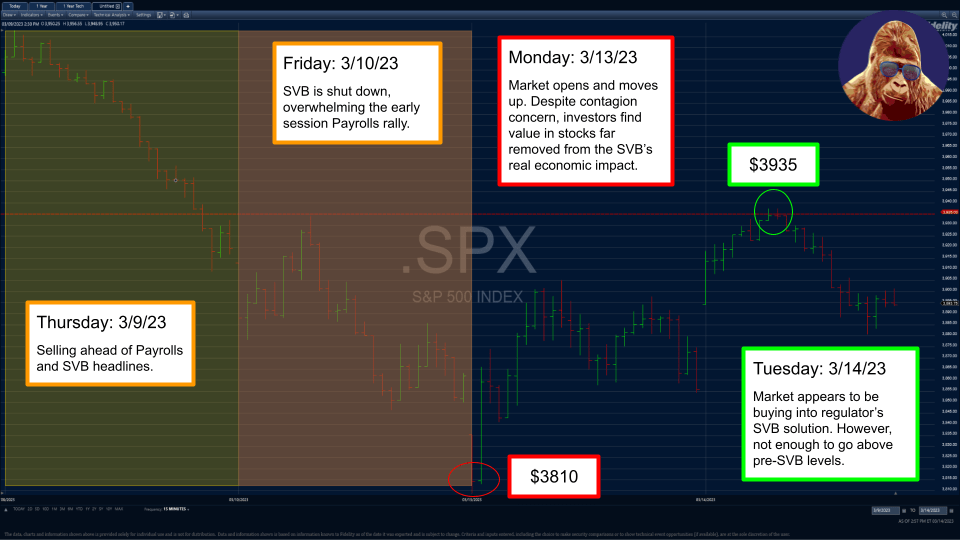

As markets grapple with the implications of Silicon Valley Bank (SVB), it is difficult to keep the emotion out of investing. Emotion – fear and hope alike – have no place in any investment strategy. Until regulators reach a more permanent resolution, we should expect increased volatility. To remove emotion from the equation, I defer to the charts to help determine the market’s perspective on new developments in the short term.

On the downside, I have identified $3,810. This is the level the S&P 500 found support in the immediate aftermath of the bank failure. Breaching this level implies the market has either lost confidence in regulator plans or has new evidence to suggest contagion may spread beyond the regional bank sector.

On the upside, I have identified $3,935. This is the level today’s relief rally, catalyzed by in-line CPI and a warm reception to the initial regulator plan, faded. This price level is synonymous with the high reached before the Payrolls rally reversed on the SVB news. Breaching this level implies the market has increased confidence in regulator plans or has incremental evidence to suggest contagion will be contained.

Leave a Reply