The Week Behind

With “Fedtoric” (Fed rhetoric) causing a temporary stall in treasuries’ advance, the major indices broke multi-week losing streaks. The DOW added 1.75%; S&P 500 gained 1.90%; and the NASDAQ advanced 2.58%.

Highlights

- Economic data released last week was mixed, offering no additional clarity on the Fed’s future actions.

- Atlanta Fed President Raphael Bostic said he would support a 25 bps hike at the next FOMC meeting.

- On Thursday, the S&P 500 violated its 200d SMA on an intraday basis. However, bulls were quick to provide the index support, ensuring the S&P 500 closed above the meaningful technical indicator. Thursday’s bounce carried over into Friday’s session, bolstered by Bostic’s comments and neutral ecodata.

Bull-Bear Stalemate

Two confounding situations have created a powerful stalemate between bulls and bears. First, the U.S. economy is bifurcated. Second, despite taking diametrically opposing views, bulls and bears are creating equally compelling cases based on the same data set.

The U.S. is a tale of two economies: the services economy, defined by travel and experiences, is booming, whereas the goods economy, defined by grocery and retail, is struggling. The word “recession” is not in the vocabulary of airline operators, hotels, restaurants, and live-entertainment (casino, resort, etc…) companies. Future bookings show no signs of demand softening. Grocers and retailers live in a starkly different world. Kroger suggested consumer habits reflect a recessionary mindset. Costco’s revenue shortcoming was due to a pullback in big-ticket home furnishings. In the great debate, bulls reference services; bears reference goods. Each economy is important to the aggregate, which means neither side is completely right nor wrong.

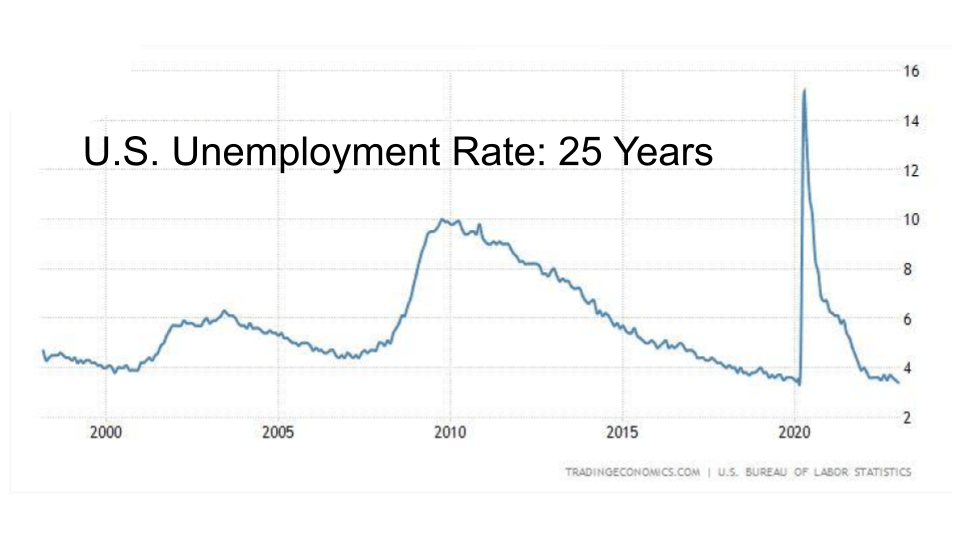

Bulls and bears are interpreting the same data in different ways. Take January Payrolls: Bulls argue that historically low unemployment and record job creation prove recession talk is premature. Furthermore, both metrics imply earnings may surprise to the upside. Bears point out that unemployment bottoms out right before a recession hits. They argue these metrics, which suggest the economy is too hot to foster disinflation, will push the Fed to raise rates higher for a longer period, dooming the economy to a steeper recession than stocks priced-in in October.

Same report; same data points; different conclusions; each compelling. It is fair to say a stalemate has developed between bulls and bears. Perhaps, February Payrolls will break the tie.

The Week Ahead

Friday’s Payrolls has the influence to break the bitter bull-bear stalemate. Due to its reliable history of providing an accurate picture of the U.S. economy, its results will affect Fed policy and corporate planning; thus, it will cause stock and bond market volatility.

Before Friday’s print, there are a few events that may drive action. Tuesday and Wednesday, Powell will speak with the Senate and House for the semiannual monetary policy meeting. Wednesday also brings us ADP employment and JOLTS (labor market metrics), which the Fed considers to shape policy. Thursday, Fed Governor Waller speaks a few hours after jobless claims.

While many companies report earnings this week, I expect Powell’s testimonies and jobs data to dominate the tape. However, if you are still interested in this week’s reports, click here for a list.

Precap: February Payrolls

February Payrolls releases Friday. The market will be hyper focused on three metrics: job creation (headline), unemployment rate, and wage growth.

- Consensus for February job creation is 200k. Bulls hope for a number that suggests January’s record of 517k was an anomaly, ideally, around or below 200k. Personally, I believe that markets will be sanguine to a headline figure below 290k.

- Unemployment is projected to remain the same MoM at 3.4%, which is historically low. It is unlikely to tick lower, and bulls are hoping for a slight uptick because higher unemployment is typically associated with lower wage inflation.

- Regarding wage inflation, our focus will be on average hourly earnings as it received the most attention in the last report. The consensus for the YoY change is 4.7%, compared to the prior report’s 4.4%. For the MoM change, the consensus is 0.3%, the same as last month. Bulls hope these numbers come in lower than expected to reassure the Fed of inflation’s downward trajectory.

Ultimately, I think the wage inflation numbers will carry the most weight. Powell has previously indicated that the Fed is comfortable with robust job creation as long as it does not lead to significant wage inflation. Although a sub 3.4% unemployment might ruffle some hawkish feathers, the Fed’s primary concern is inflation, not unemployment.

Leave a Reply