It is not my intention to make a weekly habit of this, but there have been update-worthy developments.

In the prior update, I covered the two headwinds plaguing the space.

- Persistent decline in the underlying commodity.

- Uncertainty surrounding the dividend of associated stocks.

In order for natural gas stocks to work, we need these headwinds to abate. The first is the more important of the two and will require a narrative shift to resolve. The second affects sentiment in the space but is really only a concern for variable dividend stocks.

What Happened?

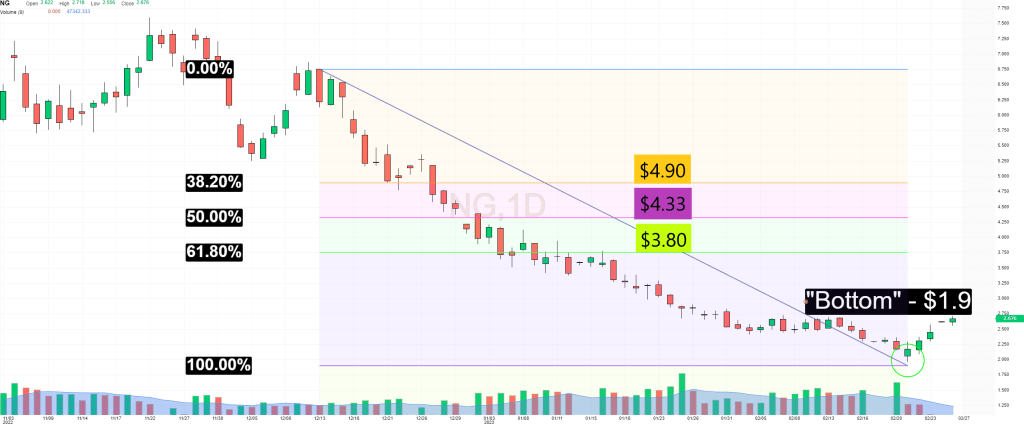

As Coterra (CTRA), Pioneer (PXD), and Cheniere (LNG) reported earnings on February 22nd and 23rd, natural gas gapped lower to start the morning. After touching $1.9, losses reversed as these stalwart energy companies provided reassuring clarity on the dividend, capex, and the energy market. Given my suspicion that institutional hedging was partially responsible for the commodity’s poor performance, I may be biased, but I think this move can be explained by short covering:

Traders woke up ahead of the earnings calls to put on last second short bets that these energy names would lay a Devon-like egg (DVN). This influx of short money sent the commodity lower. However, once it became clear there would not be another DVN and that the situation was better-than-feared, those traders as well as dividend-concerned managers covered their shorts, creating a short squeeze.

Why Does It Matter?

In my view, earnings quashed the dividend headwind and kickstarted the narrative shift necessary for resolving the remaining headwind. Nothing changes sentiment like price, and it shows. Before the short squeeze, natural gas was marketed as a losing investment. Suddenly, natural gas has bottomed, creating an opportunistic risk-reward scenario. Once skeptical strategists and traders are now referencing old IEA sources – highlighting the supply-demand imbalance and importance in the green transition – to help build new bull cases. I have no idea where these natural gas bulls were 5-10% lower, but their emergence from the sidelines or conversion from bearishness is welcome because it is evidence the narrative shift is underway.

These shifts can build momentum quickly, especially if increasing prices create more natural gas bulls, which pushes prices higher by forcing additional short covering and attracting incremental buying. It is a process that feeds on itself until a healthier bear-bull ratio is achieved.

Managing Natural Gas Positions In Your Portfolio

With a new range for natural gas, we need to update the profit-taking levels. For recovering assets, I prefer to take profits at the 61.8%, 50%, and 38.2% retracement levels, which are $3.80, $4.33, and $4.90. For my trade positions, which I manage differently from my core positions, I sell 25% at each of these levels and set stop-loss limit orders to protect profits. If all levels are reached, I sell covered calls with the remaining 25% and maintain my stop-loss discipline.

None of this is financial advice. This is a summary of what I am doing personally. I am long LNG and CTRA.

Leave a Reply