The market has decided that March Payrolls will showcase a cooling labor market, providing the Fed with additional reason to pause, which would be bullish for stocks.

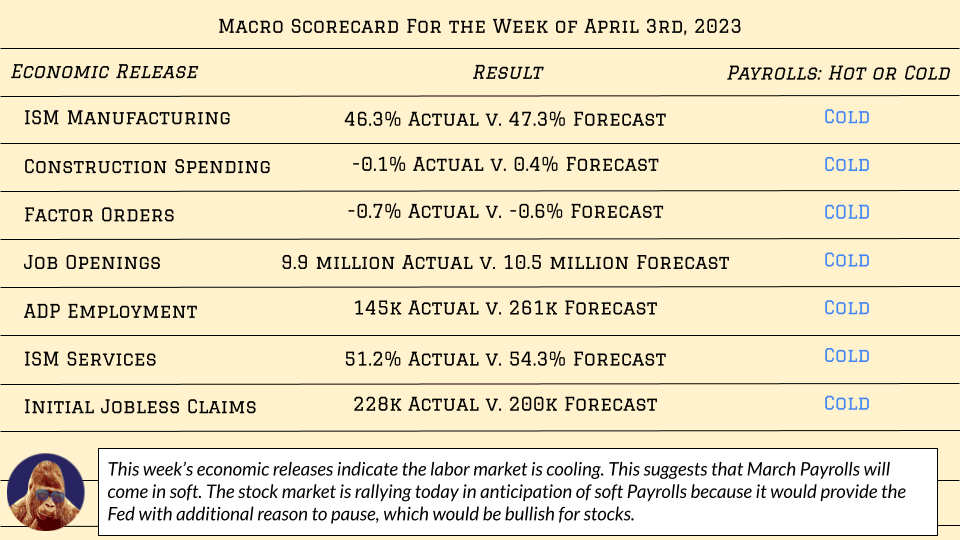

All of this week’s economic reports have painted a picture of a cooling labor market:

- Manufacturing data continues to miss forecasts.

- Job openings are disappearing.

- Private sector job creation (ADP) is decelerating.

- Initial jobless claims finally broke 200k, and last week’s figure was revised upward.

It appears that the bank scare has had a real impact on the economy. Now that its impact is showing in the data, the market does not believe the Fed will be able to live up to recent hawkish messaging. As a result, stocks are front-running a meaningful Payrolls report that has the influence to stop the Fed in its tracks.

However, it is important to realize that this bullish move will be unwound if Payrolls come in hot, contradicting a growing number of indicators suggesting the anticipated deflationary effects of the bank scare are coming to fruition.

There is also a chance traders fade this rally at the end of the day based on fears concerning additional bank failures over the weekend. That being said, the persistent fall in interest rates has mitigated that risk.

Leave a Reply