reports from J.P. Morgan (JPM), BlackRock (BLK), Wells Fargo (WFC), Citi Group (C), and PNC Financial (PNC). Although many other banks, including the regionals, have yet to report, three significant stories caught my attention.

1) The Net Interest Margin (NIM) Narrative Is Not Over

As earnings season approached, there were worries that the earnings contribution from net interest margin (NIM) – the difference between the interest a bank earns on its investments in short-term treasury bills and the interest it pays out on savings and checking accounts – had peaked. However, JPM exceeded expectations and provided a guide that surpassed the consensus.

While this boost in NIM could be attributed to the increased deposit base resulting from the regional bank scare, investors’ concerns about NIM seem to have temporarily subsided. This development is bullish for bank stocks and, by extension, bullish for the broader market.

2) Money Market Accounts Are Winning

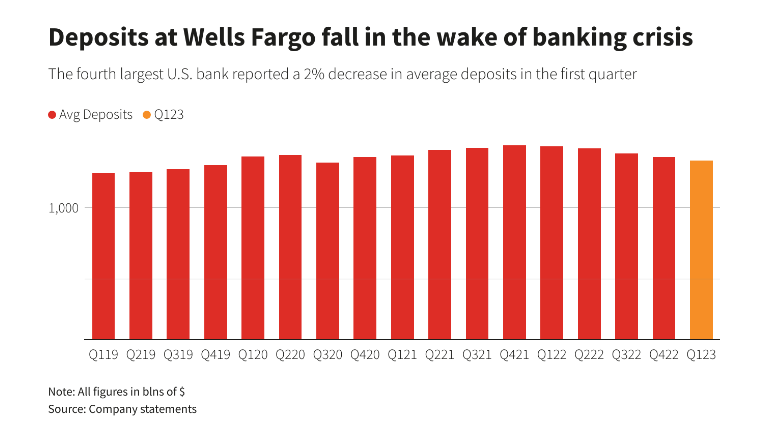

In my most recent newsletter, “9:25”, I predicted that WFC would have a good quarter due to an increased deposit base. While WFC did indeed have a strong quarter, their average deposits actually decreased slightly. According to WFC’s presentation, this outflow was attributed to customers moving to “higher yielding alternatives” such as money market funds.

Money market funds are typically used as a core position in brokerage (stock) accounts. As a result, there is reason to believe that once money market yields become less attractive – indicating lower short-term yields – investors will redeploy this money to stocks instead of leaving it in cash. This could create a bullish catalyst for stocks because incremental buyers create upward momentum for stock prices.

3) The Market is Extrapolating Health at Big Banks to Health in Lending

Initially, the stock market surged following bank earnings, but this was followed by a reversal as the U.S. Dollar and treasury yields started to rise. It seems that the market is linking healthy banks with looser lending standards, which has led to an upward response from yields and the dollar, indicating that the Fed will continue to hike rates. However, I do not agree with this conclusion.

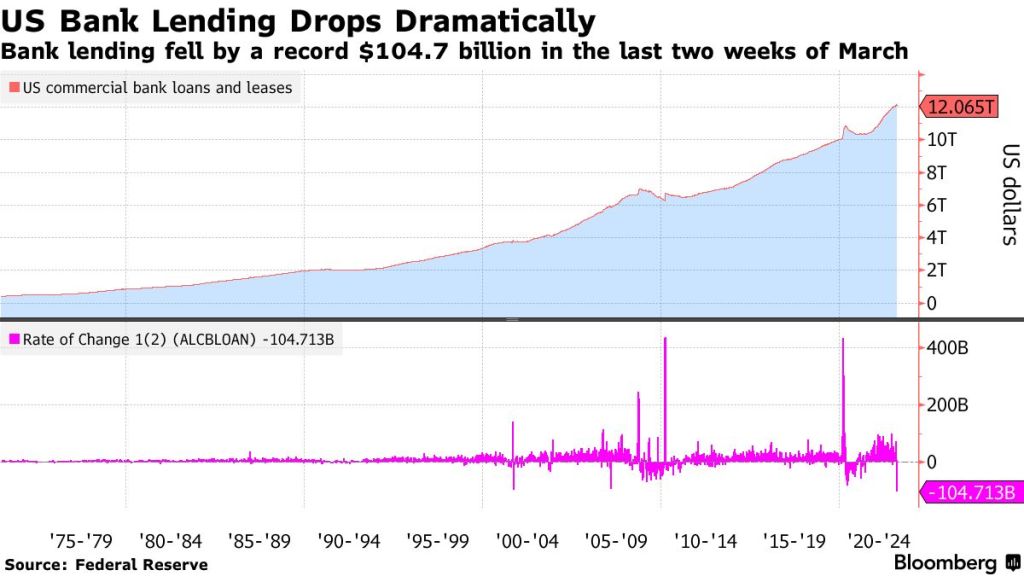

The Fed plans to cool inflation by tightening financial conditions. Prior to earnings, it was expected that lending standards would tighten significantly at all levels, particularly the regional and community level. This would do the Fed’s job in the real economy, without the need for the Fed to hike rates. While Friday’s reports showed that the big money center banks benefited from the regional scare, it did not discredit expectations for stricter lending standards. Consequently. I do not think earnings from the big money centers warranted a rethink of Fed policy or future expectations of stricter lending standards. Furthermore, Bloomberg reported that U.S. bank lending saw its biggest decline on record (since 1973) in the final weeks of March (represented by the purple bar). This indicates that the health of big banks should not be used to extrapolate on the health of the overall lending market.

A valid reason to alter our expectations would be if the regional and community banks turn out to be healthier than expected. These banks are the primary lenders for the small-to-medium sized businesses responsible for approximately 63% of job creation in the U.S. For this reason, this makes lending standards at the community and regional level more important for determining the impact on financial conditions than lending standards at the big money centers.

In short, the drop-off in new loans is a concerning development, and I hope the Fed’s recent hawkish rhetoric does not indicate that they are underestimating the potential severity of a credit scarcity.

Leave a Reply