The Week Behind

Overall, last week did not reveal any incremental news on contagion stemming from Silicon Valley Bank (SVB). Now, markets are in wait-and-see mode to see if action taken will restore confidence in the banking system. The longer we go without another incident, the better the market will feel. This is a “no news is good news” environment.

Meanwhile, the failure of SVB has advanced expectations of a Fed pause and increased the probability of cuts in the future. In less than a week, we’ve gone from “higher for longer” to “pause and maybe lower”. In response, investors started repositioning for a declining rate environment, which explains much of the divergence in performance among the majors this week. The DOW underperformed, ending the week 0.15% lower; the S&P gained 1.45%; and the NASDAQ, which has the most to gain from a rate cut, outperformed, adding 4.41%.

Highlights

- February CPI was in line with estimates, but PPI – a leading indicator for CPI – came in well below its estimates. The PPI figure indicates CPI will decline further in future months. Moreover, neither report includes data reflecting economic activity after the SVB incident, which should further dampen inflation.

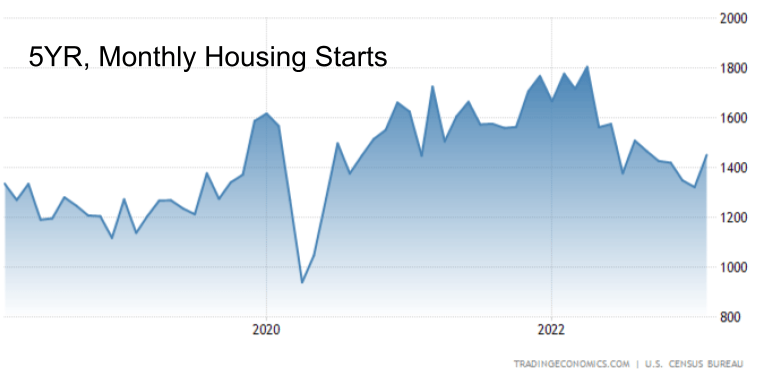

- In February, housing starts rebounded nicely. The 1.45M figure is well above the 1.31M estimate and January’s 1.32M. While this rebound will not immediately impact housing inflation, it is reassuring that housing starts avoided making another new low. Going forward, I expect this rebound to continue as the “flight to safety” prompts homebuilders to take advantage of lower interest rates.

Restoring Confidence in the Banking System

Silicon Valley Bank has damaged consumer and business confidence in the banking system. Despite determined action from the Fed, the Treasury Department, and bluechip banks, time is the only remedy for this wound. We need at least a week to pass without any new incidents before faith can be restored in earnest.

Bank scares bring back emotions from the Great Financial Crisis (GFC) of 2008. Even though 15 years have passed, the scars left by the GFC still carry weight in the minds of long-term investors. The fear is so strong that it often overrides logic. Therefore, even if a perfect solution were implemented, many would be unwilling to embrace it without a period of stability to build the credibility necessary to overcome that fear.

The Week Ahead

This week, all eyes are on Jerome Powell and the Fed – as they should be. This marks the first policy decision and press conference since the bank scare began. Moreover, there is little else in the way of earnings or economic releases to draw attention away from Wednesday’s FOMC Meeting.

The Fed is likely to do one of three things on Wednesday: pause, 25 bps, or 50 bps. Bank scare aside, the most recent data from Payrolls, CPI, and PPI suggest that a 50 bps increase would be excessive. 25 bps or a pause seem more likely.

A 25 bps increase suggests that the Fed believes the situation is well-contained but could still stoke fears of additional bank failures. Therefore, at the press conference, Powell will need to signal that a pause is near to mitigate those fears.

On the other hand, a pause could be seen as the Fed admitting that the situation is worse than previously thought. In this scenario, Powell will need to reassure the public that the Fed views the banking situation as contained. Furthermore, the pause is meant to provide banks with the time needed to evaluate their holdings and is reflective of the Fed’s lower future expectations of inflation due to the deflationary effect of SVB’s collapse.

Both decisions have the potential to immediately renew fear, and it will be up to Powell to alleviate those fears to prevent further damage to banking confidence at the press conference. While I personally favor the pause scenario, the preponderance of the evidence from the Fed’s historical actions, their messaging against “stop-start” policy, and the ECB’s recent 50 bps rate hike suggest that the Fed will most likely hike by 25 bps.

I’d Rather Hit The Buy Button than the Sell Button

If holding isn’t an option, I’d rather be a buyer than seller despite the current turbulence.

Based on what we know from verified sources (not Twitter), in my opinion, this situation is a crisis of confidence, not a crisis of liquidity. A liquidity crisis can cause a bank to fail, a confidence crisis cannot. This is why I have purposefully referred to this situation as a scare, not a crisis.

It is important to note, if the crisis of confidence escalates, causing a broader base of depositors to make a run on their banks, then probabilities of a liquidity crisis increase. However, as of Friday’s close, I believe there are more reasons to believe this crisis of confidence will be resolved than there are to believe it evolves. On Wednesday, I expect Jerome Powell to inject the markets with confidence at the presser, further stabilizing the situation.

If U.S. equity markets have shown us anything, it is that patience and calm in the face of hyperbole and sensationalism are rewarded. This is not just my opinion; it is supported by empirical evidence: the long-term performance of the S&P 500. Market scares cause disruptions that test our resilience and tempt us to take action contrary to long-term goals. History suggests these disruptions, no matter how great, are always temporary in nature, which means the prudent course is to stay the course.

Leave a Reply