The majority of my writing focuses on contextualizing complex market moves to assist in making investment decisions. While I occasionally discuss the sectors that I believe benefit from those market moves, I rarely mention individual stocks. However, recent volatility has caused unjust dislocations in certain companies’ stocks, creating attractive risk-reward scenarios only when defined entry and exit points are utilized effectively.

Full disclosure, I am a long-term investor in each of these names, but I am presenting them as if I were a trader. The downside exit represents where I cut losses to preserve capital, while the upside exit indicates where I take profit on the entire position. However, as a stock I am trading moves up, I often take profits along the way or set stop-loss orders above my basis to protect profits.

This summary is not a replacement for your own due diligence. Additionally, my thesis is that the bank scare will not lead to a bank crisis. If you disagree with this viewpoint, then this analysis may not provide actionable ideas.

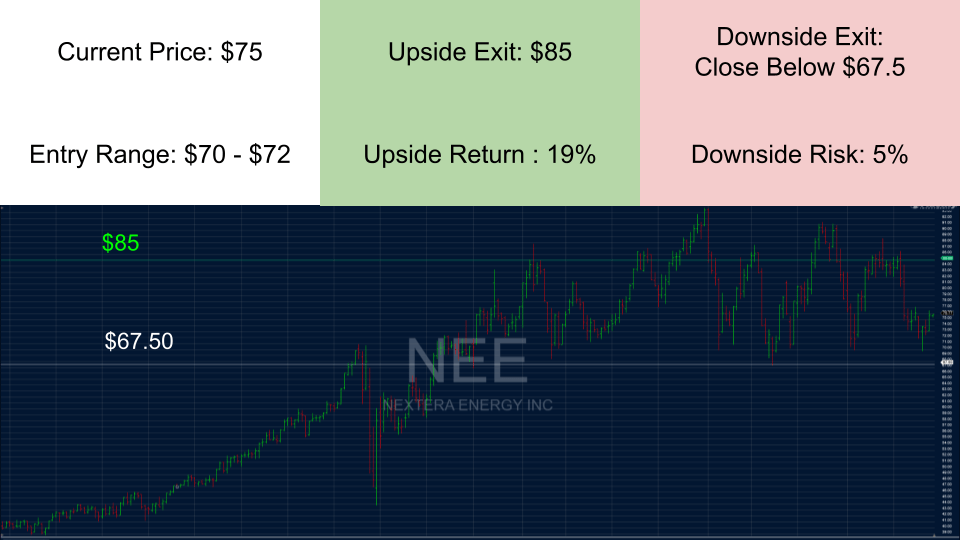

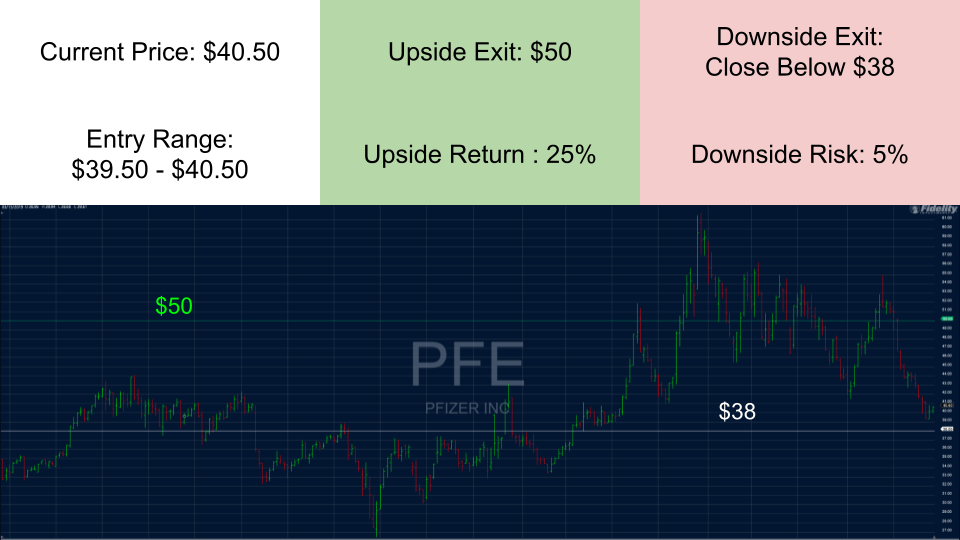

Return profile is calculated based on the midpoint of entry range; white line is downside exit; green line is upside exit. All charts are 5Y period, weekly candlesticks.

NextEra Energy: NEE

NEE is a utility company with one of the largest exposures to renewable energy solutions in the U.S. It offers shareholders the dividend and stability of a utility with superior future growth (compared to peers) backed by stimulus from the Inflation Reduction Act. While NEE is not cheap, trading at around 35x TTM earnings, it successfully tested multi-year support at $70 earlier this month. Although I would be comfortable starting a position at this level, it is worth noting that I expect an opportunity to buy it a few ticks lower.

This trade is a bet that the stock will continue to move up after successfully retesting the $70 level, as it has done three times in the last twelve months.

Southwest Gas: SWX

SWX is a natural gas utility company. Over the last 10-12 months, SWX has been a laggard in the energy cohort. However, during the recent energy sell-off catalyzed by the sharp decline in oil, SWX outperformed. Outperformance on bad news signals SWX may be washed-out. This suggests a lot of ‘bad’ and not a lot of ‘good’ is priced-in, which means investors’ expectations are low.

SWX remains a top 10 holding in Icahn’s (renowned activist) portfolio, pays a 4% dividend, and management has taken action to improve underlying performance. From a technical perspective, the stock is coming off a double bottom at $57. With expectations this low, little has to go right to get an upside surprise resulting in a lucrative trade.

This trade is a “low-risk, high-reward” setup: Expectations are so low that even a small improvement in management’s execution will generate a disproportionately positive price movement; whereas continued disappointment will not be punished as severely.

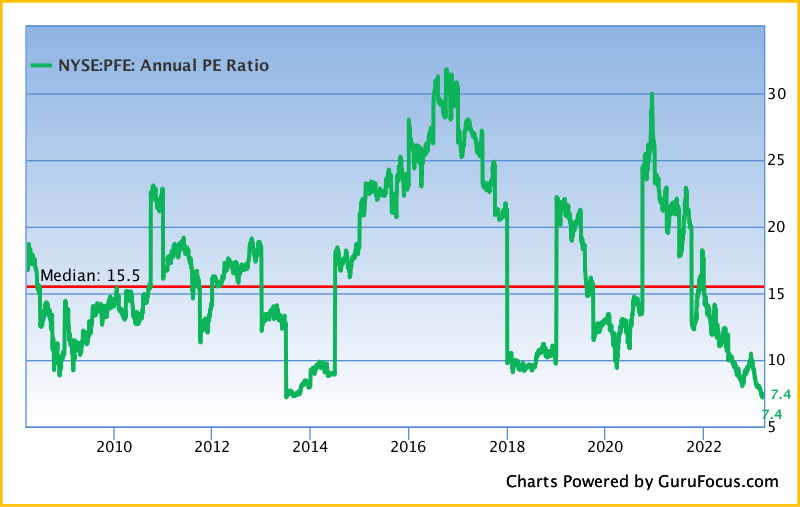

Pfizer: PFE

PFE is a world leader in the development of medicines, vaccines, and consumer healthcare products. Currently, investors are concerned about tough earnings comparisons this year due to the premise that PFE “over-earned” on COVID-vaccine sales. Moreover, big pharmaceutical companies such as PFE tend to grow through acquisitions, and the FTC under the Biden Administration has an extreme stance on the matter, thus explaining much of the stock’s persistent weakness.

However, given that PFE is trading at a near 10-year low of ~7.5x earnings, I believe the situation is priced-in. For reference, the 10-year median is 17x. Mean reversion will require management to resolve investor concerns by making progress on their medical pipeline. In my opinion, management has illustrated their ability to do exactly that. In the meantime, the dividend pays you 4% to wait, and the depressed valuation will insulate from the bulk of near-term volatility.

That being said, if the stock breaks below $38, it could send the stock back into the COVID-recovery era price range of $32 and $38. As a trade, that is where I would cut my losses and wait for the dust to settle before revisiting.

This trade relies on valuation mean reversion, which could come from a market pivot to defensive areas of the market and/or management successfully changing investor perception of their growth prospects.

Leave a Reply