Shadows of 2022

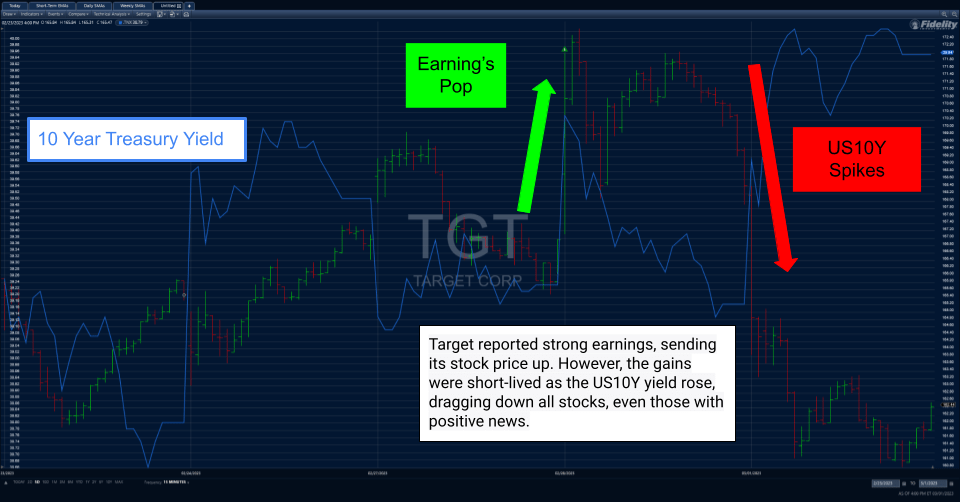

The latter half of February felt a lot like 2022. If you told me what yields were going to do, I could tell you what stocks were going to do. Yields up; stocks down: nothing else matters, no matter how good or how bad. It was that simple.

Financial Markets 101: Yields Up; Stocks Down

Stocks and bonds compete for investor dollars. Bonds are safer, but stocks have greater return potential. As bond yields increase, bonds offer better returns without as much risk, which makes stocks a less attractive investment. As a result, investors sell stocks, which sends share prices lower, to buy bonds.

As we enter March, it feels like déjà vu. Companies like Walmart (WMT), Target (TGT), or Workday (WDAY) report solid earnings worthy of sending shares higher. Unfortunately, post-earnings gains evaporated because these companies had the misfortune of reporting good news on a day yields moved up.

Bottom line, treasury yields are the dominant force. Yields have the power to take any stock lower regardless of the underlying company’s performance. Until this treasury cycle plays out, it makes sense to exercise patience before allocating new capital.

The “Good Company; Broken Stock” Opportunity

While infuriating, it does create opportunity. As yields tick up, stocks of quality companies are coming down through no fault of their own, creating “good company; broken stock” scenarios. The “fix” comes once the US2Y and/or US10Y peak. With the macro risk resolved, investors will be quick to buy up the unjustly dislocated stocks of quality companies.

The strategy is to invest in stocks as treasuries peak, which provides the fix for broken stocks. Frankly, picking the top in yields, which tends to be synonymous with the bottom in stocks, is impossible to do in real-time. It is better to have a projection in mind and monitor yields at those levels. Ideally, you will be able to identify a peak with a few sessions’ hindsight. This was more or less the strategy tactical traders used to navigate last year’s bear market rallies.

Yield Projections

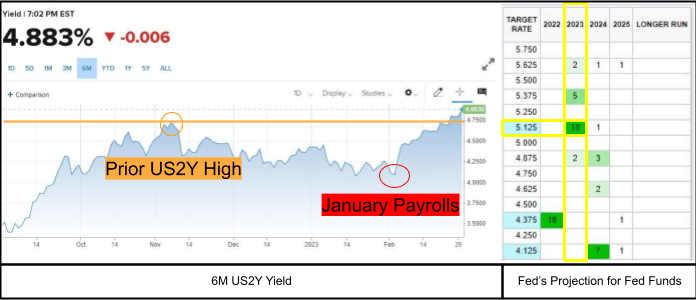

US2Y: 5.125% – 5.75%

The US2Y led Fed Funds in 2022. The Fed’s target is 5.125%. If incoming data suggests the Fed will raise their target, I expect the US2Y to either narrow the gap or overshoot that Fed Funds target.

My projection assumes February Payrolls, releasing March 10th, will showcase a resilient economy, supporting a terminal rate between 5.0 – 5.5%. However, it will not be a repeat of the record strength from January, discrediting the need for Fed Funds north of 6%.

US10Y: 4.875% – 5.5%; 50 bps minus the US2Y range

While the US10Y could be higher, it has long been distorted by monetary policy: quantitative easing and tightening. My projection implies the US2Y drags the US10Y with it.

Identifying A Peak

To identify a peak, I look for two scenarios:

- After a consolidation period – yields trade sideways, “consolidating at a particular level” – yields abruptly drop.

- Yields open at a new high but decline immediately.

The sudden or initial decline indicates that yields reached a level attractive enough to draw significant capital. Over the next 5-10 sessions, I look for the decline to continue, albeit at a more gradual pace, to confirm the peak. I also monitor yield support levels.

Where I’m Looking

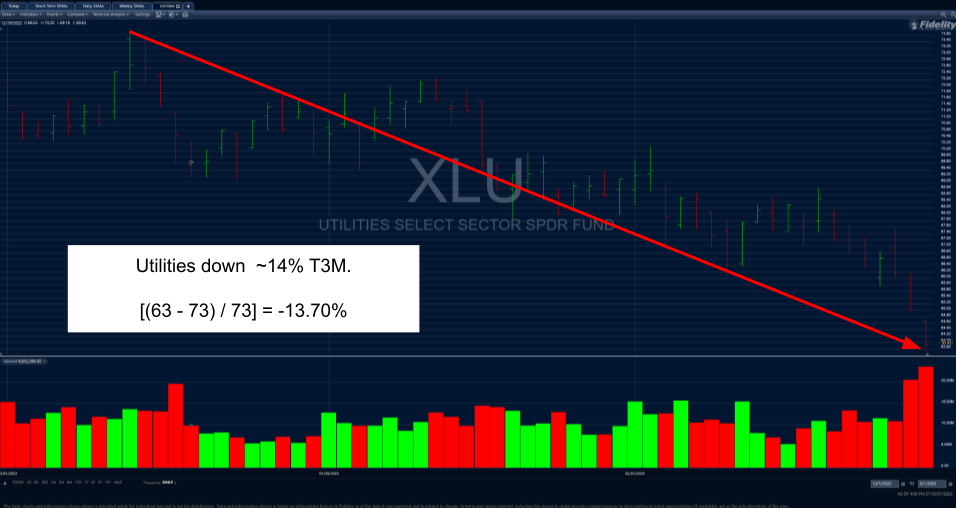

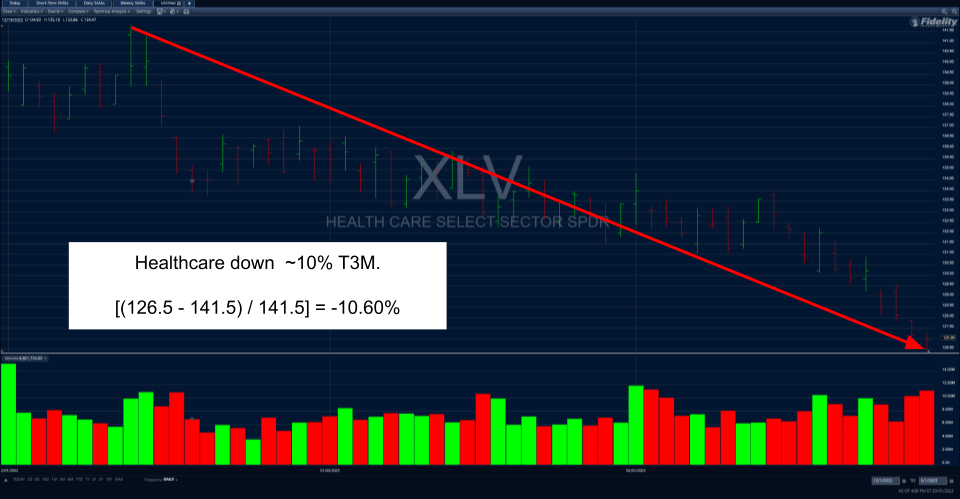

I am digging through the XLU (Utility SPDR ETF) and XLV (Healthcare SPDR ETF) to find good companies with broken stocks. Over the past three months, utilities have declined by approximately 14%, and healthcare has declined by about 10%. In January, these sectors were on the sell-side of a rotation into technology. In February, losses were compounded by rising treasury yields, which reflect the increasing probability that the Fed will raise Fed Funds above the current consensus of 5 – 5.25%.

In summary, the sell-off in these sectors is better explained by investor positioning and market sentiment than fundamental deterioration, which signals these sectors are rich with “good companies” whose stocks are temporarily “broken”.

Being Early and Being Wrong

Once you have completed your due diligence and made your picks, do not take action too early. In my experience, being early and being wrong are the same thing. You do not want to buy into a broken asset. Wait for treasuries to peak and your picks to confirm the fix has arrived before putting money to work. It is okay to miss the first 5% of a 15-20% recovery, especially when there is an unknown amount of downside associated with a known, monitorable risk in treasury yields.

Leave a Reply