April 2023

-

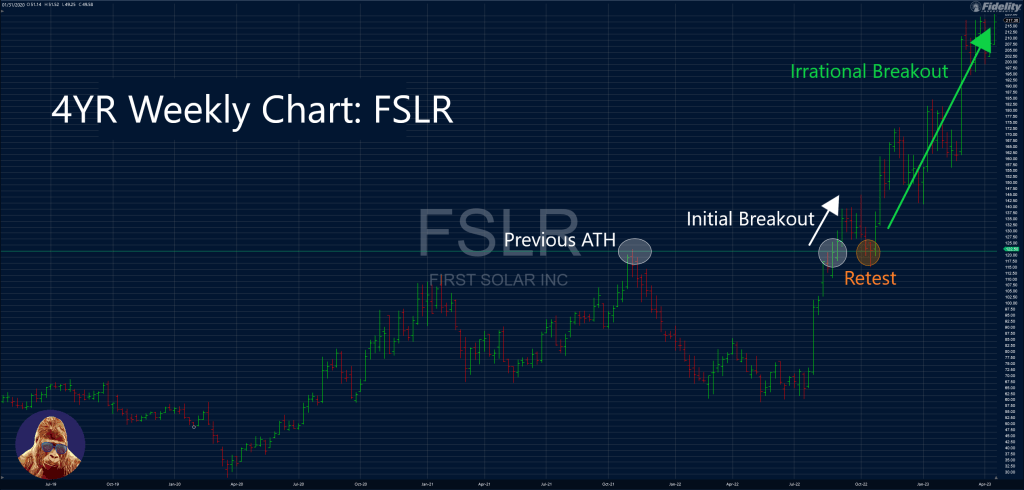

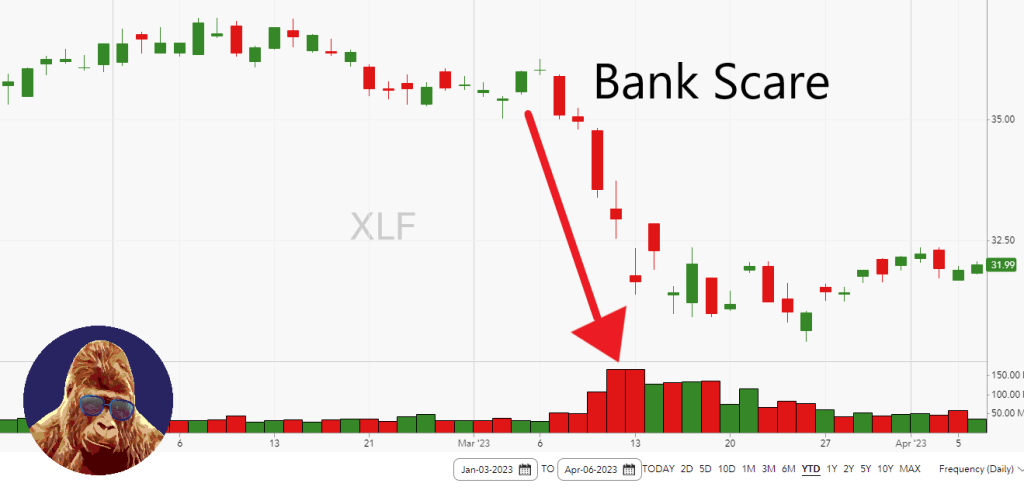

The Week Behind The first week of earnings did not reveal any significant revelations, which may explain why it was a slow week for the indices. I believe that the “business-as-usual” reporting week, along with the resilient economic data, supports the notion that the regional bank scare is contained and the economy can sustain further…

-

At the start of the year, I selected four ETFs that I believed would offer a positive return irrespective of the macroeconomic environment. We’re a quarter in, so it’s time to check in. To do so, we will compare the year-to-date (YTD) performance of each pick against the SPY (S&P 500 ETF) and update the…

-

The Week Behind Although CPI and PPI figures indicated that inflation is on a downward trajectory, the earnings of big money center banks showed a healthy outlook, causing financial markets to lower their expectations regarding real-world tightening stemming from the regional bank scare. This suggests that more Fed-tightening will be necessary to control inflation, which…

-

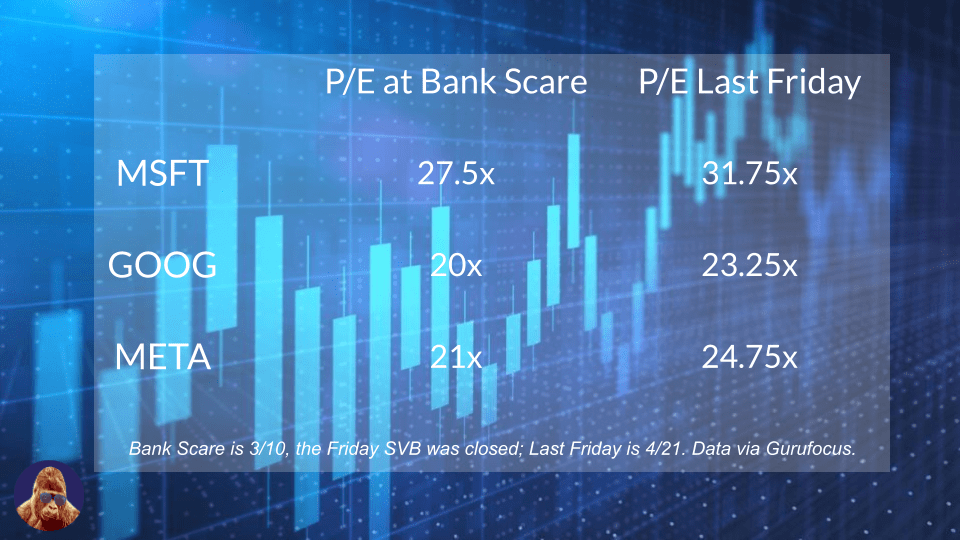

Friday morning, the financial sector kicked off earnings with reports from J.P. Morgan (JPM), BlackRock (BLK), Wells Fargo (WFC), Citi Group (C), and PNC Financial (PNC). Although many other banks, including the regionals, have yet to report, three significant stories caught my attention. 1) The Net Interest Margin (NIM) Narrative Is Not Over As earnings…

-

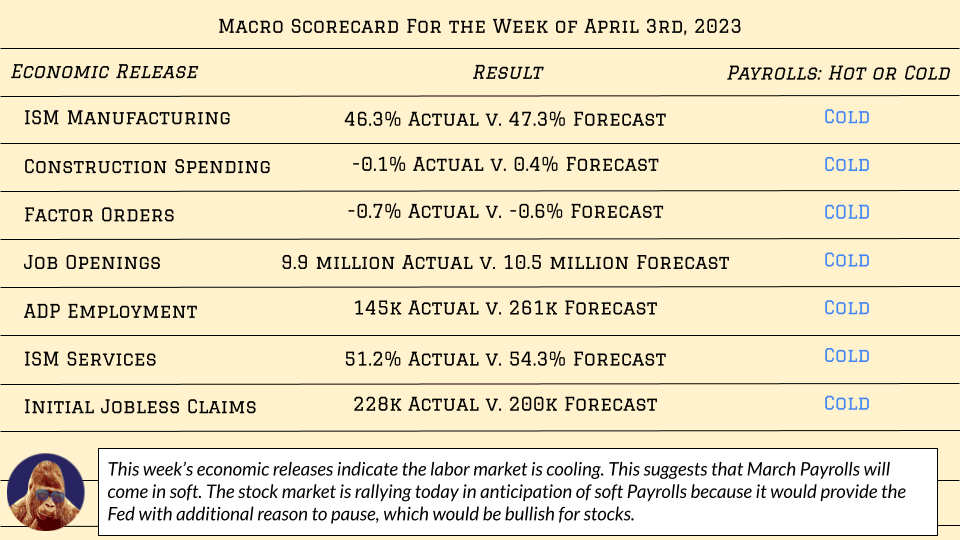

The Week Behind As the week went on and economic reports came in soft, markets became increasingly confident March Payrolls would follow the trend, providing the Fed more reason to pause at their next meeting. As a result, the major indices put together a solid performance in the shortened week. The Dow added 1.9%, the…

-

The market has decided that March Payrolls will showcase a cooling labor market, providing the Fed with additional reason to pause, which would be bullish for stocks. All of this week’s economic reports have painted a picture of a cooling labor market: It appears that the bank scare has had a real impact on the…

-

The Week Behind In a relatively calm news week, regulators made meaningful progress in restoring banking confidence, and PCE showed that inflation remains in a downtrend. The good news on the banking front collided with positive developments on the inflation front, resulting in the major indices ending the week up by ~3.5%. Highlights Cool PCE …