The Week Behind

As the week went on and economic reports came in soft, markets became increasingly confident March Payrolls would follow the trend, providing the Fed more reason to pause at their next meeting. As a result, the major indices put together a solid performance in the shortened week. The Dow added 1.9%, the S&P 500 gained 1.35%, and the NASDAQ inched up 0.62%.

Highlights

- Consistently weak economic data last week generated optimism that Payrolls would also be soft, resulting in a market rally.

Recapping March Payrolls

Overall, March Payrolls did not stray much from forecasts.

- At 236k, job creation fell well short of the prior month’s 326k and was 2k below the forecast.

- Unemployment was 3.5%, 0.1% lower than the forecast and last month’s 3.6%.

- Average hourly earnings came in at 4.2% YoY, 0.1% below the 4.3% forecast and 0.4% below February’s 4.6%.

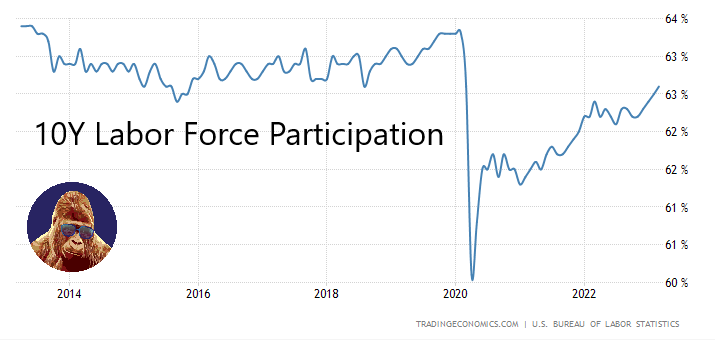

If you’re the Fed, then this report gives you reason to believe you are winning. Another month of robust job creation and decreasing wage inflation shows progress. Unemployment has ticked down, but for the right reason: labor force participation increased to pre-COVID levels.

This development is crucial. Strict immigration policies and COVID-19 have constrained labor supply in the U.S. for the past 5-6 years. Earlier this year, the Fed believed the only way they could increase the labor supply to bring down wage inflation was by slowing down the economy, forcing companies to lay off inessential personnel. However, progress towards pre-COVID labor force participation suggests that the U.S. economy can achieve a reversion to pre-COVID wage inflation without a significant increase in unemployment.

In conclusion, March Payrolls provide incremental evidence for the “soft” to “softish” landing thesis. It shows that the Fed is making progress on inflation without adversely affecting the employment market.

The Week Ahead

This week marks a transition from focusing on the macro to focusing on the micro. On Wednesday, March CPI will be released, and to close the week, banks will kick off the second quarter (2Q) of earnings in earnest.

The market is currently trying to determine whether the Fed will pause or hike one more time at the May meeting. March CPI will inform that debate. An in-line or cooler print favors a pause, while a hotter print favors an incremental hike. Core CPI is forecasted to increase 0.1% to 5.6% from 5.5% in February. In my opinion, these forecasts are achievable. Moreover, I am optimistic that Core CPI could print below the prior month’s 5.5% due to the benign March Payrolls and the outright miss in February PPI, which has predictive value as a leading indicator for CPI.

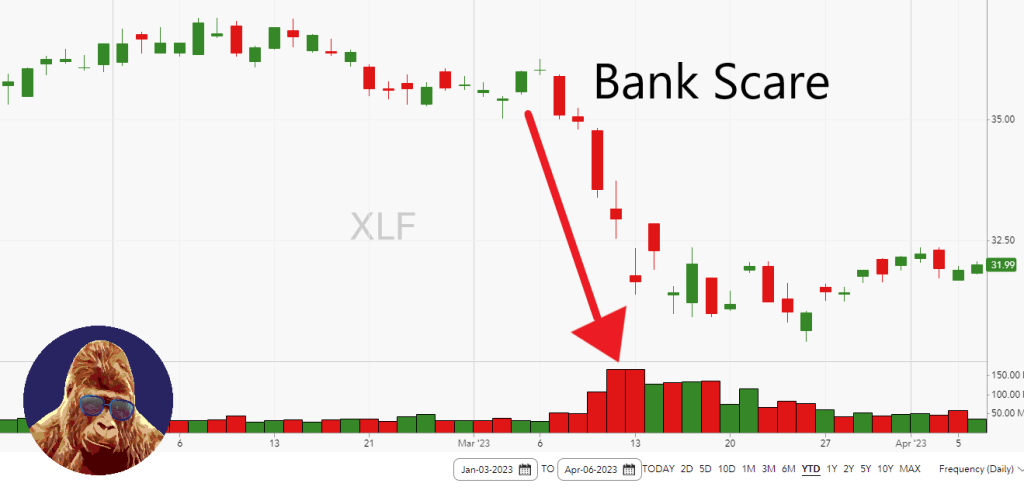

Once March CPI is released, the market will shift its focus to earnings. Friday, it starts with banks via J.P. Morgan (JPM), Citi (C), Wells Fargo (WFC), PNC Bank (PNC), and BlackRock (BLK). I am most constructive on JPM and WFC as beneficiaries of depositors seeking safety and diversification from regional banks. Positive results from the bank could help the sector recover from March’s drawdown, boosting all stocks in the process.

Early Thoughts on Earnings Season

Overall, I am optimistic as earnings season gets underway. Broadly speaking, my thesis is that corporate earnings go as the labor market goes. March Payrolls indicate the labor market is supportive of a solid earnings performance. Adding to my bullish sentiment, Payrolls also managed to provide an incremental reason for a more dovish Fed outcome. Furthermore, early reporters have printed good results and, if the banks present better-than-feared quarters, there is quite the gap to fill in financial equities.

On the other hand, it cannot be ignored that guidance is a concern; but, to be fair, that’s been the case since the Fed tightening cycle began. In my view, the only legitimate concern is the market multiple. With the S&P 500 currently trading at around 18-18.5x on a trailing and forward basis, assuming FWD EPS of $220, there is little room for error. To mitigate risk, I have shifted my portfolio away from index funds and toward stocks with lower multiples and profitable business models that are less dependent on a strong economy.

Leave a Reply