The Week Behind

Macro and micro data were mixed, but PCE went the way of the bears. The above-consensus inflation data opens the door a little wider for 50 bps and a terminal rate north of 5%. Justifiably, this sent yields and the dollar higher, which sent stocks lower. On the week, the S&P 500 closed 2.67% lower; the DOW dropped ~3%; the NASDAQ lost 3.33%.

Highlights

- Services and Manufacturing PMIs came in above consensus, which support the case for 50 bps and a higher terminal rate.

- GDP was revised lower, which supports 25 bps and holding the terminal rate at 5%.

- FOMC minutes mentioned “a few” members favored 50 bps at January’s meeting. The Fed is very purposeful with their diction. This means more than two, “a couple”, but less than four or five, “some”, favored 50 bps before hotter-than-expected data released. While not revelatory, I expect the number of members advocating 50 bps has increased from “a few”.

- Continuing and initial claims showed no signs of cracks in the labor market.

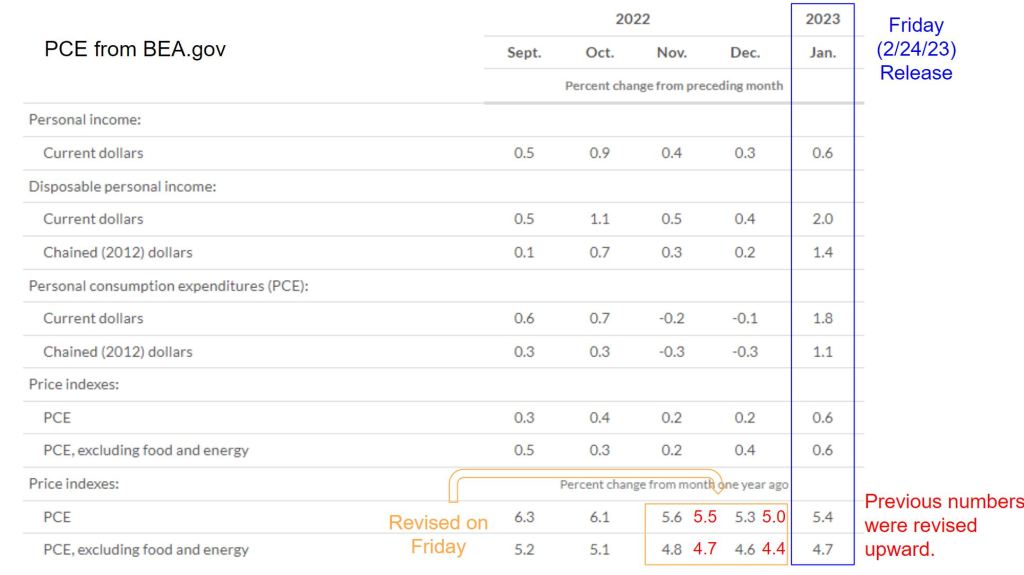

- PCE was above consensus and revisions to Nov. and Dec. revealed inflation was stickier than thought when initially calculated.

Glasses On: PCE

January PCE printed 4.7%, well above the 4.3% estimate. While the print is not bullish, I am surprised stocks did not fall further.

The previous numbers are in red; the revised numbers are in black. Nov. and Dec. PCE was revised upward, which means the Fed did not make as much progress as initially thought. Much of 2023’s rally has been attributed to the Fed’s progress over those months warranting a pause or pivot by end of year. In my view, these revisions discredit that thesis, which is why I am surprised indices kept losses below 2%.

Bulls would say that PCE offered nothing new. It only echoes the data released since January Payrolls indicating inflation had a slight flared up. They would also argue that nothing moves in a straight line, including disinflation. Finally, while bulls would admit the Fed’s work is far from over, the economy and earnings are strong enough to withstand the prolonged pressure.

Bears would say that PCE proves inflation is not cooling as fast as anticipated. This means the Fed will not wait to see the full effects of last year’s tightening before doing more. In combination with high inflation persistently pressuring household balance sheets and corporate margins, earnings will substantially miss in the near future.

Both make good points, but both are guilty of moving the goalposts. At the beginning of the year, bulls were optimistic because the Fed appeared near conclusion. Bears were pessimistic because 425 – 450 bps of tightening was going to cause a 1Q23 earnings collapse. With the benefit of hindsight, we now know neither were right. To me, this shows that consensus views are not often actualized, which highlights the importance of independent thought.

Bulls and bears aside, one good thing came out of PCE. It forced markets to price-out the end of year rate cut. When this was first priced-in, I thought the market was getting ahead of itself. I am happy to see it go. While Friday was ugly, this event proves the market is capable of pricing-in a more bearish outlook without outright panic.

The Week Ahead

As alluded to earlier, markets are drifting lower as inflation expectations adjust due to new and revised data. While markets will be micro-focused for most of the week as consumer-facing companies report in force, on Friday, a trio of Fed-speakers find microphones, and ISM releases. It is my opinion that bulls have the advantage in micro-focused markets; bears have it in macro-focused markets. As a result, I expect markets to behave relatively well as we focus on earnings until the Fed and ISM force us to focus on the macro.

Norwegian Cruise Line (NCLH) and Target (TGT) report before trade on Tuesday. The former will inform the narrative on “revenge travel”. The latter will inform our thoughts on the consumer. Walmart’s (WMT) report suggests consumers are trading-down and spending less on goods excluding groceries. Given the relative product mix and price point, WMT’s report does not bode well for TGT.

Lowe’s (LOW) reports Wednesday morning. While Home Depot (HD) left a lot to be desired, LOW is not necessarily destined to the same fate because their customer compositions differ. LOW has greater exposure to the DIY consumer; HD has greater exposure to the professional contractor. HD is more levered to the housing market, which is suffering, than LOW. HD has lowered expectations for LOW, which creates an opportunity for LOW to shine.

Portillo’s (PTLO) and Costco (COST) report on Thursday. CPI data shows the costs of eating at home are climbing faster than dining out: 11.3% at home versus 8.2% away. Portillo’s is an expanding lower-cost, fast-casual restaurant chain. While PTLO will be judged on execution, their report will show if consumers are dining out more as grocery prices grow faster than menu prices. Costco will provide color on supply chains and inflation via their massive supplier network. WMT management mentioned supply chains are easing, which is a bullish headwind for food inflation. Hopefully, COST will report similar progress.

On Friday, I expect ISM Services and Fed speakers to dominate the tape. The former updates services inflation, which has been stubborn. The latter provides Fed speakers their first opportunity to jawbone (talk down) equity markets by complementing fresh inflation data with hawkish rhetoric. While a negative reaction is not guaranteed, I would be surprised if Friday turns out to be a good day for stocks.

From Flipping the Bird to Thumbs Up

For most of 2022, the US2Y operated as the “shadow Fed”, the bond market’s proxy for the Fed Funds Rate.

November through January, despite the Fed insisting on 5% – 5.25% Fed Funds, the US2Y yield steadily declined from its peak at ~4.75% to ~4%. This decline was the bond market telling the Fed it would not be able to sustain a Fed Funds Rate much above 4.75%. Essentially, the bond market gave the Fed the finger and sided with stocks.

For what it is worth, if I had the choice between fighting the Fed and fighting the bond market, I would much rather fight the Fed. Bond market operations are beyond instrumental to our financial system. It has the power to bend the Fed to its will. Don’t just take my word for it. Take Liz Truss’ career for it. Her policies created bond volatility so disruptive that she was forced to resign in the shortest term of the position’s history.

Since January Payrolls, the US2Y has made a meaningful move higher: 80 bps to a new high of ~4.83%. Given how the US2Y has served as the bond market’s proxy for Fed Funds, the massive move suggests the bond market is giving the Fed a thumbs up instead of the bird. If incoming data persuades the bond market a higher terminal rate is probable, then the US2Y could rise to 5 – 5.50%, which puts pressure on equities.

To recap, the bond market’s reevaluation of hawkish Fed policy warrants caution. Bond yields no longer align with stock valuations. It is starting to feel similar to Jackson Hole. Yields and stocks moved up simultaneously ahead of Powell’s Jackson Hole speech, each anticipating a different outcome. The flatly hawkish speech verified the bond view, catalyzing the sell-off in stocks culminating in October’s low. February Payrolls, which releases March 10th, may be the flashpoint because it has the influence to tilt the balance in the bull-bear debate surrounding Fed Funds.

Leave a Reply